Instructions For Filing Wage Tax Refund Petition - Philadelphia Department Of Revenue

ADVERTISEMENT

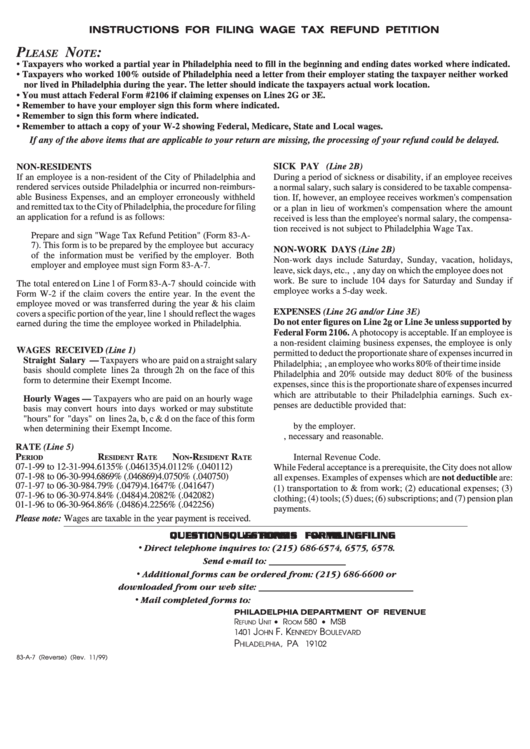

INSTRUCTIONS FOR FILING WAGE TAX REFUND PETITION

P

N

:

LEASE

OTE

• Taxpayers who worked a partial year in Philadelphia need to fill in the beginning and ending dates worked where indicated.

• Taxpayers who worked 100% outside of Philadelphia need a letter from their employer stating the taxpayer neither worked

nor lived in Philadelphia during the year. The letter should indicate the taxpayers actual work location.

• You must attach Federal Form #2106 if claiming expenses on Lines 2G or 3E.

• Remember to have your employer sign this form where indicated.

• Remember to sign this form where indicated.

• Remember to attach a copy of your W-2 showing Federal, Medicare, State and Local wages.

If any of the above items that are applicable to your return are missing, the processing of your refund could be delayed.

SICK PAY (Line 2B)

NON-RESIDENTS

If an employee is a non-resident of the City of Philadelphia and

During a period of sickness or disability, if an employee receives

rendered services outside Philadelphia or incurred non-reimburs-

a normal salary, such salary is considered to be taxable compensa-

able Business Expenses, and an employer erroneously withheld

tion. If, however, an employee receives workmen's compensation

and remitted tax to the City of Philadelphia, the procedure for filing

or a plan in lieu of workmen's compensation where the amount

an application for a refund is as follows:

received is less than the employee's normal salary, the compensa-

tion received is not subject to Philadelphia Wage Tax.

Prepare and sign "Wage Tax Refund Petition" (Form 83-A-

7). This form is to be prepared by the employee but accuracy

NON-WORK DAYS (Line 2B)

of the information must be verified by the employer. Both

Non-work days include Saturday, Sunday, vacation, holidays,

employer and employee must sign Form 83-A-7.

leave, sick days, etc., i.e., any day on which the employee does not

work. Be sure to include 104 days for Saturday and Sunday if

The total entered on Line 1 of Form 83-A-7 should coincide with

employee works a 5-day week.

Form W-2 if the claim covers the entire year. In the event the

employee moved or was transferred during the year & his claim

EXPENSES (Line 2G and/or Line 3E)

covers a specific portion of the year, line 1 should reflect the wages

Do not enter figures on Line 2g or Line 3e unless supported by

earned during the time the employee worked in Philadelphia.

Federal Form 2106. A photocopy is acceptable. If an employee is

a non-resident claiming business expenses, the employee is only

WAGES RECEIVED (Line 1)

permitted to deduct the proportionate share of expenses incurred in

Straight Salary — Taxpayers who are paid on a straight salary

Philadelphia; e.g., an employee who works 80% of their time inside

basis should complete lines 2a through 2h on the face of this

Philadelphia and 20% outside may deduct 80% of the business

form to determine their Exempt Income.

expenses, since this is the proportionate share of expenses incurred

which are attributable to their Philadelphia earnings. Such ex-

Hourly Wages — Taxpayers who are paid on an hourly wage

penses are deductible provided that:

basis may convert hours into days worked or may substitute

1. The total expenses are reduced by any amounts reimbursed

"hours" for "days" on lines 2a, b, c & d on the face of this form

by the employer.

when determining their Exempt Income.

2. They are ordinary, necessary and reasonable.

3. They are recognized as deductions from gross income in the

RATE (Line 5)

P

R

R

N

-R

R

Internal Revenue Code.

ERIOD

ESIDENT

ATE

ON

ESIDENT

ATE

07-1-99 to 12-31-99 4.6135% (.046135) 4.0112% (.040112)

While Federal acceptance is a prerequisite, the City does not allow

07-1-98 to 06-30-99 4.6869% (.046869) 4.0750% (.040750)

all expenses. Examples of expenses which are not deductible are:

07-1-97 to 06-30-98 4.79% (.0479)

4.1647% (.041647)

(1) transportation to & from work; (2) educational expenses; (3)

07-1-96 to 06-30-97 4.84% (.0484)

4.2082% (.042082)

clothing; (4) tools; (5) dues; (6) subscriptions; and (7) pension plan

01-1-96 to 06-30-96 4.86% (.0486)

4.2256% (.042256)

payments.

Please note: Wages are taxable in the year payment is received.

QUESTIONS

QUESTIONS

QUESTIONS

QUESTIONS

QUESTIONS

FORMS

FORMS

FORMS

FORMS

FORMS

FILING

FILING

FILING

FILING

FILING

•

Direct telephone inquires to: (215) 686-6574, 6575, 6578.

Send e-mail to: revenue@phila.gov

•

Additional forms can be ordered from: (215) 686-6600 or

downloaded from our web site:

•

Mail completed forms to:

PHILADELPHIA DEPARTMENT OF REVENUE

R

U

• R

580 • MSB

EFUND

NIT

OOM

J

F. K

B

1401

OHN

ENNEDY

OULEVARD

P

PA

,

19102

HILADELPHIA

83-A-7 (Reverse) (Rev. 11/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1