Instructions For Form R-9001-L - Application For Certification Of Incapable Wells

ADVERTISEMENT

R-9001 I (2/04)

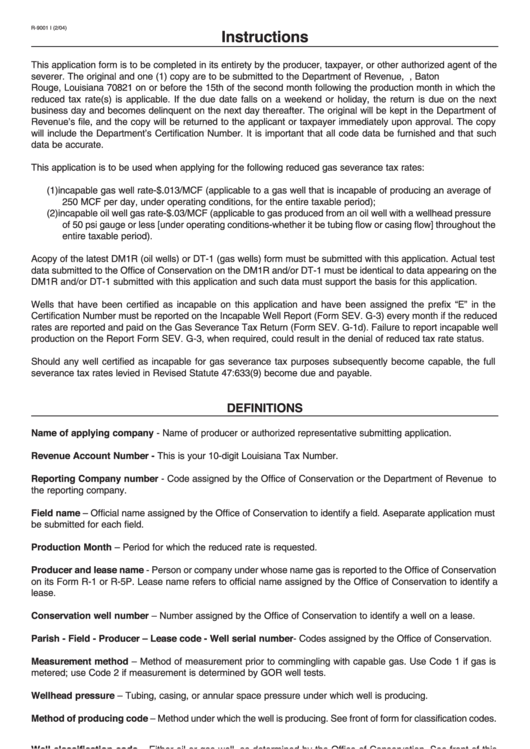

Instructions

This application form is to be completed in its entirety by the producer, taxpayer, or other authorized agent of the

severer. The original and one (1) copy are to be submitted to the Department of Revenue, P.O. Box 4998, Baton

Rouge, Louisiana 70821 on or before the 15th of the second month following the production month in which the

reduced tax rate(s) is applicable. If the due date falls on a weekend or holiday, the return is due on the next

business day and becomes delinquent on the next day thereafter. The original will be kept in the Department of

Revenue’s file, and the copy will be returned to the applicant or taxpayer immediately upon approval. The copy

will include the Department’s Certification Number. It is important that all code data be furnished and that such

data be accurate.

This application is to be used when applying for the following reduced gas severance tax rates:

(1) incapable gas well rate-$.013/MCF (applicable to a gas well that is incapable of producing an average of

250 MCF per day, under operating conditions, for the entire taxable period);

(2) incapable oil well gas rate-$.03/MCF (applicable to gas produced from an oil well with a wellhead pressure

of 50 psi gauge or less [under operating conditions-whether it be tubing flow or casing flow] throughout the

entire taxable period).

A copy of the latest DM1R (oil wells) or DT-1 (gas wells) form must be submitted with this application. Actual test

data submitted to the Office of Conservation on the DM1R and/or DT-1 must be identical to data appearing on the

DM1R and/or DT-1 submitted with this application and such data must support the basis for this application.

Wells that have been certified as incapable on this application and have been assigned the prefix “E” in the

Certification Number must be reported on the Incapable Well Report (Form SEV. G-3) every month if the reduced

rates are reported and paid on the Gas Severance Tax Return (Form SEV. G-1d). Failure to report incapable well

production on the Report Form SEV. G-3, when required, could result in the denial of reduced tax rate status.

Should any well certified as incapable for gas severance tax purposes subsequently become capable, the full

severance tax rates levied in Revised Statute 47:633(9) become due and payable.

DEFINITIONS

Name of applying company - Name of producer or authorized representative submitting application.

Revenue Account Number - This is your 10-digit Louisiana Tax Number.

Reporting Company number - Code assigned by the Office of Conservation or the Department of Revenue to

the reporting company.

Field name – Official name assigned by the Office of Conservation to identify a field. A separate application must

be submitted for each field.

Production Month – Period for which the reduced rate is requested.

Producer and lease name - Person or company under whose name gas is reported to the Office of Conservation

on its Form R-1 or R-5P. Lease name refers to official name assigned by the Office of Conservation to identify a

lease.

Conservation well number – Number assigned by the Office of Conservation to identify a well on a lease.

Parish - Field - Producer – Lease code - Well serial number - Codes assigned by the Office of Conservation.

Measurement method – Method of measurement prior to commingling with capable gas. Use Code 1 if gas is

metered; use Code 2 if measurement is determined by GOR well tests.

Wellhead pressure – Tubing, casing, or annular space pressure under which well is producing.

Method of producing code – Method under which the well is producing. See front of form for classification codes.

Well classification code – Either oil or gas well, as determined by the Office of Conservation. See front of this

form for codes.

Wells on reporting property –Total number of capable wells on property and total number of incapable wells on

property.

Taxpayer number – Purchaser or transporter code of the party responsible for payment of the tax.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1