Form Ct-46-I - Instructions For Form Ct-46 - Claim For Investment Tax Credit - 1998

ADVERTISEMENT

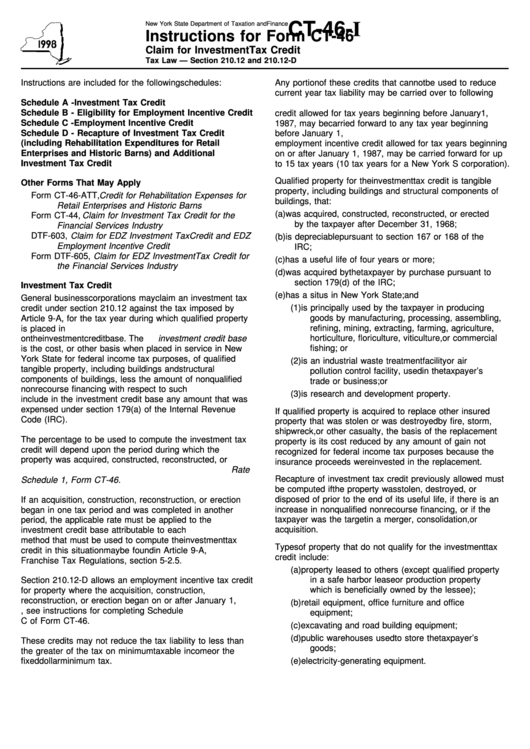

CT-46-I

New York State Department of Taxation and Finance

Instructions for Form CT-46

Claim for Investment Tax Credit

Tax Law — Section 210.12 and 210.12-D

Instructions are included for the following schedules:

Any portion of these credits that cannot be used to reduce

current year tax liability may be carried over to following

Schedule A - Investment Tax Credit

years. An investment tax credit or additional investment tax

Schedule B - Eligibility for Employment Incentive Credit

credit allowed for tax years beginning before January 1,

Schedule C - Employment Incentive Credit

1987, may be carried forward to any tax year beginning

Schedule D - Recapture of Investment Tax Credit

before January 1, 2002. An investment tax credit or

(including Rehabilitation Expenditures for Retail

employment incentive credit allowed for tax years beginning

Enterprises and Historic Barns) and Additional

on or after January 1, 1987, may be carried forward for up

Investment Tax Credit

to 15 tax years (10 tax years for a New York S corporation).

Qualified property for the investment tax credit is tangible

Other Forms That May Apply

property, including buildings and structural components of

Form CT-46-ATT, Credit for Rehabilitation Expenses for

buildings, that:

Retail Enterprises and Historic Barns

(a) was acquired, constructed, reconstructed, or erected

Form CT-44, Claim for Investment Tax Credit for the

by the taxpayer after December 31, 1968;

Financial Services Industry

DTF-603, Claim for EDZ Investment Tax Credit and EDZ

(b) is depreciable pursuant to section 167 or 168 of the

Employment Incentive Credit

IRC;

Form DTF-605, Claim for EDZ Investment Tax Credit for

(c) has a useful life of four years or more;

the Financial Services Industry

(d) was acquired by the taxpayer by purchase pursuant to

section 179(d) of the IRC;

Investment Tax Credit

(e) has a situs in New York State; and

General business corporations may claim an investment tax

(1) is principally used by the taxpayer in producing

credit under section 210.12 against the tax imposed by

goods by manufacturing, processing, assembling,

Article 9-A, for the tax year during which qualified property

refining, mining, extracting, farming, agriculture,

is placed in service. The investment tax credit is computed

horticulture, floriculture, viticulture, or commercial

on the investment credit base. The investment credit base

fishing; or

is the cost, or other basis when placed in service in New

York State for federal income tax purposes, of qualified

(2) is an industrial waste treatment facility or air

tangible property, including buildings and structural

pollution control facility, used in the taxpayer’s

components of buildings, less the amount of nonqualified

trade or business; or

nonrecourse financing with respect to such property. Do not

(3) is research and development property.

include in the investment credit base any amount that was

expensed under section 179(a) of the Internal Revenue

If qualified property is acquired to replace other insured

Code (IRC).

property that was stolen or was destroyed by fire, storm,

shipwreck, or other casualty, the basis of the replacement

The percentage to be used to compute the investment tax

property is its cost reduced by any amount of gain not

credit will depend upon the period during which the

recognized for federal income tax purposes because the

property was acquired, constructed, reconstructed, or

insurance proceeds were invested in the replacement.

erected. Periods and the applicable rates are listed in Rate

Recapture of investment tax credit previously allowed must

Schedule 1, Form CT-46.

be computed if the property was stolen, destroyed, or

disposed of prior to the end of its useful life, if there is an

If an acquisition, construction, reconstruction, or erection

increase in nonqualified nonrecourse financing, or if the

began in one tax period and was completed in another

taxpayer was the target in a merger, consolidation, or

period, the applicable rate must be applied to the

acquisition.

investment credit base attributable to each period. The

method that must be used to compute the investment tax

Types of property that do not qualify for the investment tax

credit in this situation may be found in Article 9-A,

credit include:

Franchise Tax Regulations, section 5-2.5.

(a) property leased to others (except qualified property

in a safe harbor lease or production property

Section 210.12-D allows an employment incentive tax credit

which is beneficially owned by the lessee);

for property where the acquisition, construction,

reconstruction, or erection began on or after January 1,

(b) retail equipment, office furniture and office

1987. For details, see instructions for completing Schedule

equipment;

C of Form CT-46.

(c) excavating and road building equipment;

(d) public warehouses used to store the taxpayer’s

These credits may not reduce the tax liability to less than

goods;

the greater of the tax on minimum taxable income or the

fixed dollar minimum tax.

(e) electricity-generating equipment.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6