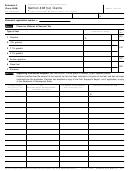

2

Schedule 5 (Form 8849) (Rev. 1-2001)

Page

Instructions

Claimant

The person who paid the second tax to the government is

Section references are to the Inter nal Revenue Code.

the only person eligible to make this claim.

Purpose of Schedule

Claim Requirement

A person who paid the second tax to the government uses

Generally, the claim must be filed within 3 years from the

Schedule 5 to make a claim for refund.

time the return for the second tax was filed or 2 years from

Section 4081(e) Claims

the time the second tax was paid to the government,

whichever is later.

Section 4081(e) applies to gasoline, gasohol, aviation

gasoline, diesel fuel, and kerosene.

Total Refund

If two taxes were paid on the fuel for which the claim is

Add all amounts in column (a) and enter the result in the

filed, then a claim for refund of the second tax may be made.

total refund box at the top of the Schedule.

Example. Acme is a taxable fuel registrant that owns 10,000

Part I

gallons of gasoline that is being transported on a vessel in

For each type of fuel, enter the total of all amounts from

the United States. On June 1, 2001, Acme sells the gasoline

column (f), Part II.

to Bravo, a person that is not a taxable fuel registrant. Acme

is liable for tax on this sale. Acme prepares a First Taxpayer’s

Part II

Report related to this sale and gives a copy of the report to

For each payment of a second tax, complete all the

Bravo.

information required.

On June 4, 2001, Bravo sells the same gallons of gasoline

Information to be Attached

to Charlie, a taxable fuel registrant. Bravo also gives Charlie

1. A copy of the First Taxpayer’s Report that relates to the

a copy of Acme’s First Taxpayer’s Report and a Statement of

fuel covered by each claim, and

Subsequent Seller. On June 9, 2001, the gasoline is removed

2. If the fuel covered by the claim was bought from

from a terminal at the rack. Charlie is the position holder of

someone other than the first taxpayer, a copy of the

the gasoline at the time of the removal and thus is liable for

Statement of Subsequent Seller that the claimant received

tax on the removal. Charlie pays this tax to the government.

with respect to that fuel.

After Charlie has filed a return of this second tax, Charlie

files Form 8849 and Schedule 5 for a refund for the second

How To File

tax and includes a copy of the First Taxpayer’s Report and

Attach Schedule 5 to Form 8849. On the envelope write

Statement of Subsequent Seller. In Part I of Schedule 5,

“Section 4081(e) Claim” and mail to the IRS at the address

Charlie enters “1840” in column 1(a). In Part II, Charlie enters

under Where To File in the Form 8849 instructions.

“1” in column (c); “06092001” in column (d); “10000” in

column (e); and “1840” in column (f).

Schedule 5 (Form 8849) (1-2001)

1

1 2

2