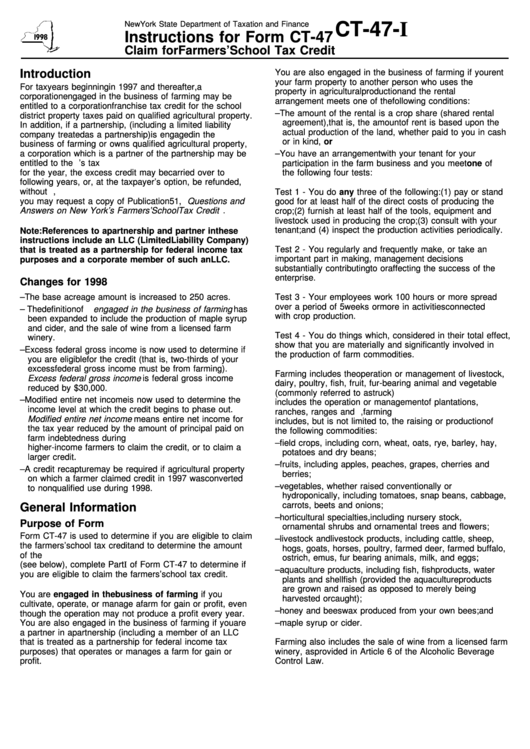

Form Ct-47-I - Instructions For Form Ct-47 - Claim For Farmers' School Tax Credit - 1998

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-47-I

Instructions for Form CT-47

Claim for Farmers’ School Tax Credit

Introduction

You are also engaged in the business of farming if you rent

your farm property to another person who uses the

For tax years beginning in 1997 and thereafter, a

property in agricultural production and the rental

corporation engaged in the business of farming may be

arrangement meets one of the following conditions:

entitled to a corporation franchise tax credit for the school

– The amount of the rental is a crop share (shared rental

district property taxes paid on qualified agricultural property.

agreement), that is, the amount of rent is based upon the

In addition, if a partnership, (including a limited liability

actual production of the land, whether paid to you in cash

company treated as a partnership) is engaged in the

or in kind, or

business of farming or owns qualified agricultural property,

a corporation which is a partner of the partnership may be

– You have an arrangement with your tenant for your

entitled to the credit. If the credit exceeds the taxpayer’s tax

participation in the farm business and you meet one of

for the year, the excess credit may be carried over to

the following four tests:

following years, or, at the taxpayer’s option, be refunded,

without interest. For more information concerning this credit,

Test 1 - You do any three of the following: (1) pay or stand

you may request a copy of Publication 51, Questions and

good for at least half of the direct costs of producing the

Answers on New York’s Farmers’ School Tax Credit .

crop; (2) furnish at least half of the tools, equipment and

livestock used in producing the crop; (3) consult with your

tenant; and (4) inspect the production activities periodically.

Note: References to a partnership and partner in these

instructions include an LLC (Limited Liability Company)

Test 2 - You regularly and frequently make, or take an

that is treated as a partnership for federal income tax

important part in making, management decisions

purposes and a corporate member of such an LLC.

substantially contributing to or affecting the success of the

enterprise.

Changes for 1998

– The base acreage amount is increased to 250 acres.

Test 3 - Your employees work 100 hours or more spread

over a period of 5 weeks or more in activities connected

– The definition of engaged in the business of farming has

with crop production.

been expanded to include the production of maple syrup

and cider, and the sale of wine from a licensed farm

Test 4 - You do things which, considered in their total effect,

winery.

show that you are materially and significantly involved in

– Excess federal gross income is now used to determine if

the production of farm commodities.

you are eligible for the credit (that is, two-thirds of your

excess federal gross income must be from farming).

Farming includes the operation or management of livestock,

Excess federal gross income is federal gross income

dairy, poultry, fish, fruit, fur-bearing animal and vegetable

reduced by $30,000.

(commonly referred to as truck) farms. Farming also

– Modified entire net income is now used to determine the

includes the operation or management of plantations,

income level at which the credit begins to phase out.

ranches, ranges and orchards. For example, farming

Modified entire net income means entire net income for

includes, but is not limited to, the raising or production of

the tax year reduced by the amount of principal paid on

the following commodities:

farm indebtedness during 1998. This change may allow

– field crops, including corn, wheat, oats, rye, barley, hay,

higher-income farmers to claim the credit, or to claim a

potatoes and dry beans;

larger credit.

– fruits, including apples, peaches, grapes, cherries and

– A credit recapture may be required if agricultural property

berries;

on which a farmer claimed credit in 1997 was converted

– vegetables, whether raised conventionally or

to nonqualified use during 1998.

hydroponically, including tomatoes, snap beans, cabbage,

carrots, beets and onions;

General Information

– horticultural specialties, including nursery stock,

Purpose of Form

ornamental shrubs and ornamental trees and flowers;

Form CT-47 is used to determine if you are eligible to claim

– livestock and livestock products, including cattle, sheep,

the farmers’ school tax credit and to determine the amount

hogs, goats, horses, poultry, farmed deer, farmed buffalo,

of the credit. If you are engaged in the business of farming

ostrich, emus, fur bearing animals, milk, and eggs;

(see below), complete Part I of Form CT-47 to determine if

– aquaculture products, including fish, fish products, water

you are eligible to claim the farmers’ school tax credit.

plants and shellfish (provided the aquaculture products

are grown and raised as opposed to merely being

You are engaged in the business of farming if you

harvested or caught);

cultivate, operate, or manage a farm for gain or profit, even

– honey and beeswax produced from your own bees; and

though the operation may not produce a profit every year.

You are also engaged in the business of farming if you are

– maple syrup or cider.

a partner in a partnership (including a member of an LLC

that is treated as a partnership for federal income tax

Farming also includes the sale of wine from a licensed farm

purposes) that operates or manages a farm for gain or

winery, as provided in Article 6 of the Alcoholic Beverage

profit.

Control Law.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4