General Instructions For Form Cd-401s Schedule N - North Carolina Department Of Revenue

ADVERTISEMENT

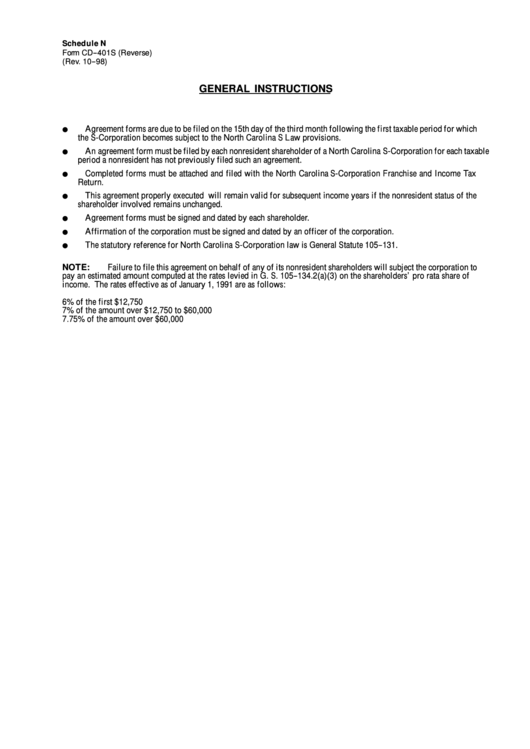

Schedule N

Form CD--401S (Reverse)

(Rev. 10--98)

GENERAL INSTRUCTIONS

Agreement forms are due to be filed on the 15th day of the third month following the first taxable period for which

F

the S-Corporation becomes subject to the North Carolina S Law provisions.

An agreement form must be filed by each nonresident shareholder of a North Carolina S-Corporation for each taxable

F

period a nonresident has not previously filed such an agreement.

Completed forms must be attached and filed with the North Carolina S-Corporation Franchise and Income Tax

F

Return.

This agreement properly executed will remain valid for subsequent income years if the nonresident status of the

F

shareholder involved remains unchanged.

Agreement forms must be signed and dated by each shareholder.

F

Affirmation of the corporation must be signed and dated by an officer of the corporation.

F

The statutory reference for North Carolina S-Corporation law is General Statute 105--131.

F

NOTE:

Failure to file this agreement on behalf of any of its nonresident shareholders will subject the corporation to

pay an estimated amount computed at the rates levied in G. S. 105--134.2(a)(3) on the shareholders’pro rata share of

income. The rates effective as of January 1, 1991 are as follows:

6% of the first $12,750

7% of the amount over $12,750 to $60,000

7.75% of the amount over $60,000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1