Instructions For Form 4578 - Michigan Business Tax (Mbt) Schedule Of Partners

ADVERTISEMENT

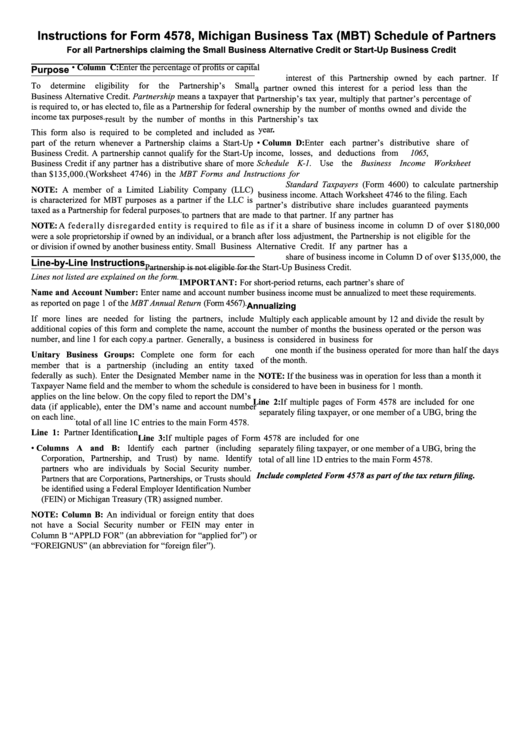

Instructions for Form 4578, Michigan Business Tax (MBT) Schedule of Partners

For all Partnerships claiming the Small Business Alternative Credit or Start-Up Business Credit

• Column C: Enter the percentage of profits or capital

Purpose

interest of this Partnership owned by each partner. If

To

determine

eligibility

for

the

Partnership’s

Small

a partner owned this interest for a period less than the

Business Alternative Credit. Partnership means a taxpayer that

Partnership’s tax year, multiply that partner’s percentage of

is required to, or has elected to, file as a Partnership for federal

ownership by the number of months owned and divide the

income tax purposes.

result by the number of months in this Partnership’s tax

year.

This form also is required to be completed and included as

• Column D: Enter each partner’s distributive share of

part of the return whenever a Partnership claims a Start-Up

income, losses, and deductions from U.S. Form 1065,

Business Credit. A partnership cannot qualify for the Start-Up

Business Credit if any partner has a distributive share of more

Schedule K-1. Use the Business Income Worksheet

(Worksheet 4746) in the MBT Forms and Instructions for

than $135,000.

Standard Taxpayers (Form 4600) to calculate partnership

Note: A member of a Limited Liability Company (LLC)

business income. Attach Worksheet 4746 to the filing. Each

is characterized for MBT purposes as a partner if the LLC is

partner’s distributive share includes guaranteed payments

taxed as a Partnership for federal purposes.

to partners that are made to that partner. If any partner has

Note: A federally disregarded entity is required to file as if it

a share of business income in column D of over $180,000

were a sole proprietorship if owned by an individual, or a branch

after loss adjustment, the Partnership is not eligible for the

Small Business Alternative Credit. If any partner has a

or division if owned by another business entity.

share of business income in Column D of over $135,000, the

Line-by-Line Instructions

Partnership is not eligible for the Start-Up Business Credit.

Lines not listed are explained on the form.

ImportANt: For short-period returns, each partner’s share of

Name and Account Number: Enter name and account number

business income must be annualized to meet these requirements.

as reported on page 1 of the MBT Annual Return (Form 4567).

Annualizing

If more lines are needed for listing the partners, include

Multiply each applicable amount by 12 and divide the result by

additional copies of this form and complete the name, account

the number of months the business operated or the person was

number, and line 1 for each copy.

a partner. Generally, a business is considered in business for

one month if the business operated for more than half the days

Unitary Business Groups: Complete one form for each

of the month.

member that is a partnership (including an entity taxed

federally as such). Enter the Designated Member name in the

Note: If the business was in operation for less than a month it

Taxpayer Name field and the member to whom the schedule

is considered to have been in business for 1 month.

applies on the line below. On the copy filed to report the DM’s

Line 2: If multiple pages of Form 4578 are included for one

data (if applicable), enter the DM’s name and account number

separately filing taxpayer, or one member of a UBG, bring the

on each line.

total of all line 1C entries to the main Form 4578.

Line 1: Partner Identification

Line 3: If multiple pages of Form 4578 are included for one

• Columns A and B: Identify each partner (including

separately filing taxpayer, or one member of a UBG, bring the

Corporation, Partnership, and Trust) by name. Identify

total of all line 1D entries to the main Form 4578.

partners who are individuals by Social Security number.

Include completed Form 4578 as part of the tax return filing.

Partners that are Corporations, Partnerships, or Trusts should

be identified using a Federal Employer Identification Number

(FEIN) or Michigan Treasury (TR) assigned number.

Note: Column B: An individual or foreign entity that does

not have a Social Security number or FEIN may enter in

Column B “APPLD FOR” (an abbreviation for “applied for”) or

“FOREIGNUS” (an abbreviation for “foreign filer”).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1