Instruction 1097-Btc- 2010

ADVERTISEMENT

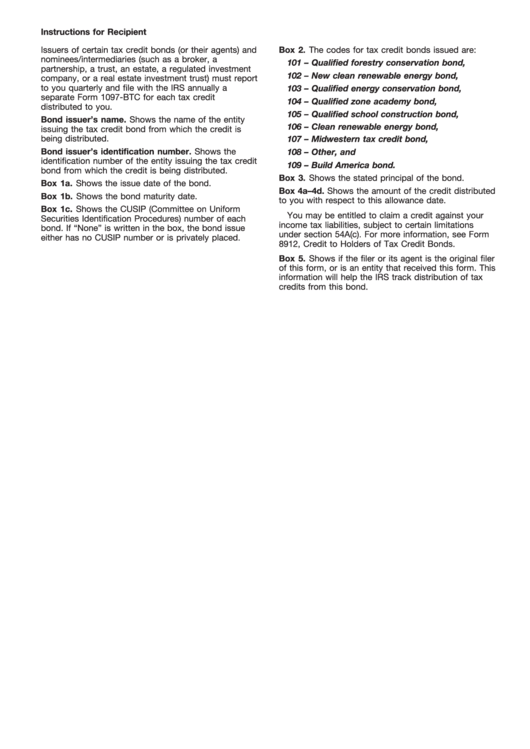

Instructions for Recipient

Issuers of certain tax credit bonds (or their agents) and

Box 2. The codes for tax credit bonds issued are:

nominees/intermediaries (such as a broker, a

101 – Qualified forestry conservation bond,

partnership, a trust, an estate, a regulated investment

102 – New clean renewable energy bond,

company, or a real estate investment trust) must report

to you quarterly and file with the IRS annually a

103 – Qualified energy conservation bond,

separate Form 1097-BTC for each tax credit

104 – Qualified zone academy bond,

distributed to you.

105 – Qualified school construction bond,

Bond issuer’s name. Shows the name of the entity

106 – Clean renewable energy bond,

issuing the tax credit bond from which the credit is

being distributed.

107 – Midwestern tax credit bond,

Bond issuer’s identification number. Shows the

108 – Other, and

identification number of the entity issuing the tax credit

109 – Build America bond.

bond from which the credit is being distributed.

Box 3. Shows the stated principal of the bond.

Box 1a. Shows the issue date of the bond.

Box 4a–4d. Shows the amount of the credit distributed

Box 1b. Shows the bond maturity date.

to you with respect to this allowance date.

Box 1c. Shows the CUSIP (Committee on Uniform

You may be entitled to claim a credit against your

Securities Identification Procedures) number of each

income tax liabilities, subject to certain limitations

bond. If “None” is written in the box, the bond issue

under section 54A(c). For more information, see Form

either has no CUSIP number or is privately placed.

8912, Credit to Holders of Tax Credit Bonds.

Box 5. Shows if the filer or its agent is the original filer

of this form, or is an entity that received this form. This

information will help the IRS track distribution of tax

credits from this bond.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5