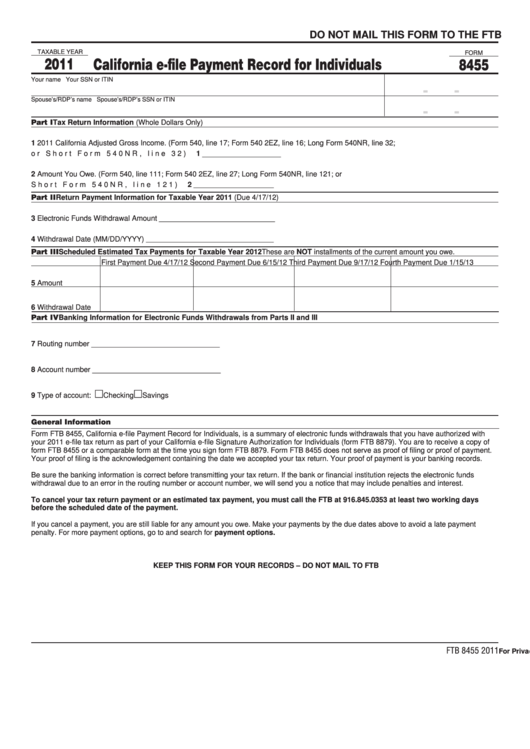

Do NoT MAIL THIS FoRM To THE FTB

TAXABLE YEAR

FORM

2011

California e-file Payment Record for Individuals

8455

Your name

Your SSN or ITIN

-

-

Spouse’s/RDP’s name

Spouse’s/RDP’s SSN or ITIN

-

-

Part I Tax Return Information (Whole Dollars Only)

1 2011 California Adjusted Gross Income. (Form 540, line 17; Form 540 2EZ, line 16; Long Form 540NR, line 32;

or Short Form 540NR, line 32) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1 ___________________

2 Amount You Owe. (Form 540, line 111; Form 540 2EZ, line 27; Long Form 540NR, line 121; or

Short Form 540NR, line 121) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2 ______________________

Part II Return Payment Information for Taxable Year 2011 (Due 4/17/12)

3 Electronic Funds Withdrawal Amount ____________________________

4 Withdrawal Date (MM/DD/YYYY) ___________________________________

Part III Scheduled Estimated Tax Payments for Taxable Year 2012 These are NoT installments of the current amount you owe.

First Payment Due 4/17/12 Second Payment Due 6/15/12 Third Payment Due 9/17/12 Fourth Payment Due 1/15/13

5 Amount

6 Withdrawal Date

Part IV Banking Information for Electronic Funds Withdrawals from Parts II and III

7 Routing number _______________________________

8 Account number _______________________________

m

m

9 Type of account:

Checking

Savings

General Information

Form FTB 8455, California e-file Payment Record for Individuals, is a summary of electronic funds withdrawals that you have authorized with

your 2011 e-file tax return as part of your California e-file Signature Authorization for Individuals (form FTB 8879). You are to receive a copy of

form FTB 8455 or a comparable form at the time you sign form FTB 8879. Form FTB 8455 does not serve as proof of filing or proof of payment.

Your proof of filing is the acknowledgement containing the date we accepted your tax return. Your proof of payment is your banking records.

Be sure the banking information is correct before transmitting your tax return. If the bank or financial institution rejects the electronic funds

withdrawal due to an error in the routing number or account number, we will send you a notice that may include penalties and interest.

To cancel your tax return payment or an estimated tax payment, you must call the FTB at 916.845.0353 at least two working days

before the scheduled date of the payment.

If you cancel a payment, you are still liable for any amount you owe. Make your payments by the due dates above to avoid a late payment

penalty. For more payment options, go to ftb.ca.gov and search for payment options.

KEEP THIS FoRM FoR YoUR RECoRDS – Do NoT MAIL To FTB

FTB 8455 2011

For Privacy Notice, get form FTB 1131.

1

1