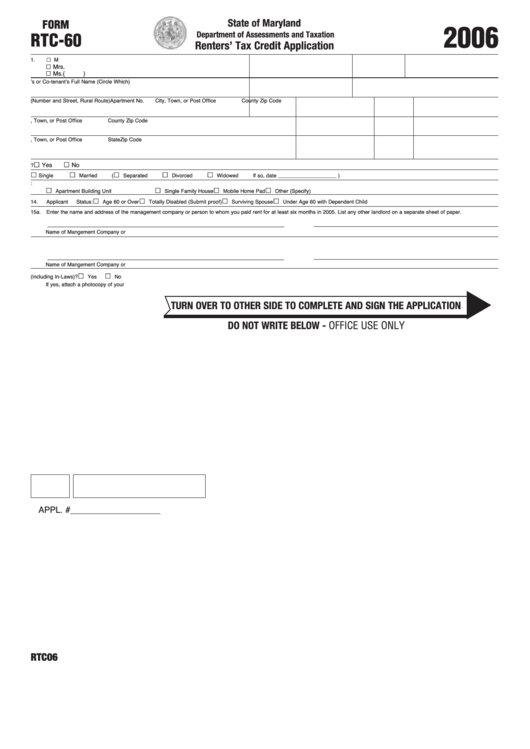

Form Rtc-60 - Renters' Tax Credit Application - 2006

ADVERTISEMENT

a Mrs.

a Ms.

a Mr.

a

a

a

a

a

a

a

a

a

a

a

a

a

a

a

State of Maryland

FORM

2006

Department of Assessments and Taxation

RTC-60

Renters’ Tax Credit Application

1.

Last Name

First Name and Middle Initial

2.

Your Social Security Number

3. Your Birth Date

4. Daytime Telephone No.

a

a

(

)

5.

Enter Spouse’s or Co-tenant’s Full Name (Circle Which)

6.

His/Her Social Security Number

7. His/Her Birth Date

8.

Present Address (Number and Street, Rural Route)

Apartment No.

City, Town, or Post Office

County

Zip Code

9.

Address in 2005 if Different from Above

City, Town, or Post Office

County

Zip Code

10.

Mailing Address if Different from Present Address

City, Town, or Post Office

State

Zip Code

Yes

No

11.

Did you reside in public housing in 2005?

12.

Marital Status

Single

Married

(

Separated

Divorced

Widowed

If so, date ____________________ )

13.

Check one of the following which describes your rented residence:

Apartment Building Unit

Single Family House

Mobile Home Pad

Other (Specify)

14.

Applicant Status:

Age 60 or Over

Totally Disabled (Submit proof)

Surviving Spouse

Under Age 60 with Dependent Child

15a.

Enter the name and address of the management company or person to whom you paid rent for at least six months in 2005. List any other landlord on a separate sheet of paper.

Name of Mangement Company or Landlord.

Address of Management Company or Landlord

15b.

Enter the name and address of the current management company or person to whom you are now paying rent.

Name of Mangement Company or Landlord.

Address of Management Company or Landlord

16.

Do you rent from a person related to you (including In-Laws)?

Yes

No

If yes, attach a photocopy of your lease.

Relationship______________________________________________________

TURN OVER TO OTHER SIDE TO COMPLETE AND SIGN THE APPLICATION

DO NOT WRITE BELOW - OFFICE USE ONLY

APPL. #___________________

RTC06

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2