Form W-1 - Ashland Municipal Income Tax Employer'S Monthly/quarterly Return Of Tax Withheld

ADVERTISEMENT

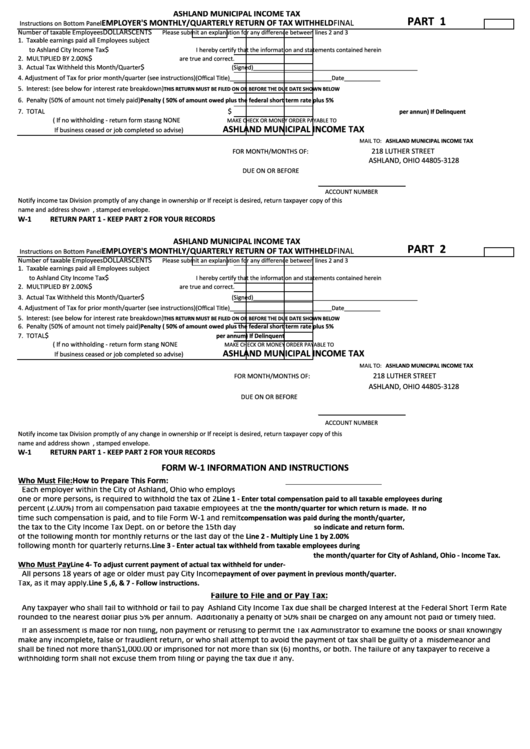

ASHLAND MUNICIPAL INCOME TAX

PART 1

EMPLOYER'S MONTHLY/QUARTERLY RETURN OF TAX WITHHELD

FINAL

Instructions on Bottom Panel

DOLLARS

CENTS

Number of taxable Employees

Please submit an explanation for any difference between lines 2 and 3

1. Taxable earnings paid all Employees subject

$

to Ashland City Income Tax

I hereby certify that the information and statements contained herein

$

2. MULTIPLIED BY 2.00%

are true and correct.

$

3. Actual Tax Withheld this Month/Quarter

(Signed)__________________________________________________

4. Adjustment of Tax for prior month/quarter (see instructions)

(Offical Title)_______________________________Date___________

5. Interest: (see below for interest rate breakdown)

THIS RETURN MUST BE FILED ON OR BEFORE THE DUE DATE SHOWN BELOW

6. Penalty (50% of amount not timely paid)

Penalty ( 50% of amount owed plus the federal short term rate plus 5%

$

7. TOTAL

per annun) If Delinquent

( If no withholding - return form stasting NONE

MAKE CHECK OR MONEY ORDER PAYABLE TO

ASHLAND MUNICIPAL INCOME TAX

If business ceased or job completed so advise)

MAIL TO: ASHLAND MUNICIPAL INCOME TAX

218 LUTHER STREET

FOR MONTH/MONTHS OF:

ASHLAND, OHIO 44805-3128

DUE ON OR BEFORE

ACCOUNT NUMBER

Notify income tax Division promptly of any change in ownership or

If receipt is desired, return taxpayer copy of this

name and address shown above.

form and enclose a self-addressed, stamped envelope.

W-1

RETURN PART 1 - KEEP PART 2 FOR YOUR RECORDS

ASHLAND MUNICIPAL INCOME TAX

PART 2

EMPLOYER'S MONTHLY/QUARTERLY RETURN OF TAX WITHHELD

FINAL

Instructions on Bottom Panel

DOLLARS

CENTS

Number of taxable Employees

Please submit an explanation for any difference between lines 2 and 3

1. Taxable earnings paid all Employees subject

$

to Ashland City Income Tax

I hereby certify that the information and statements contained herein

$

2. MULTIPLIED BY 2.00%

are true and correct.

$

3. Actual Tax Withheld this Month/Quarter

(Signed)__________________________________________________

4. Adjustment of Tax for prior month/quarter (see instructions)

(Offical Title)_______________________________Date___________

5. Interest: (see below for interest rate breakdown)

THIS RETURN MUST BE FILED ON OR BEFORE THE DUE DATE SHOWN BELOW

6. Penalty (50% of amount not timely paid)

Penalty ( 50% of amount owed plus the federal short term rate plus 5%

$

7. TOTAL

per annum) If Delinquent

( If no withholding - return form stating NONE

MAKE CHECK OR MONEY ORDER PAYABLE TO

ASHLAND MUNICIPAL INCOME TAX

If business ceased or job completed so advise)

MAIL TO: ASHLAND MUNICIPAL INCOME TAX

218 LUTHER STREET

FOR MONTH/MONTHS OF:

ASHLAND, OHIO 44805-3128

DUE ON OR BEFORE

ACCOUNT NUMBER

Notify income tax Division promptly of any change in ownership or

If receipt is desired, return taxpayer copy of this

name and address shown above.

form and enclose a self-addressed, stamped envelope.

W-1

RETURN PART 1 - KEEP PART 2 FOR YOUR RECORDS

FORM W-1 INFORMATION AND INSTRUCTIONS

Who Must File:

How to Prepare This Form:

Each employer within the City of Ashland, Ohio who employs

one or more persons, is required to withhold the tax of 2

Line 1 - Enter total compensation paid to all taxable employees during

percent (2.00%) from all compensation paid taxable employees at the

the month/quarter for which return is made. If no

time such compensation is paid, and to file Form W-1 and remit

compensation was paid during the month/quarter,

the tax to the City Income Tax Dept. on or before the 15th day

so indicate and return form.

of the following month for monthly returns or the last day of the

Line 2 - Multiply Line 1 by 2.00%

following month for quarterly returns.

Line 3 - Enter actual tax withheld from taxable employees during

the month/quarter for City of Ashland, Ohio - Income Tax.

Who Must Pay

Line 4- To adjust current payment of actual tax withheld for under-

All persons 18 years of age or older must pay City Income

payment of over payment in previous month/quarter.

Tax, as it may apply.

Line 5 ,6, & 7 - Follow instructions.

Failure to File and or Pay Tax:

Any taxpayer who shall fail to withhold or fail to pay Ashland City Income Tax due shall be charged Interest at the Federal Short Term Rate

rounded to the nearest dollar plus 5% per annum. Additionally a penalty of 50% shall be charged on any amount not paid or timely filed.

If an assessment is made for non filing, non payment or refusing to permit the Tax Administrator to examine the books or shall knowingly

make any incomplete, false or fraudlent return, or who shall attempt to avoid the payment of tax shall be guilty of a misdemeanor and

shall be fined not more than$1,000.00 or imprisoned for not more than six (6) months, or both. The failure of any taxpayer to receive a

withholding form shall not excuse them from filing or paying the tax due if any.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1