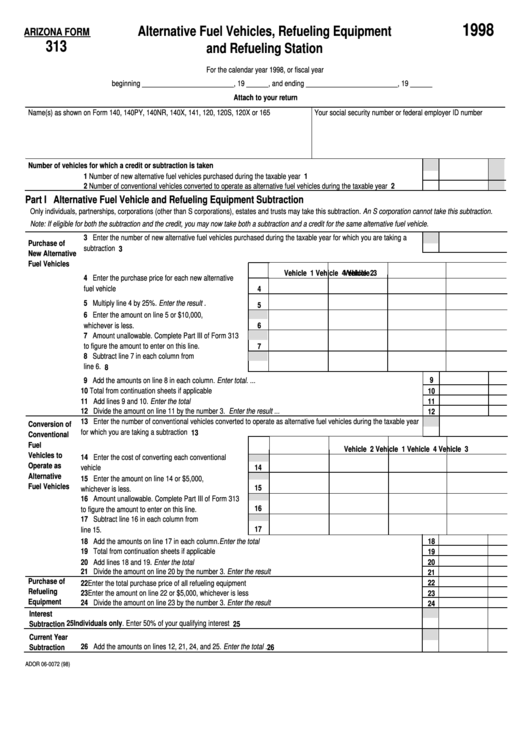

1998

Alternative Fuel Vehicles, Refueling Equipment

ARIZONA FORM

313

and Refueling Station

For the calendar year 1998, or fiscal year

beginning _________________________, 19 ______, and ending _________________________, 19 ______

Attach to your return

Name(s) as shown on Form 140, 140PY, 140NR, 140X, 141, 120, 120S, 120X or 165

Your social security number or federal employer ID number

Number of vehicles for which a credit or subtraction is taken

1 Number of new alternative fuel vehicles purchased during the taxable year ...............................................................

1

2 Number of conventional vehicles converted to operate as alternative fuel vehicles during the taxable year ..............

2

Part I Alternative Fuel Vehicle and Refueling Equipment Subtraction

Only individuals, partnerships, corporations (other than S corporations), estates and trusts may take this subtraction. An S corporation cannot take this subtraction.

Note: If eligible for both the subtraction and the credit, you may now take both a subtraction and a credit for the same alternative fuel vehicle.

3 Enter the number of new alternative fuel vehicles purchased during the taxable year for which you are taking a

Purchase of

subtraction ....................................................................................................................................................................

3

New Alternative

Fuel Vehicles

Vehicle 1

Vehicle 2

Vehicle 3

Vehicle 4

4 Enter the purchase price for each new alternative

fuel vehicle .................................................................

4

5 Multiply line 4 by 25%. Enter the result ......................

5

6 Enter the amount on line 5 or $10,000,

whichever is less. .......................................................

6

7 Amount unallowable. Complete Part III of Form 313

to figure the amount to enter on this line. ..................

7

8 Subtract line 7 in each column from

line 6. ..........................................................................

8

9

9 Add the amounts on line 8 in each column. Enter total. ...............................................................................................

10 Total from continuation sheets if applicable .................................................................................................................

10

11 Add lines 9 and 10. Enter the total ................................................................................................................................

11

12 Divide the amount on line 11 by the number 3. Enter the result .................................................................................

12

13 Enter the number of conventional vehicles converted to operate as alternative fuel vehicles during the taxable year

Conversion of

for which you are taking a subtraction ..........................................................................................................................

13

Conventional

Fuel

Vehicle 1

Vehicle 2

Vehicle 3

Vehicle 4

Vehicles to

14 Enter the cost of converting each conventional

Operate as

vehicle ........................................................................

14

Alternative

15 Enter the amount on line 14 or $5,000,

Fuel Vehicles

15

whichever is less. .......................................................

16 Amount unallowable. Complete Part III of Form 313

16

to figure the amount to enter on this line. ..................

17 Subtract line 16 in each column from

17

line 15. .......................................................................

18 Add the amounts on line 17 in each column. Enter the total .......................................................................................

18

19 Total from continuation sheets if applicable .................................................................................................................

19

20 Add lines 18 and 19. Enter the total .............................................................................................................................

20

21 Divide the amount on line 20 by the number 3. Enter the result ..................................................................................

21

Purchase of

22

22 Enter the total purchase price of all refueling equipment .............................................................................................

Refueling

23 Enter the amount on line 22 or $5,000, whichever is less ...........................................................................................

23

Equipment

24 Divide the amount on line 23 by the number 3. Enter the result ..................................................................................

24

Interest

25 Individuals only. Enter 50% of your qualifying interest ..............................................................................................

Subtraction

25

Current Year

26 Add the amounts on lines 12, 21, 24, and 25. Enter the total ......................................................................................

Subtraction

26

ADOR 06-0072 (98)

1

1 2

2 3

3 4

4 5

5