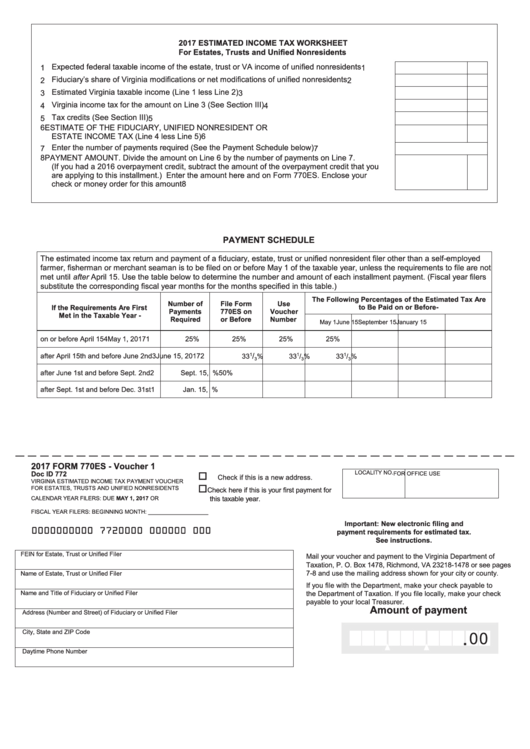

2017 ESTIMATED INCOME TAX WORKSHEET

For Estates, Trusts and Unified Nonresidents

. . . .

1 Expected federal taxable income of the estate, trust or VA income of unified nonresidents

1

. . . . . .

2 Fiduciary’s share of Virginia modifications or net modifications of unified nonresidents

2

. . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Estimated Virginia taxable income (Line 1 less Line 2)

3

. . . . . . . . . . . . . . . . . . . . . .

4 Virginia income tax for the amount on Line 3 (See Section III)

4

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Tax credits (See Section III)

5

6 ESTIMATE OF THE FIDUCIARY, UNIFIED NONRESIDENT OR

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ESTATE INCOME TAX (Line 4 less Line 5)

6

. . . . . . . . . . . .

7 Enter the number of payments required (See the Payment Schedule below)

7

8 PAYMENT AMOUNT. Divide the amount on Line 6 by the number of payments on Line 7.

(If you had a 2016 overpayment credit, subtract the amount of the overpayment credit that you

are applying to this installment.) Enter the amount here and on Form 770ES. Enclose your

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

check or money order for this amount

8

PAYMENT SCHEDULE

The estimated income tax return and payment of a fiduciary, estate, trust or unified nonresident filer other than a self-employed

farmer, fisherman or merchant seaman is to be filed on or before May 1 of the taxable year, unless the requirements to file are not

met until after April 15. Use the table below to determine the number and amount of each installment payment. (Fiscal year filers

substitute the corresponding fiscal year months for the months specified in this table.)

The Following Percentages of the Estimated Tax Are

Number of

File Form

Use

If the Requirements Are First

to Be Paid on or Before-

Payments

770ES on

Voucher

Met in the Taxable Year -

Required

or Before

Number

May 1

June 15

September 15

January 15

on or before April 15

4

May 1, 2017

1

25%

25%

25%

25%

/

after April 15th and before June 2nd

3

June 15, 2017

2

.....

33

1

%

33

1

/

%

33

1

/

%

3

3

3

after June 1st and before Sept. 2nd

2

Sept. 15, 2017

3

.....

.....

50%

50%

after Sept. 1st and before Dec. 31st

1

Jan. 15, 2018

4

.....

.....

.....

100%

2017 FORM 770ES - Voucher 1

Doc ID 772

LOCALITY NO.

FOR OFFICE USE

Check if this is a new address.

VIRGINIA ESTIMATED INCOME TAX PAYMENT VOUCHER

FOR ESTATES, TRUSTS AND UNIFIED NONRESIDENTS

Check here if this is your first payment for

this taxable year.

CALENDAR YEAR FILERS: DUE MAY 1, 2017 OR

FISCAL YEAR FILERS: BEGINNING MONTH: ___________________

Important: New electronic filing and

0000000000 7720000 000000 000

payment requirements for estimated tax.

See instructions.

FEIN for Estate, Trust or Unified Filer

Mail your voucher and payment to the Virginia Department of

Taxation, P. O. Box 1478, Richmond, VA 23218-1478 or see pages

7-8 and use the mailing address shown for your city or county.

Name of Estate, Trust or Unified Filer

If you file with the Department, make your check payable to

the Department of Taxation. If you file locally, make your check

Name and Title of Fiduciary or Unified Filer

payable to your local Treasurer.

Amount of payment

Address (Number and Street) of Fiduciary or Unified Filer

City, State and ZIP Code

00

.

Daytime Phone Number

1

1 2

2