Form Birt-Ez - Business Income & Receipts Tax - 2016

ADVERTISEMENT

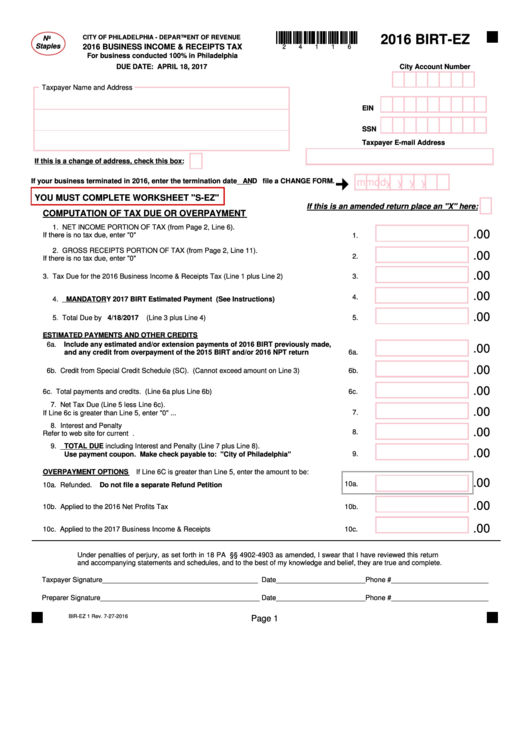

2016 BIRT-EZ

CITY OF PHILADELPHIA - DEPARTMENT OF REVENUE

No

Staples

2016 BUSINESS INCOME & RECEIPTS TAX

2

4

1

1

6

For business conducted 100% in Philadelphia

DUE DATE: APRIL 18, 2017

City Account Number

Taxpayer Name and Address

EIN

SSN

Taxpayer E-mail Address

If this is a change of address, check this box:

If your business terminated in 2016, enter the termination date AND file a CHANGE FORM.

m m d d y y y y

YOU MUST COMPLETE WORKSHEET "S-EZ"

If this is an amended return place an "X" here:

COMPUTATION OF TAX DUE OR OVERPAYMENT

1. NET INCOME PORTION OF TAX (from Page 2, Line 6).

.00

If there is no tax due, enter "0"............................................................................................

1.

2. GROSS RECEIPTS PORTION OF TAX (from Page 2, Line 11).

.00

2.

If there is no tax due, enter "0"............................................................................................

.00

3. Tax Due for the 2016 Business Income & Receipts Tax (Line 1 plus Line 2).......................

3.

.00

4.

4. MANDATORY 2017 BIRT Estimated Payment (See Instructions)...................................

.00

5. Total Due by 4/18/2017 (Line 3 plus Line 4).......................................................................

5.

ESTIMATED PAYMENTS AND OTHER CREDITS

6a. Include any estimated and/or extension payments of 2016 BIRT previously made,

.00

and any credit from overpayment of the 2015 BIRT and/or 2016 NPT return..................

6a.

.00

6b. Credit from Special Credit Schedule (SC). (Cannot exceed amount on Line 3)...................

6b.

.00

6c. Total payments and credits. (Line 6a plus Line 6b)..............................................................

6c.

7. Net Tax Due (Line 5 less Line 6c).

.00

7.

If Line 6c is greater than Line 5, enter "0".............................................................................

8. Interest and Penalty

.00

8.

Refer to web site for current percentage...................................................................... ........

9. TOTAL DUE including Interest and Penalty (Line 7 plus Line 8).

.00

9.

Use payment coupon. Make check payable to: "City of Philadelphia".........................

OVERPAYMENT OPTIONS If Line 6C is greater than Line 5, enter the amount to be:

.00

10a.

10a. Refunded. Do not file a separate Refund Petition...........................................................

.00

10b. Applied to the 2016 Net Profits Tax Return..........................................................................

10b.

.00

10c. Applied to the 2017 Business Income & Receipts Tax.........................................................

10c.

Under penalties of perjury, as set forth in 18 PA C.S. §§ 4902-4903 as amended, I swear that I have reviewed this return

and accompanying statements and schedules, and to the best of my knowledge and belief, they are true and complete.

Taxpayer Signature________________________________________ Date_______________________Phone #_________________________

Preparer Signature_________________________________________ Date_______________________Phone #_________________________

BIR-EZ 1 Rev. 7-27-2016

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2