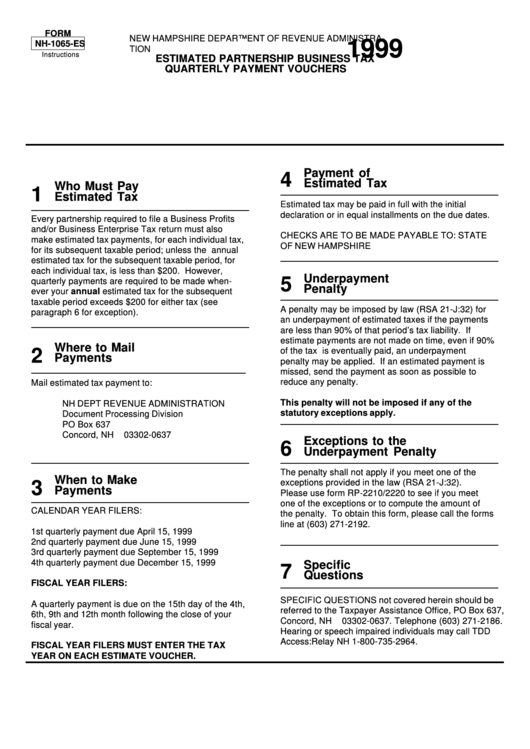

Instructions For Form Nh-1065-Es - Estimated Partnership Business Tax Quarterly Payment Vouchers - 1999

ADVERTISEMENT

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRA-

1999

NH-1065-ES

TION

Instructions

ESTIMATED PARTNERSHIP BUSINESS TAX

QUARTERLY PAYMENT VOUCHERS

Payment of

4

Estimated Tax

Who Must Pay

1

Estimated Tax

Estimated tax may be paid in full with the initial

declaration or in equal installments on the due dates.

Every partnership required to file a Business Profits

and/or Business Enterprise Tax return must also

CHECKS ARE TO BE MADE PAYABLE TO: STATE

make estimated tax payments, for each individual tax,

OF NEW HAMPSHIRE

for its subsequent taxable period; unless the annual

estimated tax for the subsequent taxable period, for

each individual tax, is less than $200. However,

Underpayment

5

quarterly payments are required to be made when-

Penalty

ever your annual estimated tax for the subsequent

taxable period exceeds $200 for either tax (see

A penalty may be imposed by law (RSA 21-J:32) for

paragraph 6 for exception).

an underpayment of estimated taxes if the payments

are less than 90% of that period’s tax liability. If

estimate payments are not made on time, even if 90%

Where to Mail

of the tax is eventually paid, an underpayment

2

Payments

penalty may be applied. If an estimated payment is

missed, send the payment as soon as possible to

reduce any penalty.

Mail estimated tax payment to:

This penalty will not be imposed if any of the

NH DEPT REVENUE ADMINISTRATION

statutory exceptions apply.

Document Processing Division

PO Box 637

Concord, NH

03302-0637

Exceptions to the

6

Underpayment Penalty

The penalty shall not apply if you meet one of the

When to Make

exceptions provided in the law (RSA 21-J:32).

3

Payments

Please use form RP-2210/2220 to see if you meet

one of the exceptions or to compute the amount of

CALENDAR YEAR FILERS:

the penalty. To obtain this form, please call the forms

line at (603) 271-2192.

1st quarterly payment due April 15, 1999

2nd quarterly payment due June 15, 1999

3rd quarterly payment due September 15, 1999

4th quarterly payment due December 15, 1999

Specific

7

Questions

FISCAL YEAR FILERS:

SPECIFIC QUESTIONS not covered herein should be

A quarterly payment is due on the 15th day of the 4th,

referred to the Taxpayer Assistance Office, PO Box 637,

6th, 9th and 12th month following the close of your

Concord, NH

03302-0637. Telephone (603) 271-2186.

fiscal year.

Hearing or speech impaired individuals may call TDD

Access:Relay NH 1-800-735-2964.

FISCAL YEAR FILERS MUST ENTER THE TAX

YEAR ON EACH ESTIMATE VOUCHER.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1