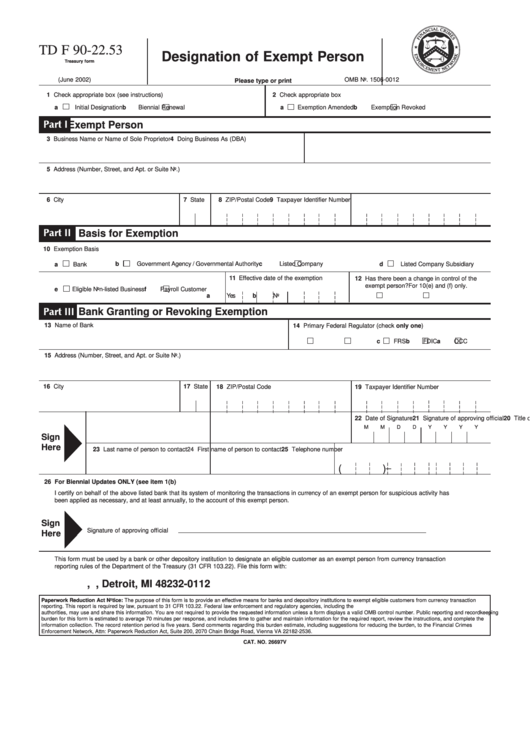

TD F 90-22.53

Designation of Exempt Person

Treasury form

(June 2002)

OMB No. 1506-0012

Please type or print

1 Check appropriate box (see instructions)

2 Check appropriate box

a

Initial Designation

b

Biennial Renewal

a

Exemption Amended

b

Exemption Revoked

Part I

Exempt Person

3 Business Name or Name of Sole Proprietor

4 Doing Business As (DBA)

5 Address (Number, Street, and Apt. or Suite No.)

6 City

7 State

8 ZIP/Postal Code

9 Taxpayer Identifier Number

Part II

Basis for Exemption

10 Exemption Basis

b

Government Agency / Governmental Authority

c

Listed Company

d

Listed Company Subsidiary

a

Bank

11 Effective date of the exemption

12 Has there been a change in control of the

exempt person?For 10(e) and (f) only.

e

Eligible Non-listed Business

f

Payroll Customer

a

Yes

b

No

Part III

Bank Granting or Revoking Exemption

13 Name of Bank

14 Primary Federal Regulator (check only one)

a

OCC

b

FDIC

c

FRS

d

OTS

e

NCUA

15 Address (Number, Street, and Apt. or Suite No.)

16 City

17 State

18 ZIP/Postal Code

19 Taxpayer Identifier Number

20 Title of approving official

21 Signature of approving official

22 Date of Signature

M

M

D

D

Y

Y

Y

Y

Sign

Here

23 Last name of person to contact

24 First name of person to contact

25 Telephone number

_

(

)

26 For Biennial Updates ONLY (see item 1(b)

I certify on behalf of the above listed bank that its system of monitoring the transactions in currency of an exempt person for suspicious activity has

been applied as necessary, and at least annually, to the account of this exempt person.

Sign

Signature of approving official

Here

This form must be used by a bank or other depository institution to designate an eligible customer as an exempt person from currency transaction

reporting rules of the Department of the Treasury (31 CFR 103.22). File this form with:

U.S. Department of the Treasury, P.O. Box 33112, Detroit, MI 48232-0112

Paperwork Reduction Act Notice: The purpose of this form is to provide an effective means for banks and depository institutions to exempt eligible customers from currency transaction

reporting. This report is required by law, pursuant to 31 CFR 103.22. Federal law enforcement and regulatory agencies, including the U.S. Department of the Treasury and other authorized

authorities, may use and share this information. You are not required to provide the requested information unless a form displays a valid OMB control number. Public reporting and recordkeeping

burden for this form is estimated to average 70 minutes per response, and includes time to gather and maintain information for the required report, review the instructions, and complete the

information collection. The record retention period is five years. Send comments regarding this burden estimate, including suggestions for reducing the burden, to the Financial Crimes

Enforcement Network, Attn: Paperwork Reduction Act, Suite 200, 2070 Chain Bridge Road, Vienna VA 22182-2536.

CAT. NO. 26697V

1

1