2004 Super Research And Development Tax Credit Worksheet

ADVERTISEMENT

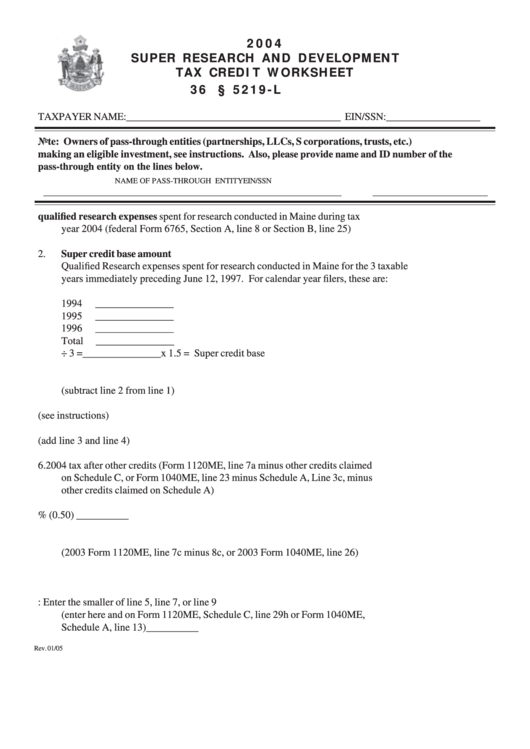

2004

SUPER RESEARCH AND DEVELOPMENT

TAX CREDIT WORKSHEET

36 M.R.S.A. § 5219-L

TAXPAYER NAME: _________________________________________ EIN/SSN: __________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.)

making an eligible investment, see instructions. Also, please provide name and ID number of the

pass-through entity on the lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

_________________________________________________________

______________________

1.

Total qualified research expenses spent for research conducted in Maine during tax

year 2004 (federal Form 6765, Section A, line 8 or Section B, line 25) ...................... 1. ______________

2.

Super credit base amount

Qualified Research expenses spent for research conducted in Maine for the 3 taxable

years immediately preceding June 12, 1997. For calendar year filers, these are:

1994

_______________

1995

_______________

1996

_______________

Total

_______________

÷ 3 =

_______________ x 1.5 = Super credit base amount ..................................... 2. ______________

3.

Qualified research expenses in excess of super credit base amount

(subtract line 2 from line 1).......................................................................................... 3. ______________

4.

Carryover from previous years (see instructions) ........................................................ 4. ______________

5.

Total credit available this year (add line 3 and line 4) ................................................ 5. ______________

6.

2004 tax after other credits (Form 1120ME, line 7a minus other credits claimed

on Schedule C, or Form 1040ME, line 23 minus Schedule A, Line 3c, minus

other credits claimed on Schedule A). .......................................................................... 6. ______________

7.

Line 6 x 50% (0.50) ..................................................................................................... 7._____________

8.

Year 2003 tax less credits

(2003 Form 1120ME, line 7c minus 8c, or 2003 Form 1040ME, line 26) ................... 8._____________

9.

Subtract line 8 from line 6 and enter the difference here .............................................. 9._____________

10. Credit Amount: Enter the smaller of line 5, line 7, or line 9

(enter here and on Form 1120ME, Schedule C, line 29h or Form 1040ME,

Schedule A, line 13) ..................................................................................................... 10. _____________

Rev. 01/05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1