Instructions For Form Nyc-Htx

ADVERTISEMENT

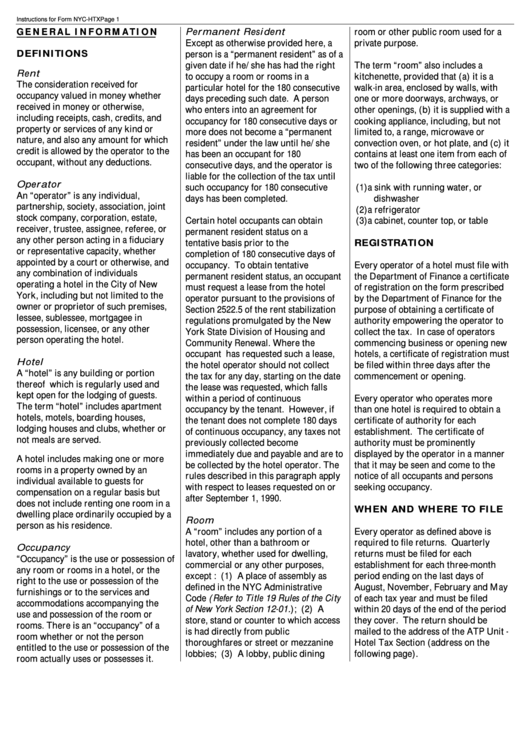

Instructions for Form NYC-HTX

Page 1

GE N E R A L IN F O R M A T I O N

room or other public room used for a

Permanent Resident

Except as otherwise provided here, a

private purpose.

DEFINITIONS

person is a “permanent resident” as of a

given date if he/she has had the right

The term “room” also includes a

Rent

to occupy a room or rooms in a

kitchenette, provided that (a) it is a

The consideration received for

particular hotel for the 180 consecutive

walk-in area, enclosed by walls, with

occupancy valued in money whether

days preceding such date. A person

one or more doorways, archways, or

received in money or otherwise,

who enters into an agreement for

other openings, (b) it is supplied with a

including receipts, cash, credits, and

occupancy for 180 consecutive days or

cooking appliance, including, but not

property or services of any kind or

more does not become a “permanent

limited to, a range, microwave or

nature, and also any amount for which

resident” under the law until he/she

convection oven, or hot plate, and (c) it

credit is allowed by the operator to the

has been an occupant for 180

contains at least one item from each of

occupant, without any deductions.

consecutive days, and the operator is

two of the following three categories:

liable for the collection of the tax until

Operator

such occupancy for 180 consecutive

(1) a sink with running water, or

An “operator” is any individual,

days has been completed.

dishwasher

partnership, society, association, joint

(2) a refrigerator

stock company, corporation, estate,

Certain hotel occupants can obtain

(3) a cabinet, counter top, or table

receiver, trustee, assignee, referee, or

permanent resident status on a

any other person acting in a fiduciary

tentative basis prior to the

REGISTRATION

or representative capacity, whether

completion of 180 consecutive days of

appointed by a court or otherwise, and

occupancy. To obtain tentative

Every operator of a hotel must file with

any combination of individuals

permanent resident status, an occupant

the Department of Finance a certificate

operating a hotel in the City of New

must request a lease from the hotel

of registration on the form prescribed

York, including but not limited to the

operator pursuant to the provisions of

by the Department of Finance for the

owner or proprietor of such premises,

Section 2522.5 of the rent stabilization

purpose of obtaining a certificate of

lessee, sublessee, mortgagee in

regulations promulgated by the New

authority empowering the operator to

possession, licensee, or any other

York State Division of Housing and

collect the tax. In case of operators

person operating the hotel.

Community Renewal. Where the

commencing business or opening new

occupant has requested such a lease,

hotels, a certificate of registration must

Hotel

the hotel operator should not collect

be filed within three days after the

A “hotel” is any building or portion

the tax for any day, starting on the date

commencement or opening.

thereof which is regularly used and

the lease was requested, which falls

kept open for the lodging of guests.

within a period of continuous

Every operator who operates more

The term “hotel” includes apartment

occupancy by the tenant. However, if

than one hotel is required to obtain a

hotels, motels, boarding houses,

the tenant does not complete 180 days

certificate of authority for each

lodging houses and clubs, whether or

of continuous occupancy, any taxes not

establishment. The certificate of

not meals are served.

previously collected become

authority must be prominently

immediately due and payable and are to

displayed by the operator in a manner

A hotel includes making one or more

be collected by the hotel operator. The

that it may be seen and come to the

rooms in a property owned by an

rules described in this paragraph apply

notice of all occupants and persons

individual available to guests for

with respect to leases requested on or

seeking occupancy.

compensation on a regular basis but

after September 1, 1990.

does not include renting one room in a

WHEN AND WHERE TO FILE

dwelling place ordinarily occupied by a

Room

person as his residence.

A “room” includes any portion of a

Every operator as defined above is

hotel, other than a bathroom or

required to file returns. Quarterly

Occupancy

lavatory, whether used for dwelling,

returns must be filed for each

“Occupancy” is the use or possession of

commercial or any other purposes,

establishment for each three-month

any room or rooms in a hotel, or the

except : (1) A place of assembly as

period ending on the last days of

right to the use or possession of the

defined in the NYC Administrative

August, November, February and May

furnishings or to the services and

Code (Refer to Title 19 Rules of the City

of each tax year and must be filed

accommodations accompanying the

of New York Section 12-01.); (2) A

within 20 days of the end of the period

use and possession of the room or

store, stand or counter to which access

they cover. The return should be

rooms. There is an “occupancy” of a

is had directly from public

mailed to the address of the ATP Unit -

room whether or not the person

thoroughfares or street or mezzanine

Hotel Tax Section (address on the

entitled to the use or possession of the

lobbies; (3) A lobby, public dining

following page).

room actually uses or possesses it.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3