Form Rp-458-A-Dis - Renewal Application For Alternative Veterans Exemption From Real Property Taxation Based On Service Connected Disability Compensation Rating

ADVERTISEMENT

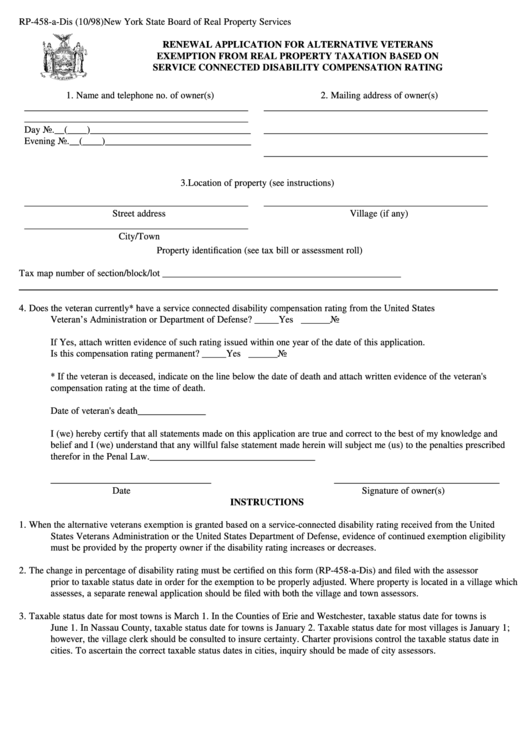

RP-458-a-Dis (10/98)

New York State Board of Real Property Services

RENEWAL APPLICATION FOR ALTERNATIVE VETERANS

EXEMPTION FROM REAL PROPERTY TAXATION BASED ON

SERVICE CONNECTED DISABILITY COMPENSATION RATING

1. Name and telephone no. of owner(s)

2. Mailing address of owner(s)

______________________________________________

______________________________________________

______________________________________________

Day No.__(____)_________________________________

______________________________________________

Evening No.__(____)______________________________

______________________________________________

3. Location of property (see instructions)

______________________________________________

______________________________________________

Street address

Village (if any)

______________________________________________

City/Town

Property identification (see tax bill or assessment roll)

Tax map number of section/block/lot _________________________________________________

4.

Does the veteran currently* have a service connected disability compensation rating from the United States

Veteran’ s Administration or Department of Defense? _____Yes ______No

If Yes, attach written evidence of such rating issued within one year of the date of this application.

Is this compensation rating permanent? _____Yes ______No

* If the veteran is deceased, indicate on the line below the date of death and attach written evidence of the veteran's

compensation rating at the time of death.

Date of veteran's death______________

I (we) hereby certify that all statements made on this application are true and correct to the best of my knowledge and

belief and I (we) understand that any willful false statement made herein will subject me (us) to the penalties prescribed

therefor in the Penal Law.

__________________________________

_________________________________

__________________________________

Date

Signature of owner(s)

INSTRUCTIONS

1.

When the alternative veterans exemption is granted based on a service-connected disability rating received from the United

States Veterans Administration or the United States Department of Defense, evidence of continued exemption eligibility

must be provided by the property owner if the disability rating increases or decreases.

2.

The change in percentage of disability rating must be certified on this form (RP-458-a-Dis) and filed with the assessor

prior to taxable status date in order for the exemption to be properly adjusted. Where property is located in a village which

assesses, a separate renewal application should be filed with both the village and town assessors.

3.

Taxable status date for most towns is March 1. In the Counties of Erie and Westchester, taxable status date for towns is

June 1. In Nassau County, taxable status date for towns is January 2. Taxable status date for most villages is January 1;

however, the village clerk should be consulted to insure certainty. Charter provisions control the taxable status date in

cities. To ascertain the correct taxable status dates in cities, inquiry should be made of city assessors.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1