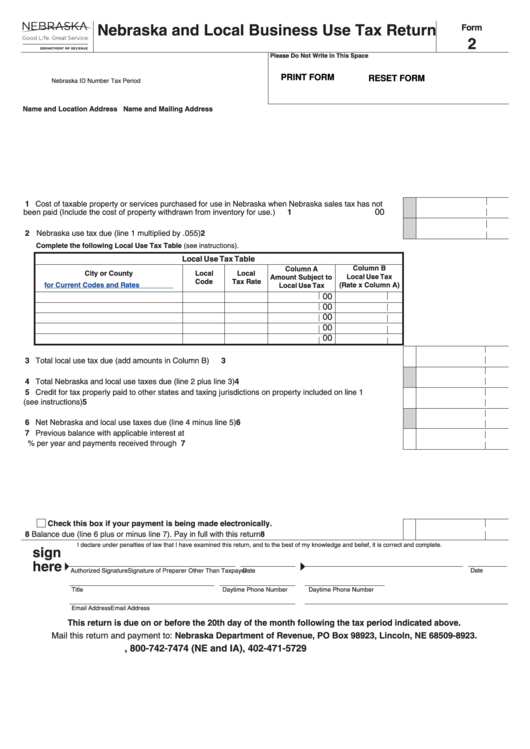

Nebraska and Local Business Use Tax Return

Form

2

Please Do Not Write in This Space

PRINT FORM

RESET FORM

Tax Period

Nebraska ID Number

Name and Location Address

Name and Mailing Address

1 Cost of taxable property or services purchased for use in Nebraska when Nebraska sales tax has not

00

1

been paid (Include the cost of property withdrawn from inventory for use.) .................................................

2 Nebraska use tax due (line 1 multiplied by .055) ..........................................................................................

2

Complete the following Local Use Tax Table (see instructions).

Local Use Tax Table

Column B

Column A

Local

Local

City or County

Local Use Tax

Amount Subject to

Code

Tax Rate

(Rate x Column A)

Click here for Current Codes and Rates

Local Use Tax

00

00

00

00

00

3 Total local use tax due (add amounts in Column B) .....................................................................................

3

4 Total Nebraska and local use taxes due (line 2 plus line 3) ..........................................................................

4

5 Credit for tax properly paid to other states and taxing jurisdictions on property included on line 1

(see instructions) ..........................................................................................................................................

5

6 Net Nebraska and local use taxes due (line 4 minus line 5) .........................................................................

6

7 Previous balance with applicable interest at

% per year and payments received through

7

Check this box if your payment is being made electronically.

8 Balance due (line 6 plus or minus line 7). Pay in full with this return ............................................................

8

I declare under penalties of law that I have examined this return, and to the best of my knowledge and belief, it is correct and complete.

sign

here

Authorized Signature

Date

Signature of Preparer Other Than Taxpayer

Date

Title

Daytime Phone Number

Daytime Phone Number

Email Address

Email Address

This return is due on or before the 20th day of the month following the tax period indicated above.

Mail this return and payment to: Nebraska Department of Revenue, PO Box 98923, Lincoln, NE 68509-8923.

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

1

1 2

2