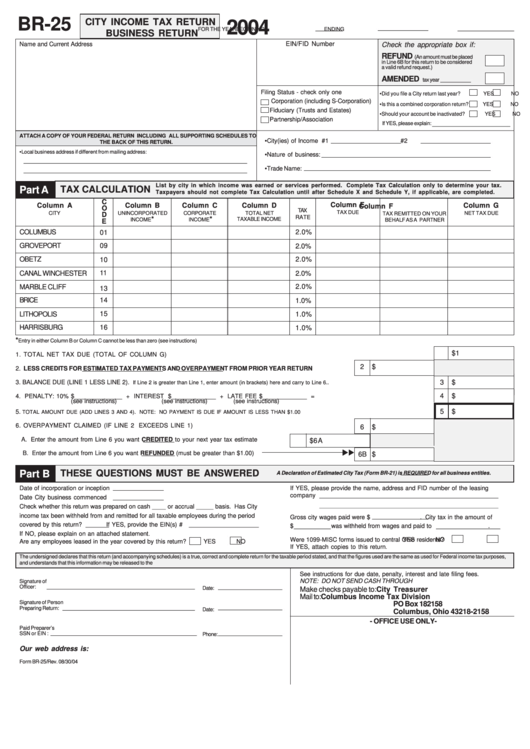

BR-25

CITY INCOME TAX RETURN

2004

FOR THE YEAR

BEGINNING

ENDING

BUSINESS RETURN

EIN/FID Number

Name and Current Address

Check the appropriate box if:

REFUND

(An amount must be placed

in Line 6B for this return to be considered

a valid refund request.)

AMENDED

tax year

Filing Status - check only one

•Did you file a City return last year?

YES

NO

Corporation (including S-Corporation)

•Is this a combined corporation return?

YES

NO

Fiduciary (Trusts and Estates)

•Should your account be inactivated?

YES

NO

Partnership/Association

If YES, please explain:

ATTACH A COPY OF YOUR FEDERAL RETURN INCLUDING ALL SUPPORTING SCHEDULES TO

•City(ies) of Income #1

#2

THE BACK OF THIS RETURN.

•Local business address if different from mailing address:

•Nature of business:

•Trade Name:

List by city in which income was earned or services performed. Complete Tax Calculation only to determine your tax.

Part A

TAX CALCULATION

Taxpayers should not complete Tax Calculation until after Schedule X and Schedule Y, if applicable, are completed.

C

Column E

Column A

Column B

Column C

Column D

Column G

Column F

O

TAX

TAX DUE

CITY

TOTAL NET

NET TAX DUE

UNINCORPORATED

CORPORATE

D

TAX REMITTED ON YOUR

RATE

*

*

INCOME

INCOME

TAXABLE INCOME

BEHALF AS A PARTNER

E

COLUMBUS

2.0%

01

GROVEPORT

09

2.0%

OBETZ

10

2.0%

11

CANAL WINCHESTER

2.0%

MARBLE CLIFF

2.0%

13

BRICE

14

1.0%

15

LITHOPOLIS

1.0%

HARRISBURG

16

1.0%

*

Entry in either Column B or Column C cannot be less than zero (see instructions)

1

$

1. TOTAL NET TAX DUE (TOTAL OF COLUMN G).............................................................................................................................................

2

$

2. LESS CREDITS FOR ESTIMATED TAX PAYMENTS AND OVERPAYMENT FROM PRIOR YEAR RETURN ONLY.............

3. BALANCE DUE (LINE 1 LESS LINE 2).

.........................................................

3

$

If Line 2 is greater than Line 1, enter amount (in brackets) here and carry to Line 6..

4

$

4. PENALTY: 10% $______________ + INTEREST $_____________ + LATE FEE $_____________ = ..............................................................

(see instructions)

(see instructions)

(see instructions)

5

$

5.

...........................................................................

TOTAL AMOUNT DUE (ADD LINES 3 AND 4). NOTE: NO PAYMENT IS DUE IF AMOUNT IS LESS THAN $1.00

6. OVERPAYMENT CLAIMED (IF LINE 2 EXCEEDS LINE 1) ..................................................................................

6

$

A. Enter the amount from Line 6 you want CREDITED to your next year tax estimate............

6A

$

B. Enter the amount from Line 6 you want REFUNDED (must be greater than $1.00)

6B

$

Part B

THESE QUESTIONS MUST BE ANSWERED

A Declaration of Estimated City Tax (Form BR-21) is REQUIRED for all business entities.

Date of incorporation or inception

If YES, please provide the name, address and FID number of the leasing

company

Date City business commenced

Check whether this return was prepared on cash ____ or accrual _____ basis. Has City

income tax been withheld from and remitted for all taxable employees during the period

Gross city wages paid were $

. City tax in the amount of

covered by this return?

If YES, provide the EIN(s) #

$

was withheld from wages and paid to

.

If NO, please explain on an attached statement.

Were 1099-MISC forms issued to central Ohio residents?

YES

NO

Are any employees leased in the year covered by this return?

YES

NO

If YES, attach copies to this return.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated, and that the figures used are the same as used for Federal income tax purposes,

and understands that this information may be released to the I.R.S.

See instructions for due date, penalty, interest and late filing fees.

Signature of

NOTE: DO NOT SEND CASH THROUGH U.S. MAIL

Officer:

Date:

Make checks payable to:

City Treasurer

Mail to:

Columbus Income Tax Division

Signature of Person

PO Box 182158

Preparing Return:

Date:

Columbus, Ohio 43218-2158

- OFFICE USE ONLY-

Paid Preparer’s

SSN or EIN :

Phone:

Our web address is:

Form BR-25/Rev. 08/30/04

1

1 2

2 3

3