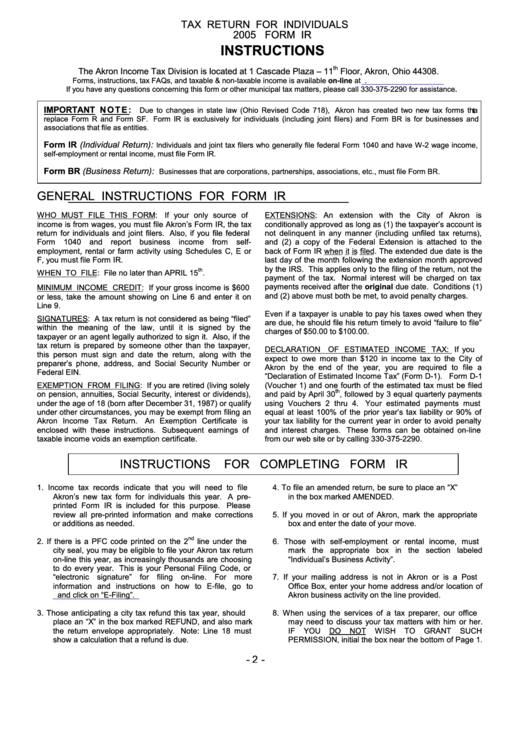

TAX RETURN FOR INDIVIDUALS

2005 FORM IR

INSTRUCTIONS

th

The Akron Income Tax Division is located at 1 Cascade Plaza – 11

Floor, Akron, Ohio 44308.

Forms, instructions, tax FAQs, and taxable & non-taxable income is available on-line at

If you have any questions concerning this form or other municipal tax matters, please call 330-375-2290 for assistance

.

IMPORTANT NOTE:

Due to changes in state law (Ohio Revised Code 718), Akron has created two new tax forms that

replace Form R and Form SF. Form IR is exclusively for individuals (including joint filers) and Form BR is for businesses and

associations that file as entities.

Form IR (Individual Return):

Individuals and joint tax filers who generally file federal Form 1040 and have W-2 wage income,

self-employment or rental income, must file Form IR.

Form BR (Business Return):

Businesses that are corporations, partnerships, associations, etc., must file Form BR.

GENERAL INSTRUCTIONS FOR FORM IR

WHO MUST FILE THIS FORM:

If your only source of

EXTENSIONS: An extension with the City of Akron is

income is from wages, you must file Akron’s Form IR, the tax

conditionally approved as long as (1) the taxpayer’s account is

return for individuals and joint filers. Also, if you file federal

not delinquent in any manner (including unfiled tax returns),

Form

1040

and

report

business

income

from

self-

and (2) a copy of the Federal Extension is attached to the

employment, rental or farm activity using Schedules C, E or

back of Form IR when it is filed. The extended due date is the

F, you must file Form IR.

last day of the month following the extension month approved

by the IRS. This applies only to the filing of the return, not the

th

WHEN TO FILE: File no later than APRIL 15

.

payment of the tax. Normal interest will be charged on tax

payments received after the original due date. Conditions (1)

MINIMUM INCOME CREDIT: If your gross income is $600

and (2) above must both be met, to avoid penalty charges.

or less, take the amount showing on Line 6 and enter it on

Line 9.

Even if a taxpayer is unable to pay his taxes owed when they

SIGNATURES: A tax return is not considered as being “filed”

are due, he should file his return timely to avoid “failure to file”

within the meaning of the law, until it is signed by the

charges of $50.00 to $100.00.

taxpayer or an agent legally authorized to sign it. Also, if the

tax return is prepared by someone other than the taxpayer,

DECLARATION

OF ESTIMATED INCOME TAX: If you

this person must sign and date the return, along with the

expect to owe more than $120 in income tax to the City of

preparer’s phone, address, and Social Security Number or

Akron by the end of the year, you are required to file a

Federal EIN.

“Declaration of Estimated Income Tax” (Form D-1). Form D-1

EXEMPTION FROM FILING: If you are retired (living solely

(Voucher 1) and one fourth of the estimated tax must be filed

th

on pension, annuities, Social Security, interest or dividends),

and paid by April 30

, followed by 3 equal quarterly payments

under the age of 18 (born after December 31, 1987) or qualify

using Vouchers 2 thru 4.

Your estimated payments must

under other circumstances, you may be exempt from filing an

equal at least 100% of the prior year’s tax liability or 90% of

Akron Income Tax Return.

An Exemption Certificate is

your tax liability for the current year in order to avoid penalty

enclosed with these instructions.

Subsequent earnings of

and interest charges. These forms can be obtained on-line

taxable income voids an exemption certificate.

from our web site or by calling 330-375-2290.

INSTRUCTIONS

FOR COMPLETING FORM IR

1.

Income tax records indicate that you will need to file

4.

To file an amended return, be sure to place an “X”

Akron’s new tax form for individuals this year. A pre-

in the box marked AMENDED.

printed Form IR is included for this purpose.

Please

review all pre-printed information and make corrections

5.

If you moved in or out of Akron, mark the appropriate

or additions as needed.

box and enter the date of your move.

nd

2.

If there is a PFC code printed on the 2

line under the

6.

Those with self-employment or rental income, must

city seal, you may be eligible to file your Akron tax return

mark the appropriate box in the section labeled

on-line this year, as increasingly thousands are choosing

“Individual’s Business Activity”.

to do every year. This is your Personal Filing Code, or

“electronic signature” for filing on-line. For more

7.

If your mailing address is not in Akron or is a Post

information and instructions on how to E-file, go to

Office Box, enter your home address and/or location of

and click on “E-Filing”.

Akron business activity on the line provided.

3.

Those anticipating a city tax refund this tax year, should

8.

When using the services of a tax preparer, our office

place an “X” in the box marked REFUND, and also mark

may need to discuss your tax matters with him or her.

the return envelope appropriately. Note: Line 18 must

IF

YOU

DO

NOT

WISH

TO

GRANT

SUCH

show a calculation that a refund is due.

PERMISSION, initial the box near the bottom of Page 1.

- 2 -

1

1 2

2 3

3