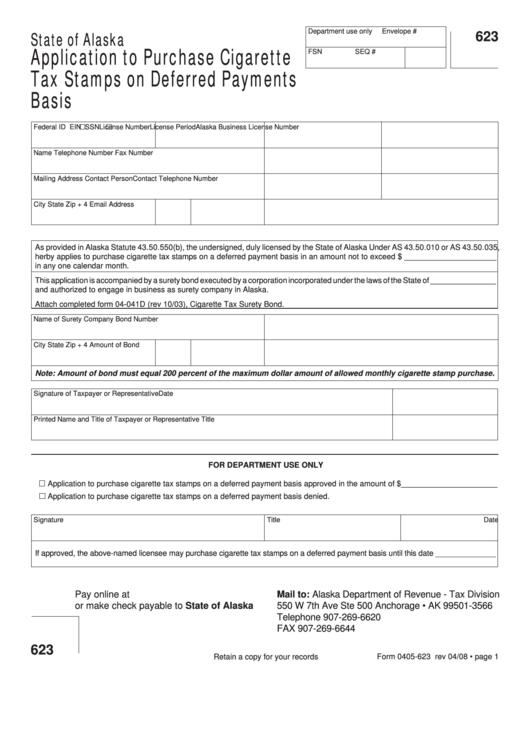

Form 0405-623 - Application To Purchase Cigarette Tax Stamps On Deferred Payments Basis

ADVERTISEMENT

State of Alaska

Department use only

Envelope #

623

Application to Purchase Cigarette

FSN

SEQ #

Tax Stamps on Deferred Payments

Basis

Federal ID

EIN

SSN

License Number

License Period

Alaska Business License Number

Name

Telephone Number

Fax Number

Mailing Address

Contact Person

Contact Telephone Number

City

State

Zip + 4

Email Address

As provided in Alaska Statute 43.50.550(b), the undersigned, duly licensed by the State of Alaska Under AS 43.50.010 or AS 43.50.035,

herby applies to purchase cigarette tax stamps on a deferred payment basis in an amount not to exceed $ _____________________

in any one calendar month.

This application is accompanied by a surety bond executed by a corporation incorporated under the laws of the State of _______________

and authorized to engage in business as surety company in Alaska.

Attach completed form 04-041D (rev 10/03), Cigarette Tax Surety Bond.

Name of Surety Company

Bond Number

City

State

Zip + 4

Amount of Bond

Note: Amount of bond must equal 200 percent of the maximum dollar amount of allowed monthly cigarette stamp purchase.

Signature of Taxpayer or Representative

Date

Printed Name and Title of Taxpayer or Representative

Title

FOR DEPARTMENT USE ONLY

Application to purchase cigarette tax stamps on a deferred payment basis approved in the amount of $______________________

Application to purchase cigarette tax stamps on a deferred payment basis denied.

Signature

Title

Date

If approved, the above-named licensee may purchase cigarette tax stamps on a deferred payment basis until this date ______________

Pay online at

Mail to: Alaska Department of Revenue - Tax Division

or make check payable to State of Alaska

550 W 7th Ave Ste 500 Anchorage • AK 99501-3566

Telephone 907-269-6620

FAX 907-269-6644

623

Form 0405-623 rev 04/08 • page 1

Retain a copy for your records

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1