8734

2006

43

F

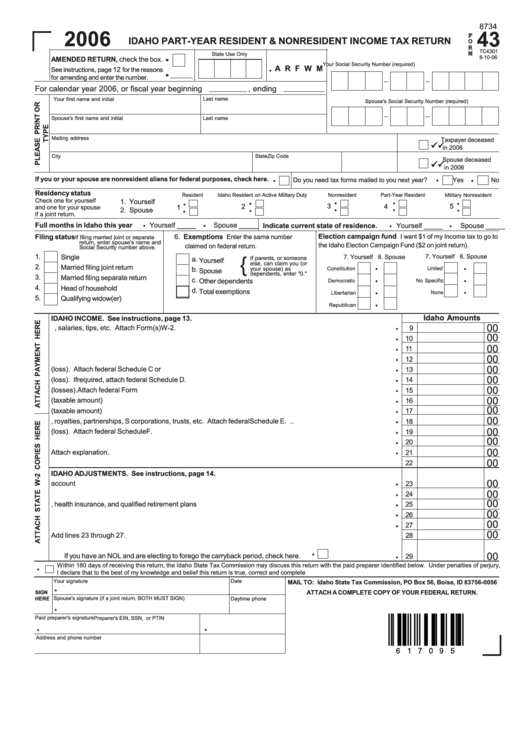

IDAHO PART-YEAR RESIDENT & NONRESIDENT INCOME TAX RETURN

O

R

.

TC4301

M

State Use Only

8-10-06

AMENDED RETURN, check the box.

.

Your Social Security Number (required)

.

A R F W M

12

See instructions, page

for the reasons

for amending and enter the number.

For calendar year 2006, or fiscal year beginning

, ending

Last name

Your first name and initial

Spouse's Social Security Number (required)

Spouse's first name and initial

Last name

Mailing address

Taxpayer deceased

in 2006

State

Zip Code

City

Spouse deceased

in 2006

.

.

.

If you or your spouse are nonresident aliens for federal purposes, check here.

Do you need tax forms mailed to you next year?

Yes

No

Residency status

. .

. .

. .

. .

. .

Resident

Idaho Resident on Active Military Duty

Nonresident

Part-Year Resident

Military Nonresident

Check one for yourself

1. Yourself

3

4

5

2

1

and one for your spouse

2. Spouse

if a joint return.

.

.

.

.

Full months in Idaho this year

Yourself _____

Spouse _____

Indicate current state of residence.

Yourself _____

Spouse _____

Filing status

6. Exemptions

Election campaign fund

I want $1 of my Income tax to go to

Enter the same number

f filing married joint or separate

I

return, enter spouse's name and

the Idaho Election Campaign Fund ($2 on joint return).

claimed on federal return.

Social Security number above.

1.

{

Single

7. Yourself 8. Spouse

7. Yourself 8. Spouse

a.

f parents, or someone

.

I

.

Yourself

else, can claim you (or

2.

Married filing joint return

b.

your spouse) as

Constitution

United

Spouse

.

.

dependents, enter "0."

3.

Married filing separate return

c.

Other dependents

No Specific

Democratic

.

.

4.

Head of household

d.

Total exemptions

None

Libertarian

.

5.

Qualifying widow(er)

Republican

Idaho Amounts

IDAHO INCOME. See instructions, page 13.

.

00

9. Wages, salaries, tips, etc. Attach Form(s) W-2. ...............................................................................................

9

.

00

10. Taxable interest income .....................................................................................................................................

10

.

00

11. Dividend income ................................................................................................................................................

11

.

00

12. Alimony received ...............................................................................................................................................

12

.

00

13. Business income or (loss). Attach federal Schedule C or C-EZ. .......................................................................

13

.

00

14. Capital gain or (loss). If required, attach federal Schedule D. ............................................................................

14

.

00

15. Other gains or (losses). Attach federal Form 4797. ...........................................................................................

15

.

00

16. IRA distributions (taxable amount) .....................................................................................................................

16

.

00

17. Pensions and annuities (taxable amount) ...........................................................................................................

17

.

00

18. Rents, royalties, partnerships, S corporations, trusts, etc. Attach federal Schedule E. ......................................

18

.

00

19. Farm income or (loss). Attach federal Schedule F. ...........................................................................................

19

.

00

20. Unemployment compensation ............................................................................................................................

20

.

00

21. Other income. Attach explanation. .....................................................................................................................

21

00

22. TOTAL INCOME. Add lines 9 through 21.

22

IDAHO ADJUSTMENTS. See instructions, page 14.

.

00

23. Deductions for IRAs and health savings account ...............................................................................................

23

.

00

24. Moving expenses. Attach federal Form 3903. ...................................................................................................

24

.

00

25. Deductions for self-employment tax, health insurance, and qualified retirement plans .......................................

25

.

00

26. Penalty on early withdrawal of savings ...............................................................................................................

26

.

00

27. Other deductions. See instructions. ..................................................................................................................

27

00

28. TOTAL ADJUSTMENTS. Add lines 23 through 27. .........................................................................................

28

.

29. ADJUSTED GROSS INCOME. Subtract line 28 from line 22.

.

00

If you have an NOL and are electing to forego the carryback period, check here.

29

.

Within 180 days of receiving this return, the Idaho State Tax Commission may discuss this return with the paid preparer identified below. Under penalties of perjury,

I declare that to the best of my knowledge and belief this return is true, correct and complete

.

Your signature

Date

MAIL TO: Idaho State Tax Commission, PO Box 56, Boise, ID 83756-0056

SIGN

ATTACH A COMPLETE COPY OF YOUR FEDERAL RETURN.

HERE

Spouse's signature (if a joint return, BOTH MUST SIGN)

Daytime phone

.

{^g¦}

Paid preparer's signature

Preparer's EIN, SSN, or PTIN

.

.

Address and phone number

1

1 2

2