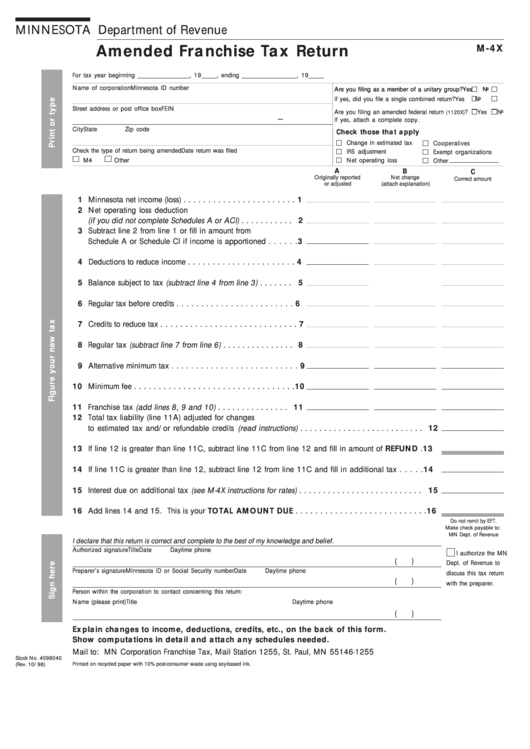

MINNESOTA Department of Revenue

Amended Franchise Tax Return

M-4X

For tax year beginning _________________, 19_____, ending __________________, 19_____

Name of corporation

Minnesota ID number

Are you filing as a member of a unitary group?

Yes

No

If yes, did you file a single combined return?

Yes

No

Street address or post office box

FEIN

Are you filing an amended federal return

?

Yes

No

(1120X)

–

If yes, attach a complete copy.

City

State

Zip code

Check those that apply

Change in estimated tax

Cooperatives

Check the type of return being amended

Date return was filed

IRS adjustment

Exempt organizations

M4

Other

Net operating loss

Other

A

B

C

Originally reported

Net change

Correct amount

or adjusted

(attach explanation)

1 Minnesota net income (loss) . . . . . . . . . . . . . . . . . . . . . . . 1

2 Net operating loss deduction

(if you did not complete Schedules A or ACI) . . . . . . . . . . . 2

3 Subtract line 2 from line 1 or fill in amount from

Schedule A or Schedule CI if income is apportioned . . . . . . 3

4 Deductions to reduce income . . . . . . . . . . . . . . . . . . . . . . 4

5 Balance subject to tax (subtract line 4 from line 3) . . . . . . . 5

6 Regular tax before credits . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Credits to reduce tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Regular tax (subtract line 7 from line 6) . . . . . . . . . . . . . . . 8

9 Alternative minimum tax . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Minimum fee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Franchise tax (add lines 8, 9 and 10) . . . . . . . . . . . . . . . 11

12 Total tax liability (line 11A) adjusted for changes

to estimated tax and/or refundable credits (read instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 If line 12 is greater than line 11C, subtract line 11C from line 12 and fill in amount of REFUND . 13

14 If line 11C is greater than line 12, subtract line 12 from line 11C and fill in additional tax . . . . . 14

15 Interest due on additional tax (see M-4X instructions for rates) . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Add lines 14 and 15. This is your TOTAL AMOUNT DUE . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

Do not remit by EFT.

Make check payable to:

MN Dept. of Revenue

I declare that this return is correct and complete to the best of my knowledge and belief.

Authorized signature

Title

Date

Daytime phone

I authorize the MN

(

)

Dept. of Revenue to

Preparer’s signature

Minnesota ID or Social Security number

Date

Daytime phone

discuss this tax return

(

)

with the preparer.

Person within the corporation to contact concerning this return:

Name (please print)

Title

Daytime phone

(

)

Explain changes to income, deductions, credits, etc., on the back of this form.

Show computations in detail and attach any schedules needed.

Mail to: MN Corporation Franchise Tax, Mail Station 1255, St. Paul, MN 55146-1255

Stock No. 4098040

Printed on recycled paper with 10% post-consumer waste using soy-based ink.

(Rev. 10/98)

1

1 2

2