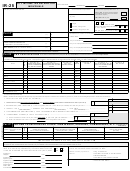

Form Ir-25 - City Income Tax Return For Individuals - City Of Columbus Income Tax Division - 2000 Page 2

ADVERTISEMENT

Name(s) as shown on Page 1

Your Social Security Number

Stop:

If your only source of income is from wages, do not complete the remainder of this page. Return to Page1.

SCHEDULE C

Part D

- INCOME FROM SELF-EMPLOYMENT

Profit or Loss from Business (Sole Proprietorship)

Section 1

INCOME

attach 1099’s

attach schedule

EXPENSES

Section 2

attach 1099’s

Attach Schedule if over $5,000

Part E

RENTAL, PARTNERSHIP AND S-CORP INCOME

Section 1

Part 1

INCOME OR LOSS FROM RENTAL REAL ESTATE

Property A

Property B

Property C

Property D

PARTNERSHIP INCOME

/S-CORP INCOME

Section 2

The loss from an unincorporated business activity reported on this page may not be used to offset W-2 wages reported on Page 1. However, the loss from an unincorporated business

activity may be used to offset a gain from another unincorporated business activity if: 1) both unincorporated activities were conducted in the same city; or 2) both unincorporated activities

are taxed by your city of residence. The loss from an S-Corp reported on this page may not be used to offset wages reported on Page 1 nor may it be used to offset a gain from an

unincorporated business activity. However, the loss from an S-Corp may offset the gain from another S-Corp, wherever located. See the instructions. NOTE: Remember to file your

Declaration of Estimated Taxes (Form IR-21) for the current year. Phone (614) 645-7370. TDD (614) 645-6000.

IR-25 Page 2 (Rev. 10/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3