Form Ap-110-3 - Texas Application For Gross Receipts Tax Permit

ADVERTISEMENT

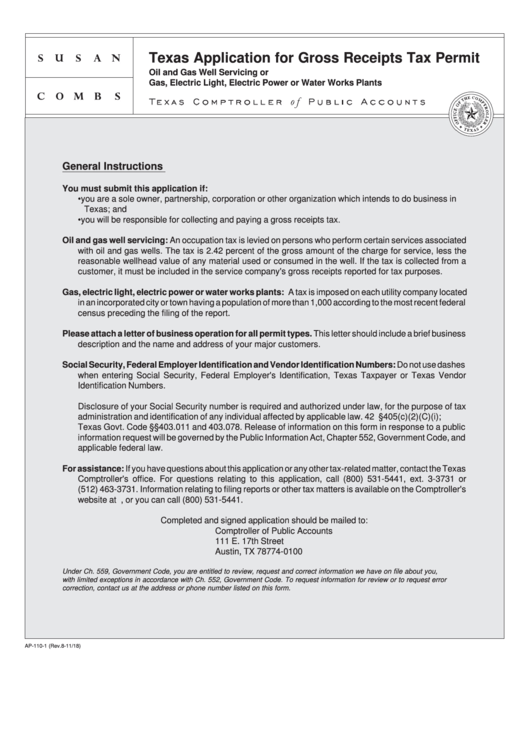

Texas Application for Gross Receipts Tax Permit

Oil and Gas Well Servicing or

Gas, Electric Light, Electric Power or Water Works Plants

General Instructions

You must submit this application if:

• you are a sole owner, partnership, corporation or other organization which intends to do business in

Texas; and

• you will be responsible for collecting and paying a gross receipts tax.

Oil and gas well servicing: An occupation tax is levied on persons who perform certain services associated

with oil and gas wells. The tax is 2.42 percent of the gross amount of the charge for service, less the

reasonable wellhead value of any material used or consumed in the well. If the tax is collected from a

customer, it must be included in the service company's gross receipts reported for tax purposes.

Gas, electric light, electric power or water works plants: A tax is imposed on each utility company located

in an incorporated city or town having a population of more than 1,000 according to the most recent federal

census preceding the filing of the report.

Please attach a letter of business operation for all permit types. This letter should include a brief business

description and the name and address of your major customers.

Social Security, Federal Employer Identification and Vendor Identification Numbers: Do not use dashes

when entering Social Security, Federal Employer's Identification, Texas Taxpayer or Texas Vendor

Identification Numbers.

Disclosure of your Social Security number is required and authorized under law, for the purpose of tax

administration and identification of any individual affected by applicable law. 42 U.S.C. §405(c)(2)(C)(i);

Texas Govt. Code §§403.011 and 403.078. Release of information on this form in response to a public

information request will be governed by the Public Information Act, Chapter 552, Government Code, and

applicable federal law.

For assistance: If you have questions about this application or any other tax-related matter, contact the Texas

Comptroller's office. For questions relating to this application, call (800) 531-5441, ext. 3-3731 or

(512) 463-3731. Information relating to filing reports or other tax matters is available on the Comptroller's

website at , or you can call (800) 531-5441.

Completed and signed application should be mailed to:

Comptroller of Public Accounts

111 E. 17th Street

Austin, TX 78774-0100

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on file about you,

with limited exceptions in accordance with Ch. 552, Government Code. To request information for review or to request error

correction, contact us at the address or phone number listed on this form.

AP-110-1 (Rev.8-11/18)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4