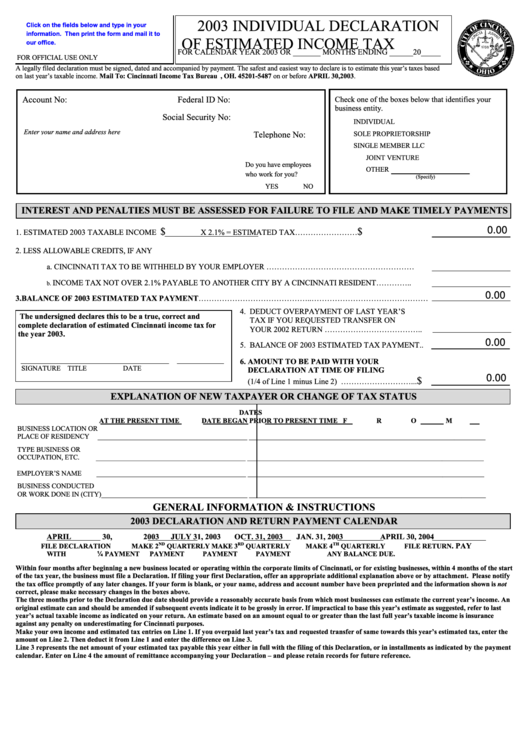

2003 INDIVIDUAL DECLARATION

Click on the fields below and type in your

information. Then print the form and mail it to

OF ESTIMATED INCOME TAX

our office.

FOR CALENDAR YEAR 2003 OR _______ MONTHS ENDING ______20_____

FOR OFFICIAL USE ONLY

A legally filed declaration must be signed, dated and accompanied by payment. The safest and easiest way to declare is to estimate this year’s taxes based

on last year’s taxable income. Mail To: Cincinnati Income Tax Bureau P.O. Box 5487 Cincinnati, OH. 45201-5487 on or before APRIL 30,2003.

Federal ID No:

Account No:

Check one of the boxes below that identifies your

business entity.

Social Security No:

INDIVIDUAL

Enter your name and address here

Telephone No:

SOLE PROPRIETORSHIP

SINGLE MEMBER LLC

JOINT VENTURE

Do you have employees

OTHER

who work for you?

(Specify)

YES

NO

INTEREST AND PENALTIES MUST BE ASSESSED FOR FAILURE TO FILE AND MAKE TIMELY PAYMENTS

$

$

0.00

1. ESTIMATED 2003 TAXABLE INCOME

X 2.1% = ESTIMATED TAX……………………

2. LESS ALLOWABLE CREDITS, IF ANY

a.

CINCINNATI TAX TO BE WITHHELD BY YOUR EMPLOYER …………………………………………………

INCOME TAX NOT OVER 2.1% PAYABLE TO ANOTHER CITY BY A CINCINNATI RESIDENT…………..

b.

0.00

3. BALANCE OF 2003 ESTIMATED TAX PAYMENT……………………………………..………………………………………

4. DEDUCT OVERPAYMENT OF LAST YEAR’S

The undersigned declares this to be a true, correct and

TAX IF YOU REQUESTED TRANSFER ON

complete declaration of estimated Cincinnati income tax for

YOUR 2002 RETURN ………………………………..

the year 2003.

0.00

5. BALANCE OF 2003 ESTIMATED TAX PAYMENT..

6. AMOUNT TO BE PAID WITH YOUR

SIGNATURE

TITLE

DATE

DECLARATION AT TIME OF FILING

0.00

$

(1/4 of Line 1 minus Line 2) ………………………...

EXPLANATION OF NEW TAXPAYER OR CHANGE OF TAX STATUS

DATES

AT THE PRESENT TIME

DATE BEGAN

PRIOR TO PRESENT TIME

FROM

TO

BUSINESS LOCATION OR

PLACE OF RESIDENCY

___________________________________________

____________________________________________________________________

TYPE BUSINESS OR

OCCUPATION, ETC.

___________________________________________

____________________________________________________________________

EMPLOYER’S NAME

___________________________________________

____________________________________________________________________

BUSINESS CONDUCTED

OR WORK DONE IN (CITY)__________________________________________

____________________________________________________________________

GENERAL INFORMATION & INSTRUCTIONS

2003 DECLARATION AND RETURN PAYMENT CALENDAR

APRIL 30, 2003

JULY 31, 2003

OCT. 31, 2003

JAN. 31, 2003

APRIL 30, 2004

ND

RD

TH

. PAY

FILE DECLARATION

MAKE 2

QUARTERLY

MAKE 3

QUARTERLY

MAKE 4

QUARTERLY

FILE RETURN

WITH ¼ PAYMENT

PAYMENT

PAYMENT

PAYMENT

ANY BALANCE DUE.

Within four months after beginning a new business located or operating within the corporate limits of Cincinnati, or for existing businesses, within 4 months of the start

of the tax year, the business must file a Declaration. If filing your first Declaration, offer an appropriate additional explanation above or by attachment. Please notify

the tax office promptly of any later changes. If your form is blank, or your name, address and account number have been preprinted and the information shown is not

correct, please make necessary changes in the boxes above.

The three months prior to the Declaration due date should provide a reasonably accurate basis from which most businesses can estimate the current year’s income. An

original estimate can and should be amended if subsequent events indicate it to be grossly in error. If impractical to base this year’s estimate as suggested, refer to last

year’s actual taxable income as indicated on your return. An estimate based on an amount equal to or greater than the last full year’s taxable income is insurance

against any penalty on underestimating for Cincinnati purposes.

Make your own income and estimated tax entries on Line 1. If you overpaid last year’s tax and requested transfer of same towards this year’s estimated tax, enter the

amount on Line 2. Then deduct it from Line 1 and enter the difference on Line 3.

Line 3 represents the net amount of your estimated tax payable this year either in full with the filing of this Declaration, or in installments as indicated by the payment

calendar. Enter on Line 4 the amount of remittance accompanying your Declaration – and please retain records for future reference.

1

1 2

2 3

3