Schedule Cms Instructions

ADVERTISEMENT

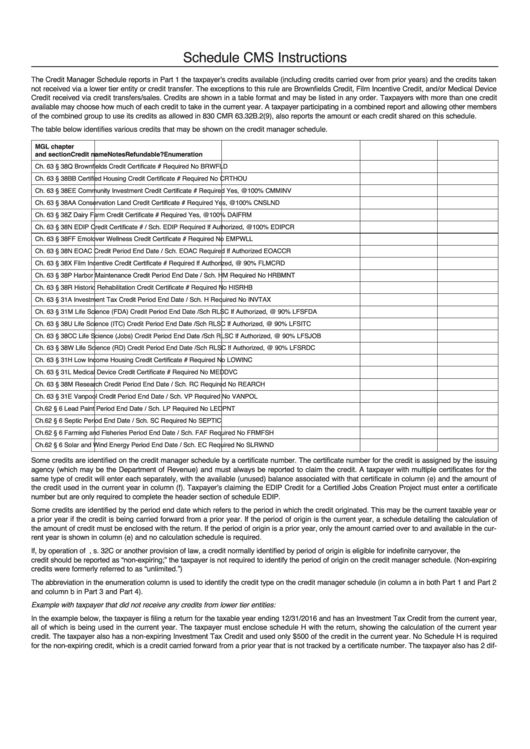

Schedule CMS Instructions

The Credit Manager Schedule reports in Part 1 the taxpayer’s credits available (including credits carried over from prior years) and the credits taken

not received via a lower tier entity or credit transfer. The exceptions to this rule are Brownfields Credit, Film Incentive Credit, and/or Medical Device

Credit received via credit transfers/sales. Credits are shown in a table format and may be listed in any order. Taxpayers with more than one credit

available may choose how much of each credit to take in the current year. A taxpayer participating in a combined report and allowing other members

of the combined group to use its credits as allowed in 830 CMR 63.32B.2(9), also reports the amount or each credit shared on this schedule.

The table below identifies various credits that may be shown on the credit manager schedule.

MGL chapter

and section

Credit name

Notes

Refundable?

Enumeration

Ch. 63 § 38Q

Brownfields Credit

Certificate # Required

No

BRWFLD

Ch. 63 § 38BB

Certified Housing Credit

Certificate # Required

No

CRTHOU

Ch. 63 § 38EE

Community Investment Credit

Certificate # Required

Yes, @100%

CMMINV

Ch. 63 § 38AA

Conservation Land Credit

Certificate # Required

Yes, @100%

CNSLND

Ch. 63 § 38Z

Dairy Farm Credit

Certificate # Required

Yes, @100%

DAIFRM

Ch. 63 § 38N

EDIP Credit

Certificate # / Sch. EDIP Required

If Authorized, @100%

EDIPCR

Ch. 63 § 38FF

Emolover Wellness Credit

Certificate # Required

No

EMPWLL

Ch. 63 § 38N

EOAC Credit

Period End Date / Sch. EOAC Required

If Authorized

EOACCR

Ch. 63 § 38X

Film Incentive Credit

Certificate # Required

If Authorized, @ 90%

FLMCRD

Ch. 63 § 38P

Harbor Maintenance Credit

Period End Date / Sch. HM Required

No

HRBMNT

Ch. 63 § 38R

Historic Rehabilitation Credit

Certificate # Required

No

HISRHB

Ch. 63 § 31A

Investment Tax Credit

Period End Date / Sch. H Required

No

INVTAX

Ch. 63 § 31M

Life Science (FDA) Credit

Period End Date /Sch RLSC

If Authorized, @ 90%

LFSFDA

Ch. 63 § 38U

Life Science (ITC) Credit

Period End Date /Sch RLSC

If Authorized, @ 90%

LFSITC

Ch. 63 § 38CC

Life Science (Jobs) Credit

Period End Date /Sch RLSC

If Authorized, @ 90%

LFSJOB

Ch. 63 § 38W

Life Science (RD) Credit

Period End Date /Sch RLSC

If Authorized, @ 90%

LFSRDC

Ch. 63 § 31H

Low Income Housing Credit

Certificate # Required

No

LOWINC

Ch. 63 § 31L

Medical Device Credit

Certificate # Required

No

MEDDVC

Ch. 63 § 38M

Research Credit

Period End Date / Sch. RC Required

No

REARCH

Ch. 63 § 31E

Vanpool Credit

Period End Date / Sch. VP Required

No

VANPOL

Ch.62 § 6

Lead Paint

Period End Date / Sch. LP Required

No

LEDPNT

Ch.62 § 6

Septic

Period End Date / Sch. SC Required

No

SEPTIC

Ch.62 § 6

Farming and Fisheries

Period End Date / Sch. FAF Required

No

FRMFSH

Ch.62 § 6

Solar and Wind Energy

Period End Date / Sch. EC Required

No

SLRWND

Some credits are identified on the credit manager schedule by a certificate number. The certificate number for the credit is assigned by the issuing

agency (which may be the Department of Revenue) and must always be reported to claim the credit. A taxpayer with multiple certificates for the

same type of credit will enter each separately, with the available (unused) balance associated with that certificate in column (e) and the amount of

the credit used in the current year in column (f). Taxpayer’s claiming the EDIP Credit for a Certified Jobs Creation Project must enter a certificate

number but are only required to complete the header section of schedule EDIP.

Some credits are identified by the period end date which refers to the period in which the credit originated. This may be the current taxable year or

a prior year if the credit is being carried forward from a prior year. If the period of origin is the current year, a schedule detailing the calculation of

the amount of credit must be enclosed with the return. If the period of origin is a prior year, only the amount carried over to and available in the cur-

rent year is shown in column (e) and no calculation schedule is required.

If, by operation of M.G.L. c. 63, s. 32C or another provision of law, a credit normally identified by period of origin is eligible for indefinite carryover, the

credit should be reported as “non-expiring;” the taxpayer is not required to identify the period of origin on the credit manager schedule. (Non-expiring

credits were formerly referred to as “unlimited.”)

The abbreviation in the enumeration column is used to identify the credit type on the credit manager schedule (in column a in both Part 1 and Part 2

and column b in Part 3 and Part 4).

Example with taxpayer that did not receive any credits from lower tier entities:

In the example below, the taxpayer is filing a return for the taxable year ending 12/31/2016 and has an Investment Tax Credit from the current year,

all of which is being used in the current year. The taxpayer must enclose schedule H with the return, showing the calculation of the current year

credit. The taxpayer also has a non-expiring Investment Tax Credit and used only $500 of the credit in the current year. No Schedule H is required

for the non-expiring credit, which is a credit carried forward from a prior year that is not tracked by a certificate number. The taxpayer also has 2 dif-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3