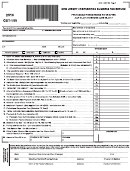

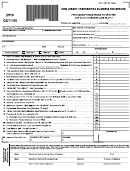

OA-100

NEW JERSEY OUTDOOR ADVERTISING FEE QUARTERLY RETURN

5/06

_______________________________

For the Quarter Ending:

This return and payment must be received no later than the fifteenth (15) day of the month following the quarter end in which the fee is due.

FOR DIVISION USE ONLY

1

Outdoor Advertising Gross Receipts

2

Deductions (Exempt Receipts)

IF INFORMATION BELOW IS INCORRECT, MAKE THE NECESSARY CHANGES

3

Net Receipts Subject To Fee

NJ Taxpayer Identification Number

.04

4

Fee Imposed

Taxpayer Name

5

Total Fee Due

( Multiply Line 3 by Line 4)

Trade Name

6

Penalty & Interest

Street Address

7

Total Amount Due

I verify and/or affirm that all tax information on this statement is correct. I am

City

State

Zip Code

aware that if any of the foregoing information provided by me is knowingly

false, I am subject to punishment.

Signature _______________________________________________________

Send check or money order payable to: New Jersey Division of Taxation-Outdoor Advertising Fee

or to pay via EFT use Tax Payment Code “04690”; addendum “A” format.

_______________________________________________________________

Title

Date

AVOID PENALTIES - FILE ON TIME

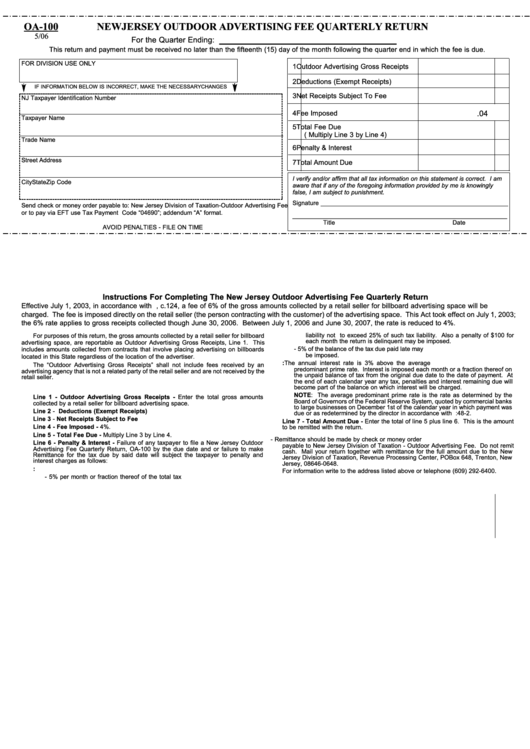

Instructions For Completing The New Jersey Outdoor Advertising Fee Quarterly Return

Effective July 1, 2003, in accordance with P.L. 2003, c.124, a fee of 6% of the gross amounts collected by a retail seller for billboard advertising space will be

charged. The fee is imposed directly on the retail seller (the person contracting with the customer) of the advertising space. This Act took effect on July 1, 2003;

the 6% rate applies to gross receipts collected though June 30, 2006. Between July 1, 2006 and June 30, 2007, the rate is reduced to 4%.

liability not to exceed 25% of such tax liability. Also a penalty of $100 for

For purposes of this return, the gross amounts collected by a retail seller for billboard

each month the return is delinquent may be imposed.

advertising space, are reportable as Outdoor Advertising Gross Receipts, Line 1. This

2. LATE PAYMENT PENALTY - 5% of the balance of the tax due paid late may

includes amounts collected from contracts that involve placing advertising on billboards

be imposed.

located in this State regardless of the location of the advertiser.

b. INTEREST CHARGES: The annual interest rate is 3% above the average

The “Outdoor Advertising Gross Receipts” shall not include fees received by an

predominant prime rate. Interest is imposed each month or a fraction thereof on

advertising agency that is not a related party of the retail seller and are not received by the

the unpaid balance of tax from the original due date to the date of payment. At

retail seller.

the end of each calendar year any tax, penalties and interest remaining due will

become part of the balance on which interest will be charged.

A. SPECIFIC INSTRUCTIONS

NOTE: The average predominant prime rate is the rate as determined by the

Line 1 - Outdoor Advertising Gross Receipts - Enter the total gross amounts

Board of Governors of the Federal Reserve System, quoted by commercial banks

collected by a retail seller for billboard advertising space.

to large businesses on December 1st of the calendar year in which payment was

Line 2 - Deductions (Exempt Receipts)

due or as redetermined by the director in accordance with R.S. 54:48-2.

Line 3 - Net Receipts Subject to Fee

Line 7 - Total Amount Due - Enter the total of line 5 plus line 6. This is the amount

Line 4 - Fee Imposed - 4%.

to be remitted with the return.

Line 5 - Total Fee Due - Multiply Line 3 by Line 4.

B. REMITTANCE AND FILING - Remittance should be made by check or money order

Line 6 - Penalty & Interest - Failure of any taxpayer to file a New Jersey Outdoor

payable to New Jersey Division of Taxation - Outdoor Advertising Fee. Do not remit

Advertising Fee Quarterly Return, OA-100 by the due date and or failure to make

cash. Mail your return together with remittance for the full amount due to the New

Remittance for the tax due by said date will subject the taxpayer to penalty and

Jersey Division of Taxation, Revenue Processing Center, PO Box 648, Trenton, New

interest charges as follows:

Jersey, 08646-0648.

a.

PENALTY CHARGES:

For information write to the address listed above or telephone (609) 292-6400.

1. LATE FILING PENALTY - 5% per month or fraction thereof of the total tax

1

1