Form E-500j Machinery And Equipment Tax Return General Instructions

ADVERTISEMENT

10-16

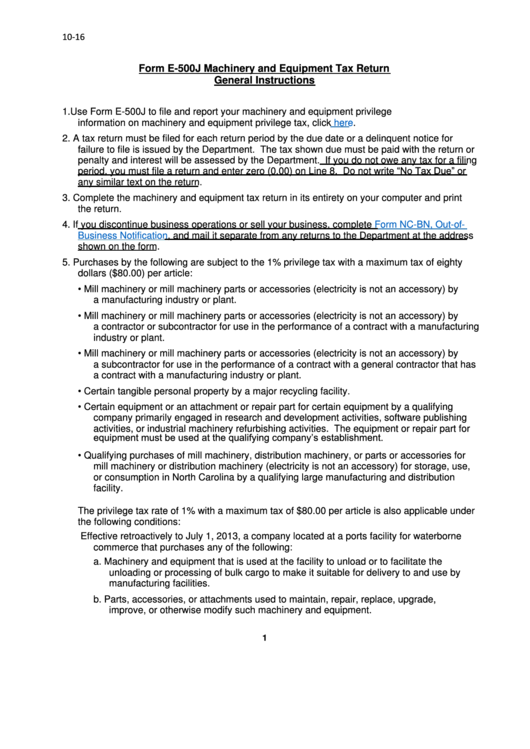

Form E-500J Machinery and Equipment Tax Return

General Instructions

1. Use Form E-500J to file and report your machinery and equipment privilege tax. For more

information on machinery and equipment privilege tax, click here.

2. A tax return must be filed for each return period by the due date or a delinquent notice for

failure to file is issued by the Department. The tax shown due must be paid with the return or

penalty and interest will be assessed by the Department. If you do not owe any tax for a filing

period, you must file a return and enter zero (0.00) on Line 8. Do not write “No Tax Due” or

any similar text on the return.

3. Complete the machinery and equipment tax return in its entirety on your computer and print

the return.

4. If you discontinue business operations or sell your business, complete

Form NC-BN, Out-of-

Business

Notification, and mail it separate from any returns to the Department at the address

shown on the form.

5. Purchases by the following are subject to the 1% privilege tax with a maximum tax of eighty

dollars ($80.00) per article:

•

Mill machinery or mill machinery parts or accessories (electricity is not an accessory) by

a manufacturing industry or plant.

•

Mill machinery or mill machinery parts or accessories (electricity is not an accessory) by

a contractor or subcontractor for use in the performance of a contract with a manufacturing

industry or plant.

•

Mill machinery or mill machinery parts or accessories (electricity is not an accessory) by

a subcontractor for use in the performance of a contract with a general contractor that has

a contract with a manufacturing industry or plant.

•

Certain tangible personal property by a major recycling facility.

•

Certain equipment or an attachment or repair part for certain equipment by a qualifying

company primarily engaged in research and development activities, software publishing

activities, or industrial machinery refurbishing activities. The equipment or repair part for

equipment must be used at the qualifying company’s establishment.

•

Qualifying purchases of mill machinery, distribution machinery, or parts or accessories for

mill machinery or distribution machinery (electricity is not an accessory) for storage, use,

or consumption in North Carolina by a qualifying large manufacturing and distribution

facility.

The privilege tax rate of 1% with a maximum tax of $80.00 per article is also applicable under

the following conditions:

Effective retroactively to July 1, 2013, a company located at a ports facility for waterborne

commerce that purchases any of the following:

a. Machinery and equipment that is used at the facility to unload or to facilitate the

unloading or processing of bulk cargo to make it suitable for delivery to and use by

manufacturing facilities.

b. Parts, accessories, or attachments used to maintain, repair, replace, upgrade,

improve, or otherwise modify such machinery and equipment.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3