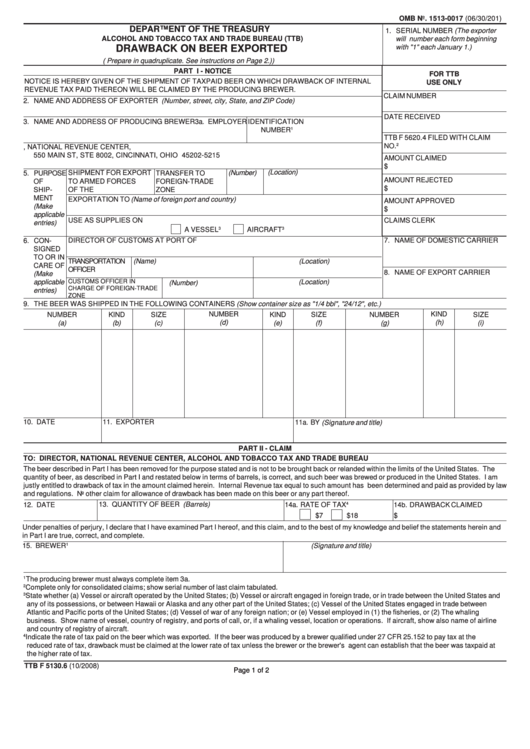

OMB No. 1513-0017 (06/30/201 )

DEPARTMENT OF THE TREASURY

1. SERIAL NUMBER (The exporter

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU (TTB)

will number each form beginning

DRAWBACK ON BEER EXPORTED

with "1" each January 1.)

( Prepare in quadruplicate. See instructions on Page 2.) )

PART I - NOTICE

FOR TTB

NOTICE IS HEREBY GIVEN OF THE SHIPMENT OF TAXPAID BEER ON WHICH DRAWBACK OF INTERNAL

USE ONLY

REVENUE TAX PAID THEREON WILL BE CLAIMED BY THE PRODUCING BREWER.

CLAIM NUMBER

2. NAME AND ADDRESS OF EXPORTER (Number, street, city, State, and ZIP Code)

DATE RECEIVED

3. NAME AND ADDRESS OF PRODUCING BREWER

3a. EMPLOYER IDENTIFICATION

NUMBER

1

TTB F 5620.4 FILED WITH CLAIM

2

NO.

4. ADDRESS OF THE DIRECTOR, NATIONAL REVENUE CENTER,

550 MAIN ST, STE 8002, CINCINNATI, OHIO 45202-5215

AMOUNT CLAIMED

$

(Location)

(Number)

5. PURPOSE

SHIPMENT FOR EXPORT

TRANSFER TO

AMOUNT REJECTED

OF

TO ARMED FORCES

FOREIGN-TRADE

$

SHIP-

OF THE U.S.

ZONE

MENT

EXPORTATION TO (Name of foreign port and country)

AMOUNT APPROVED

(Make

$

applicable

USE AS SUPPLIES ON

CLAIMS CLERK

entries)

A VESSEL

3

AIRCRAFT

3

6. CON-

DIRECTOR OF CUSTOMS AT PORT OF

7. NAME OF DOMESTIC CARRIER

SIGNED

TO OR IN

TRANSPORTATION

(Name)

(Location)

CARE OF

OFFICER

8. NAME OF EXPORT CARRIER

(Make

applicable

CUSTOMS OFFICER IN

(Location)

(Number)

CHARGE OF FOREIGN-TRADE

entries)

ZONE

9. THE BEER WAS SHIPPED IN THE FOLLOWING CONTAINERS (Show container size as "1/4 bbl", "24/12", etc.)

NUMBER

KIND

NUMBER

KIND

SIZE

KIND

SIZE

NUMBER

SIZE

(d)

(h)

(a)

(b)

(c)

(e)

(f)

(g)

(i)

10. DATE

11. EXPORTER

11a. BY (Signature and title)

PART II - CLAIM

TO: DIRECTOR, NATIONAL REVENUE CENTER, ALCOHOL AND TOBACCO TAX AND TRADE BUREAU

The beer described in Part I has been removed for the purpose stated and is not to be brought back or relanded within the limits of the United States. The

quantity of beer, as described in Part I and restated below in terms of barrels, is correct, and such beer was brewed or produced in the United States. I am

justly entitled to drawback of tax in the amount claimed herein. Internal Revenue tax equal to such amount has been determined and paid as provided by law

and regulations. No other claim for allowance of drawback has been made on this beer or any part thereof.

13. QUANTITY OF BEER (Barrels)

14a. RATE OF TAX

4

12. DATE

14b. DRAWBACK CLAIMED

$7

$18

$

Under penalties of perjury, I declare that I have examined Part I hereof, and this claim, and to the best of my knowledge and belief the statements herein and

in Part I are true, correct, and complete.

1

15. BREWER

15a. BY (Signature and title)

1

The producing brewer must always complete item 3a.

2

Complete only for consolidated claims; show serial number of last claim tabulated.

3

State whether (a) Vessel or aircraft operated by the United States; (b) Vessel or aircraft engaged in foreign trade, or in trade between the United States and

any of its possessions, or between Hawaii or Alaska and any other part of the United States; (c) Vessel of the United States engaged in trade between

Atlantic and Pacific ports of the United States; (d) Vessel of war of any foreign nation; or (e) Vessel employed in (1) the fisheries, or (2) The whaling

business. Show name of vessel, country of registry, and ports of call, or, if a whaling vessel, location or operations. If aircraft, show also name of airline

and country of registry of aircraft.

4

Indicate the rate of tax paid on the beer which was exported. If the beer was produced by a brewer qualified under 27 CFR 25.152 to pay tax at the

reduced rate of tax, drawback must be claimed at the lower rate of tax unless the brewer or the brewer's agent can establish that the beer was taxpaid at

the higher rate of tax.

TTB F 5130.6 (10/2008)

Page 1 of 2

1

1 2

2