Form 511nol Draft - Oklahoma Net Operating Loss Full-Year Residents Only - 2016

ADVERTISEMENT

Supplement to Form 511

511nol

Oklahoma Net Operating Loss

Revised 2016

Full-Year Residents Only

For loss year 2016, use this form. For loss years 2015 and prior, use the NOL form from the “Archives: Past Years Income

Tax Forms” page of our website at

Draft

NOL Instructions...

8/3/16

The loss year return must be filed to establish the Oklahoma Net Operating Loss. If the loss is from a pass-through

entity, the pass-through entity must also file a tax return.

An Oklahoma net operating loss (NOL) shall be separately determined by reference to Section 172 of the Internal Revenue

Code as modified by the Oklahoma Income Tax Act and shall be allowed without regard to the existence of a Federal NOL.

For additional information, use the instructions for Federal Form 1045 “Application for Tentative Refund” or Federal Publication

536 “Net Operating Losses (NOLs) for Individuals, Estates, and Trusts”.

The loss carryback and carryforward periods shall be determined solely by reference to Section 172 of the Internal Reve-

nue Code. An election may be made to forego the Net Operating Loss (NOL) carryback period. A written statement of the

election must be part of the timely filed Oklahoma loss year return or to an amended return for the NOL year filed within

six months of the due date of your original return (excluding extensions).

Notes:

An NOL that is a result of a farming loss may be carried back in accordance with the provisions contained in the In-

ternal Revenue Code. However, the amount of the NOL carryback shall not exceed the lesser of $60,000 or the loss

properly shown on the Federal Schedule F reduced by 1/2 of the net income from all other sources other than reflect-

ed on Schedule F.

You may choose to treat a farming loss as if it were not a farming loss. To make this choice, attach a statement to

your loss year return stating that you are choosing to treat the farming loss as if it were not a farming loss under Sec-

tion 172(i)(3) of the Internal Revenue Code.

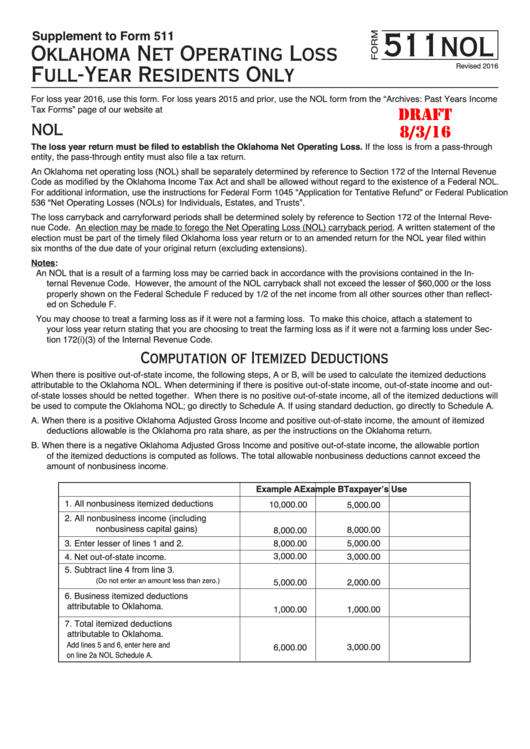

Computation of Itemized Deductions

When there is positive out-of-state income, the following steps, A or B, will be used to calculate the itemized deductions

attributable to the Oklahoma NOL. When determining if there is positive out-of-state income, out-of-state income and out-

of-state losses should be netted together. When there is no positive out-of-state income, all of the itemized deductions will

be used to compute the Oklahoma NOL; go directly to Schedule A. If using standard deduction, go directly to Schedule A.

A. When there is a positive Oklahoma Adjusted Gross Income and positive out-of-state income, the amount of itemized

deductions allowable is the Oklahoma pro rata share, as per the instructions on the Oklahoma return.

B. When there is a negative Oklahoma Adjusted Gross Income and positive out-of-state income, the allowable portion

of the itemized deductions is computed as follows. The total allowable nonbusiness deductions cannot exceed the

amount of nonbusiness income.

Example A

Example B

Taxpayer’s Use

1.

All nonbusiness itemized deductions

10,000.00

5,000.00

2.

All nonbusiness income (including

nonbusiness capital gains)

8,000.00

8,000.00

3.

Enter lesser of lines 1 and 2.

8,000.00

5,000.00

3,000.00

3,000.00

4.

Net out-of-state income.

5.

Subtract line 4 from line 3.

(Do not enter an amount less than zero.)

5,000.00

2,000.00

6.

Business itemized deductions

attributable to Oklahoma.

1,000.00

1,000.00

7.

Total itemized deductions

attributable to Oklahoma.

Add lines 5 and 6, enter here and

6,000.00

3,000.00

on line 2a NOL Schedule A.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3