Minnesota Income Tax Calculations For Tax Year 1998

ADVERTISEMENT

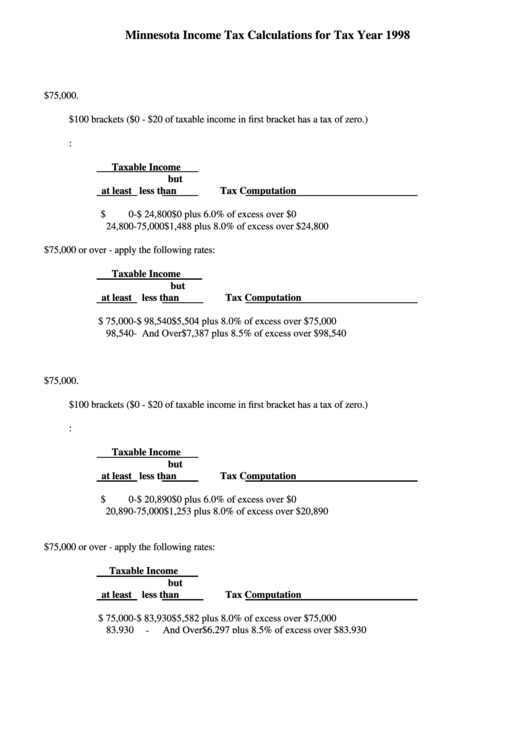

Minnesota Income Tax Calculations for Tax Year 1998

I.

Married Filing Jointly

A.

Minnesota Taxable income under $75,000.

1.

Determine midpoint of $100 brackets ($0 - $20 of taxable income in first bracket has a tax of zero.)

2.

Apply following rates to that midpoint:

Taxable Income

but

at least

less than

Tax Computation

$

0

-

$ 24,800

$0 plus 6.0% of excess over $0

24,800

-

75,000

$1,488 plus 8.0% of excess over $24,800

B.

Minnesota taxable income $75,000 or over - apply the following rates:

Taxable Income

but

at least

less than

Tax Computation

$ 75,000

-

$ 98,540

$5,504 plus 8.0% of excess over $75,000

98,540

-

And Over

$7,387 plus 8.5% of excess over $98,540

II.

Single Head of Household

A.

Minnesota taxable income under $75,000.

1.

Determine midpoint of $100 brackets ($0 - $20 of taxable income in first bracket has a tax of zero.)

2.

Apply following rates to that midpoint:

Taxable Income

but

at least

less than

Tax Computation

$

0

- $ 20,890

$0 plus 6.0% of excess over $0

20,890

-

75,000

$1,253 plus 8.0% of excess over $20,890

B.

Minnesota taxable income $75,000 or over - apply the following rates:

Taxable Income

but

at least

less than

Tax Computation

$ 75,000

-

$ 83,930

$5,582 plus 8.0% of excess over $75,000

83,930

-

And Over

$6,297 plus 8.5% of excess over $83,930

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2