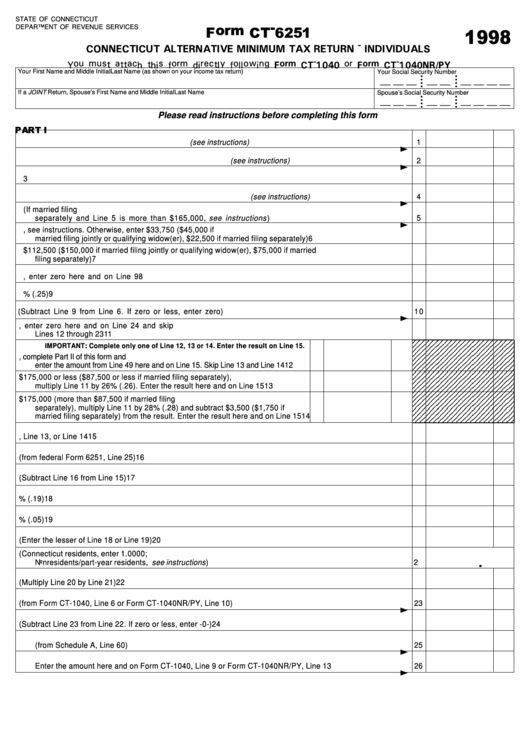

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

Your First Name and Middle Initial

Last Name (as shown on your income tax return)

Your Social Security Number

•

•

__ __ __ __ __ __ __ __ __

•

•

•

•

•

•

If a JOINT Return, Spouse’s First Name and Middle Initial

Last Name

Spouse’s Social Security Number

•

•

__ __ __ __ __ __ __ __ __

•

•

•

•

•

•

Please read instructions before completing this form

1. Federal alternative minimum taxable income (see instructions)

1

2. Additions to federal alternative minimum taxable income (see instructions)

2

3. Add Line 1 and Line 2

3

4. Subtractions from federal alternative minimum taxable income (see instructions)

4

5. Adjusted federal alternative minimum taxable income. Subtract Line 4 from Line 3 (If married filing

separately and Line 5 is more than $165,000, see instructions )

5

6. If this form is for a child under age 14, see instructions. Otherwise, enter $33,750 ($45,000 if

married filing jointly or qualifying widow(er), $22,500 if married filing separately)

6

7. Enter $112,500 ($150,000 if married filing jointly or qualifying widow(er), $75,000 if married

filing separately)

7

8. Subtract Line 7 from Line 5. If zero or less, enter zero here and on Line 9

8

9. Multiply Line 8 by 25% (.25)

9

10. Exemption (Subtract Line 9 from Line 6. If zero or less, enter zero)

1 0

11. Subtract Line 10 from Line 5. If zero or less, enter zero here and on Line 24 and skip

Lines 12 through 23

11

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

IMPORTANT: Complete only one of Line 12, 13 or 14. Enter the result on Line 15.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

12. If you completed Part IV of the federal Form 6251, complete Part II of this form and

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

enter the amount from Line 49 here and on Line 15. Skip Line 13 and Line 14

12

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

13. If Line 11 is $175,000 or less ($87,500 or less if married filing separately),

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

multiply Line 11 by 26% (.26). Enter the result here and on Line 15

13

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

14. If Line 11 is more than $175,000 (more than $87,500 if married filing

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

separately), multiply Line 11 by 28% (.28) and subtract $3,500 ($1,750 if

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

married filing separately) from the result. Enter the result here and on Line 15

14

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

15. Enter the amount from Line 12, Line 13, or Line 14

15

16. Alternative minimum tax foreign tax credit (from federal Form 6251, Line 25)

16

17. Adjusted federal tentative minimum tax (Subtract Line 16 from Line 15)

17

18. Multiply Line 17 by 19% (.19)

18

19. Multiply Line 5 by 5% (.05)

19

20. Connecticut minimum tax (Enter the lesser of Line 18 or Line 19)

20

21. Apportionment factor (Connecticut residents, enter 1.0000;

Nonresidents/part-year residents, see instructions )

21

22. Apportioned Connecticut minimum tax (Multiply Line 20 by Line 21)

22

23. Connecticut income tax (from Form CT-1040, Line 6 or Form CT-1040NR/PY, Line 10)

23

24. Net Connecticut minimum tax (Subtract Line 23 from Line 22. If zero or less, enter -0-)

24

25. Credit for minimum tax paid to qualifying jurisdictions. Residents and part-year residents only

(from Schedule A, Line 60)

25

26. Subtract Line 25 from Line 24

Enter the amount here and on Form CT-1040, Line 9 or Form CT-1040NR/PY, Line 13

26

1

1 2

2