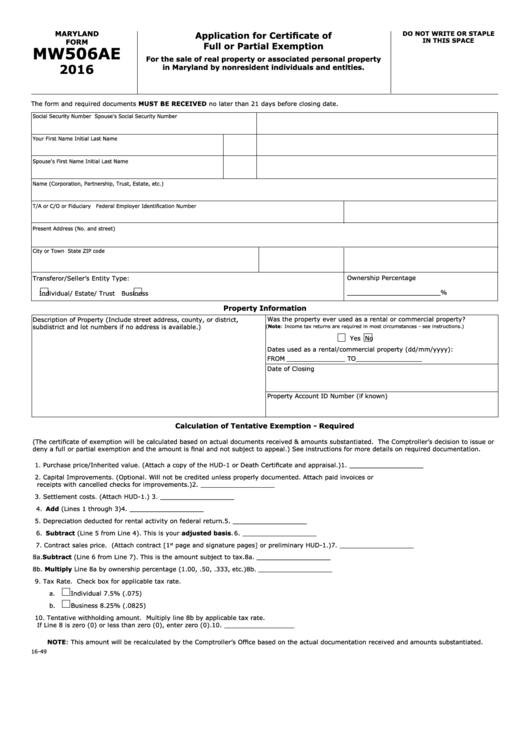

MARYLAND

DO NOT WRITE OR STAPLE

Application for Certificate of

IN THIS SPACE

FORM

Full or Partial Exemption

MW506AE

For the sale of real property or associated personal property

2016

in Maryland by nonresident individuals and entities.

The form and required documents MUST BE RECEIVED no later than 21 days before closing date.

Social Security Number

Spouse's Social Security Number

Your First Name

Initial

Last Name

Spouse's First Name

Initial

Last Name

Name (Corporation, Partnership, Trust, Estate, etc.)

T/A or C/O or Fiduciary

Federal Employer Identification Number

Present Address (No. and street)

City or Town

State

ZIP code

Transferor/Seller’s Entity Type:

Ownership Percentage

________________________%

Individual/ Estate/ Trust

Business

Property Information

Was the property ever used as a rental or commercial property?

Description of Property (Include street address, county, or district,

subdistrict and lot numbers if no address is available.)

(Note: Income tax returns are required in most circumstances - see instructions.)

Yes

No

Dates used as a rental/commercial property (dd/mm/yyyy):

FROM _______________ TO _________________

Date of Closing

Property Account ID Number (if known)

Calculation of Tentative Exemption - Required

(The certificate of exemption will be calculated based on actual documents received & amounts substantiated. The Comptroller’s decision to issue or

deny a full or partial exemption and the amount is final and not subject to appeal.) See instructions for more details on required documentation.

1. Purchase price/Inherited value. (Attach a copy of the HUD-1 or Death Certificate and appraisal.) . . . . . . . . . . . . 1. ___________________

2. Capital Improvements. (Optional. Will not be credited unless properly documented. Attach paid invoices or

receipts with cancelled checks for improvements.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. ___________________

3. Settlement costs. (Attach HUD-1.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. ___________________

4. Add (Lines 1 through 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. ___________________

5. Depreciation deducted for rental activity on federal return. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. ___________________

6. Subtract (Line 5 from Line 4). This is your adjusted basis. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. ___________________

7. Contract sales price. (Attach contract [1

page and signature pages] or preliminary HUD-1.) . . . . . . . . . . . . . . . 7. ___________________

st

8a. Subtract (Line 6 from Line 7). This is the amount subject to tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8a. ___________________

8b. Multiply Line 8a by ownership percentage (1.00, .50, .333, etc.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8b. ___________________

9. Tax Rate. Check box for applicable tax rate.

a.

Individual

7.5% (.075)

b.

Business

8.25% (.0825)

10. Tentative withholding amount. Multiply line 8b by applicable tax rate.

If Line 8 is zero (0) or less than zero (0), enter zero (0). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10. __________________

NOTE: This amount will be recalculated by the Comptroller’s Office based on the actual documentation received and amounts substantiated.

16-49

1

1 2

2