Form Dp-147 - Application For 6-Month Extension Of Time To File - New Hampshire Department Of Revenue

ADVERTISEMENT

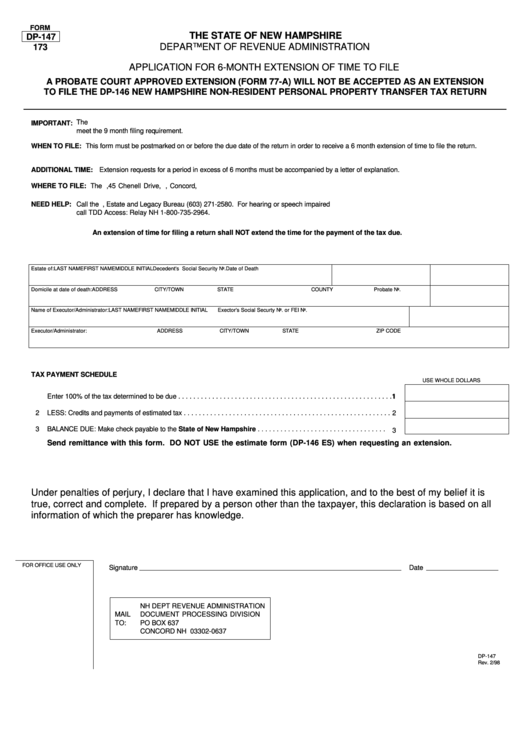

FORM

THE STATE OF NEW HAMPSHIRE

DP-147

DEPARTMENT OF REVENUE ADMINISTRATION

173

APPLICATION FOR 6-MONTH EXTENSION OF TIME TO FILE

A PROBATE COURT APPROVED EXTENSION (FORM 77-A) WILL NOT BE ACCEPTED AS AN EXTENSION

TO FILE THE DP-146 NEW HAMPSHIRE NON-RESIDENT PERSONAL PROPERTY TRANSFER TAX RETURN

The N.H. Department of Revenue Administration requires a form DP-147 Extension of Time to File for all tax returns for taxpayers unable to

IMPORTANT:

meet the 9 month filing requirement.

WHEN TO FILE:

This form must be postmarked on or before the due date of the return in order to receive a 6 month extension of time to file the return.

ADDITIONAL TIME:

Extension requests for a period in excess of 6 months must be accompanied by a letter of explanation.

WHERE TO FILE:

The N.H. Department of Revenue Administration,45 Chenell Drive, P.O. Box 637, Concord, N.H.

03302-0637.

NEED HELP:

Call the N.H. Department of Revenue Administration, Estate and Legacy Bureau (603) 271-2580. For hearing or speech impaired

call TDD Access: Relay NH 1-800-735-2964.

An extension of time for filing a return shall NOT extend the time for the payment of the tax due.

Estate of:

LAST NAME

FIRST NAME

MIDDLE INITIAL

Decedent's Social Security No.

Date of Death

Domicile at date of death:

ADDRESS

CITY/TOWN

STATE

COUNTY

Probate No.

Name of Executor/Administrator:

LAST NAME

FIRST NAME

MIDDLE INITIAL

Exector's Social Securty No. or FEI No.

Executor/Administrator:

ADDRESS

CITY/TOWN

STATE

ZIP CODE

TAX PAYMENT SCHEDULE

USE WHOLE DOLLARS

1

Enter 100% of the tax determined to be due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

LESS: Credits and payments of estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3

BALANCE DUE: Make check payable to the State of New Hampshire . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

Send remittance with this form. DO NOT USE the estimate form (DP-146 ES) when requesting an extension.

Under penalties of perjury, I declare that I have examined this application, and to the best of my belief it is

true, correct and complete. If prepared by a person other than the taxpayer, this declaration is based on all

information of which the preparer has knowledge.

FOR OFFICE USE ONLY

Signature

Date

NH DEPT REVENUE ADMINISTRATION

MAIL

DOCUMENT PROCESSING DIVISION

TO:

PO BOX 637

CONCORD NH 03302-0637

DP-147

Rev. 2/98

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1