Form 520 - Net Profit License Fee Return - City Of Stanford

ADVERTISEMENT

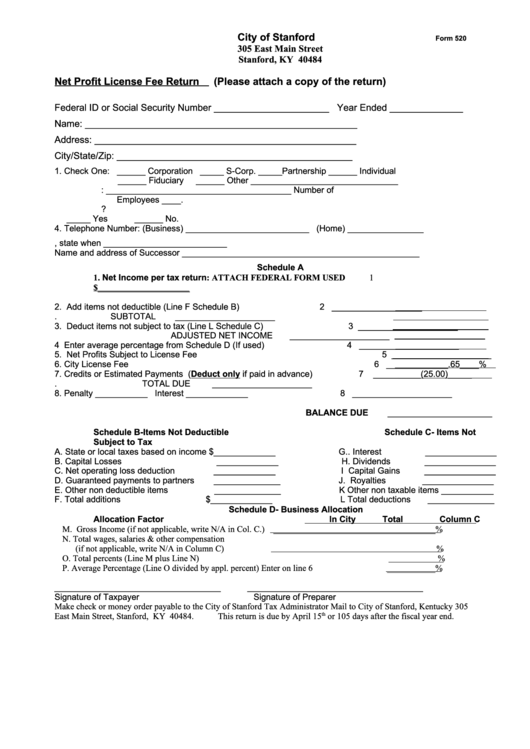

City of Stanford

Form 520

305 East Main Street

Stanford, KY 40484

Net Profit License Fee Return

(Please attach a copy of the return)

Federal ID or Social Security Number ______________________ Year Ended ______________

Name: ____________________________________________________

Address: __________________________________________________

City/State/Zip: _____________________________________________

1. Check One: ______ Corporation _____ S-Corp. _____Partnership ______ Individual

______ Fiduciary

______ Other _______________________________

2. Nature of Business: _______________________________________ Number of

Employees ____.

3. Have Federal authorities changed the net income as originally reported for any prior year?

_____ Yes

______ No.

4. Telephone Number: (Business) __________________________ (Home) ________________

5.If organization was discontinued, state when __________________________

Name and address of Successor __________________________________________________

Schedule A

1. Net Income per tax return: ATTACH FEDERAL FORM USED

1

$_____________________

2. Add items not deductible (Line F Schedule B)

2 ___________________

.

SUBTOTAL

_____________________

3. Deduct items not subject to tax (Line L Schedule C)

3 _____________________

ADJUSTED NET INCOME

_____________________

4 Enter average percentage from Schedule D (If used)

4 _____________________

5. Net Profits Subject to License Fee

5 _____________________

6. City License Fee

6 _____________.65____%

7. Credits or Estimated Payments (Deduct only if paid in advance)

7

__________(25.00)_____

.

TOTAL DUE

_____________________

8. Penalty ___________ Interest _____________

8 _____________________

BALANCE DUE

______________________

Schedule B-Items Not Deductible

Schedule C- Items Not

Subject to Tax

A. State or local taxes based on income $_____________

G.. Interest

_______________

B. Capital Losses

_____________

H. Dividends

_______________

C. Net operating loss deduction

_____________

I Capital Gains

_______________

D. Guaranteed payments to partners

______________

J. Royalties

_______________

E. Other non deductible items

______________

K Other non taxable items ___________

F. Total additions

$_____________

L Total deductions

______________

Schedule D- Business Allocation

Allocation Factor

In City

Total

Column C

M. Gross Income (if not applicable, write N/A in Col. C.) _____________________________________%

N. Total wages, salaries & other compensation

(if not applicable, write N/A in Column C)

%

O. Total percents (Line M plus Line N)

%

P. Average Percentage (Line O divided by appl. percent) Enter on line 6

___________%

___________________________________

_____________________________________

Signature of Taxpayer

Signature of Preparer

Make check or money order payable to the City of Stanford Tax Administrator Mail to City of Stanford, Kentucky 305

East Main Street, Stanford, KY 40484.

This return is due by April 15

th

or 105 days after the fiscal year end.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1