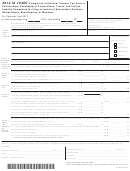

Form Cdi Fs-003 - Title Insurance Tax Return - 2013 Page 3

ADVERTISEMENT

State of California

Department of Insurance

TITLE INSURANCE TAX RETURN

CDI FS-003 (REV 9/2013)

2013

FOR CALENDAR YEAR

TAX DUE DATE APRIL 1, 2014

Name of Insurer

Fed Tax I.D. No.

CA Perm No.

NAIC No.

SCHEDULE A - - Retaliatory Tax Return

ALL INSURERS NOT DOMICILED IN CALIFORNIA MUST COMPLETE THIS SCHEDULE. ATTACH A COPY OF THE

STATE OF DOMICILE PREMIUM TAX RETURN.

Part I. State of Domicile Tax on California Insurer

1.

1.1

Gross Premiums

1.1

1.2

Allowable Deductions

1.2

1.3

Net Taxable Premiums

1.3

1.4

Tax Rate

1.4

1.5

Amount of Tax

1.5

1.6

Fire Department Tax (Please provide support)

1.6

1.7

Fire Marshall Tax (Please provide support)

1.7

1.8

Annual Statement Fee in State of Domicile

1.8

1.9

Certificate of Authority in State of Domicile

1.9

1.10

Certification Fee in State of Domicile

1.10

1.11

Agents License fees (State number of agents x fee amt.)

1.11

2.

Total State of Domicile Aggregate Imposition

2.

Part II. California Tax on Foreign/Alien Insurer

1.

Premium Tax from Page 1, Line 06.

1.

2.

Annual Statement Fee in the amount of $347. May apply if paid.

2.

3.

Certificate of Authority Fee in the amount of $350. May apply if paid.

3.

4.

Agents License fees (State number of agents x fee amt.)

4.

5.

Total California Aggregate Imposition

5.

6.

2013 Retaliatory Tax

6.

If amount on Part II, Line 5 is greater than Part I, Line 2,

enter zero on Part II, Line 6.

If amount on Part I, Line 2 is greater than Part II, Line 5,

enter difference between the two amounts on Part II, Line 6.

Enter result of calculation on Page 1, Line 14.

Attach a copy of the 2013 Annual Statement - Schedule T with this return.

Page 3 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3