Local Services Tax - Exemption Certificate - Pennsylvania Capital Tax Collection Bureau - 2013 Page 2

ADVERTISEMENT

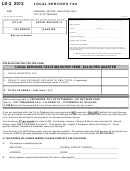

SCHEDULE I. – LOW-INCOME EXEMPTION INFORMATION ►HOW TO USE: Look first for the MUNICIPALITY in which your

occupation is located, If it is not listed, look for the SCHOOL DISTRICT in which your occupation is located.

A

B

C

D

E

COUNTY

2013 LST Tax Amount

Low Income

Amount Exempt if Low-

Amount NOT Exempt if

Taxing Jurisdiction

(combined if applicable)

Exemption Limit

Income Exemption

Low-Income Exemption

DAUPHIN COUNTY

Harrisburg City

$52.00

< $12,000

$47.00

$5.00

Highspire Bo.

$52.00

< $12,000

$52.00

$0.00

Steelton Bo.

$52.00

< $12,000

$52.00

$0.00

PERRY COUNTY

(New) Bloomfield Bo.

$52.00

< $12,000

$52.00

$0.00

Howe Twp.

$20.00

< $12,000

$20.00

$0.00

Marysville Bo.

$52.00

< $12,000

$52.00

$0.00

Newport Bo.

$52.00

< $12,000

$52.00

$0.00

Penn Twp

$52.00

< $12,000

$52.00

$0.00

Watts Twp.

$10.00

N/A

$0.00

$10.00

JUNIATA COUNTY

Fermanagh Twp.

$52.00

<$12,000

$52.00

$0.00

Susquehanna Twp.

$52.00

< $12,000

$52.00

$0.00

SOMERSET COUNTY

Boswell Boro

$40.00

<$12,000

$40.00

$0.00

Conemaugh Twp

$52.00

<$12,000

$47.00

$5.00

Jenner Twp

$10.00

<$12,000

$10.00

$0.00

Jennerstown Boro

$52.00

NONE

$47.00

$5.00

Lincoln Twp

$52.00

<$12,000

$47.00

$5.00

Paint Bo.

$52.00

< $12,000

$47.00

$5.00

Paint Twp.

$52.00

< $12,000

$47.00

$5.00

Quemahoning Twp.

$10.00

N/A

$10.00

$0.00

Scalp Level Bo.

$10.00

N/A

$0.00

$10.00

Somerset Bo.

$52.00

<$12,000

$47.00

$5.00

Summit Twp.

$52.00

<$12,000

$52.00

$0.00

Windber Bo.

$52.00

< $12,000

$52.00

$5.00

SCHEDULE II. -- CTCB DIVISION OFFICES

CAPITAL TAX COLLECTION BUREAU

CAPITAL TAX COLLECTION BUREAU

HARRISBURG DIVISION

SOMERSET DIVISION

2301 N 3RD ST

PO BOX 146

HARRISBURG PA 17110-1893

SOMERSET PA 15501

Phone: (717) 234-3217

Phone: (814) 701-2475

Fax:

(717) 234-2962

Fax: (814) 701-2318

SCHEDULE III. – COTERMINOUS EMPLOYER INFORMATION – List all places of employment for the applicable tax year. List your PRIMARY

EMPLOYER under # 1 below and your secondary employers under the other columns. If self-employed, enter SELF in the “Employer Name” Row. If you

need to list more than 3 employers use an additional Exemption Form & change the numbers of the employers listed to 4., 5, etc.

1. Primary Employer

2.

3.

Employer Name

Street Address 1

Street Address 2

City, State & Zip Code

Municipality

Phone

Start Date

Status (Full or Part Time)

Expected earnings for tax

year _________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2