Line-By-Line Instructions For The Missouri Itemized Deductions

ADVERTISEMENT

spouse’s part in the “Your Spouse” column. The following items are special points to keep in mind.

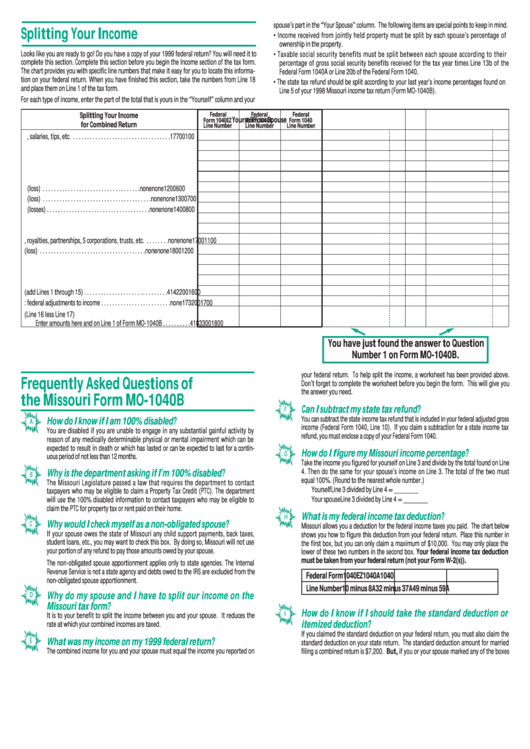

Splitting Your Income

• Income received from jointly held property must be split by each spouse’s percentage of

ownership in the property.

Looks like you are ready to go! Do you have a copy of your 1999 federal return? You will need it to

• Taxable social security benefits must be split between each spouse according to their

complete this section. Complete this section before you begin the Income section of the tax form.

percentage of gross social security benefits received for the tax year times Line 13b of the

The chart provides you with specific line numbers that make it easy for you to locate this informa-

Federal Form 1040A or Line 20b of the Federal Form 1040.

tion on your federal return. When you have finished this section, take the numbers from Line 18

• The state tax refund should be split according to your last year’s income percentages found on

and place them on Line 1 of the tax form.

Line 5 of your 1998 Missouri income tax return (Form MO-1040B).

For each type of income, enter the part of the total that is yours in the “Yourself” column and your

Federal

Federal

Federal

Splitting Your Income

Yourself

Your Spouse

Form 1040EZ

Form 1040A

Form 1040

for Combined Return

Line Number

Line Number

Line Number

1. Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

7

7

00

1

00

2. Taxable interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

8a

8a

00

2

00

3. Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

9

9

00

3

00

4. State and local income tax refunds . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

10

00

4

00

5. Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

11

00

5

00

6. Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

12

00

6

00

7. Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

13

00

7

00

8. Other gains or (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

14

00

8

00

9. Taxable IRA distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

10b

15b

00

9

00

10. Taxable pensions and annuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

11b

16b

00

10

00

11. Rents, royalties, partnerships, S corporations, trusts, etc. . . . . . . . .

none

none

17

00

11

00

12. Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

18

00

12

00

13. Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

12

19

00

13

00

14. Taxable social security benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

13b

20b

00

14

00

15. Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

21

00

15

00

16. Total (add Lines 1 through 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

14

22

00

16

00

17. Less: federal adjustments to income . . . . . . . . . . . . . . . . . . . . . . . . .

none

17

32

00

17

00

18. Federal adjusted gross income (Line 16 less Line 17)

Enter amounts here and on Line 1 of Form MO-1040B . . . . . . . . . .

4

18

33

00

18

00

You have just found the answer to Question

Number 1 on Form MO-1040B.

your federal return. To help split the income, a worksheet has been provided above.

Frequently Asked Questions of

Don’t forget to complete the worksheet before you begin the form. This will give you

the answer you need.

the Missouri Form MO-1040B

Can I subtract my state tax refund?

F

You can subtract the state income tax refund that is included in your federal adjusted gross

How do I know if I am 100% disabled?

A

income (Federal Form 1040, Line 10). If you claim a subtraction for a state income tax

You are disabled if you are unable to engage in any substantial gainful activity by

refund, you must enclose a copy of your Federal Form 1040.

reason of any medically determinable physical or mental impairment which can be

expected to result in death or which has lasted or can be expected to last for a contin-

How do I figure my Missouri income percentage?

G

uous period of not less than 12 months.

Take the income you figured for yourself on Line 3 and divide by the total found on Line

4. Then do the same for your spouse’s income on Line 3. The total of the two must

Why is the department asking if I’m 100% disabled?

B

equal 100%. (Round to the nearest whole number.)

The Missouri Legislature passed a law that requires the department to contact

Yourself

Line 3 divided by Line 4 = ______

taxpayers who may be eligible to claim a Property Tax Credit (PTC). The department

Your spouse

Line 3 divided by Line 4 = ______

will use the 100% disabled information to contact taxpayers who may be eligible to

claim the PTC for property tax or rent paid on their home.

What is my federal income tax deduction?

H

Why would I check myself as a non-obligated spouse?

C

Missouri allows you a deduction for the federal income taxes you paid. The chart below

If your spouse owes the state of Missouri any child support payments, back taxes,

shows you how to figure this deduction from your federal return. Place this number in

student loans, etc., you may want to check this box. By doing so, Missouri will not use

the first box, but you can only claim a maximum of $10,000. You may only place the

your portion of any refund to pay those amounts owed by your spouse.

lower of these two numbers in the second box. Your federal income tax deduction

must be taken from your federal return (not your Form W-2(s)).

The non-obligated spouse apportionment applies only to state agencies. The Internal

Revenue Service is not a state agency and debts owed to the IRS are excluded from the

Federal Form

1040EZ

1040A

1040

non-obligated spouse apportionment.

Line Number

10 minus 8A

32 minus 37A

49 minus 59A

D

Why do my spouse and I have to split our income on the

Missouri tax form?

How do I know if I should take the standard deduction or

I

It is to your benefit to split the income between you and your spouse. It reduces the

itemized deduction?

rate at which your combined incomes are taxed.

If you claimed the standard deduction on your federal return, you must also claim the

E

What was my income on my 1999 federal return?

standard deduction on your state return. The standard deduction amount for married

The combined income for you and your spouse must equal the income you reported on

filing a combined return is $7,200. But, if you or your spouse marked any of the boxes

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2