3

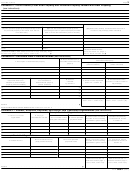

Form 990-T (2011)

Page

Schedule C—Rent Income (From Real Property and Personal Property Leased With Real Property)

(see instructions)

1. Description of property

(1)

(2)

(3)

(4)

2. Rent received or accrued

3(a) Deductions directly connected with the income

(a) From personal property (if the percentage of rent

(b) From real and personal property (if the

in columns 2(a) and 2(b) (attach schedule)

for personal property is more than 10% but not

percentage of rent for personal property exceeds

more than 50%)

50% or if the rent is based on profit or income)

(1)

(2)

(3)

(4)

Total

Total

(b) Total deductions.

(c) Total income. Add totals of columns 2(a) and 2(b). Enter

Enter here and on page 1,

here and on page 1, Part I, line 6, column (A)

.

.

.

Part I, line 6, column (B)

▶

▶

Schedule E—Unrelated Debt-Financed Income

(see instructions)

3. Deductions directly connected with or allocable to

2. Gross income from or

debt-financed property

1. Description of debt-financed property

allocable to debt-financed

(a) Straight line depreciation

(b) Other deductions

property

(attach schedule)

(attach schedule)

(1)

(2)

(3)

(4)

4. Amount of average

5. Average adjusted basis

6. Column

8. Allocable deductions

acquisition debt on or

of or allocable to

7. Gross income reportable

4 divided

(column 6 × total of columns

allocable to debt-financed

debt-financed property

(column 2 × column 6)

by column 5

3(a) and 3(b))

property (attach schedule)

(attach schedule)

%

(1)

(2)

%

(3)

%

%

(4)

Enter here and on page 1,

Enter here and on page 1,

Part I, line 7, column (A).

Part I, line 7, column (B).

Totals

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

Total dividends-received deductions included in column 8

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

Schedule F—Interest, Annuities, Royalties, and Rents From Controlled Organizations

(see instructions)

Exempt Controlled Organizations

1. Name of controlled

2. Employer

5. Part of column 4 that is

6. Deductions directly

3. Net unrelated income

4. Total of specified

organization

identification number

included in the controlling

connected with income

(loss) (see instructions)

payments made

organization’s gross income

in column 5

(1)

(2)

(3)

(4)

Nonexempt Controlled Organizations

10. Part of column 9 that is

11. Deductions directly

8. Net unrelated income

9. Total of specified

7. Taxable Income

included in the controlling

connected with income in

(loss) (see instructions)

payments made

organization’s gross income

column 10

(1)

(2)

(3)

(4)

Add columns 5 and 10.

Add columns 6 and 11.

Enter here and on page 1,

Enter here and on page 1,

Part I, line 8, column (A).

Part I, line 8, column (B).

Totals

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

990-T

Form

(2011)

1

1 2

2 3

3 4

4