Employer-Provided Long-Term Care Benefits Tax Credit Worksheet For Tax Year 2015

ADVERTISEMENT

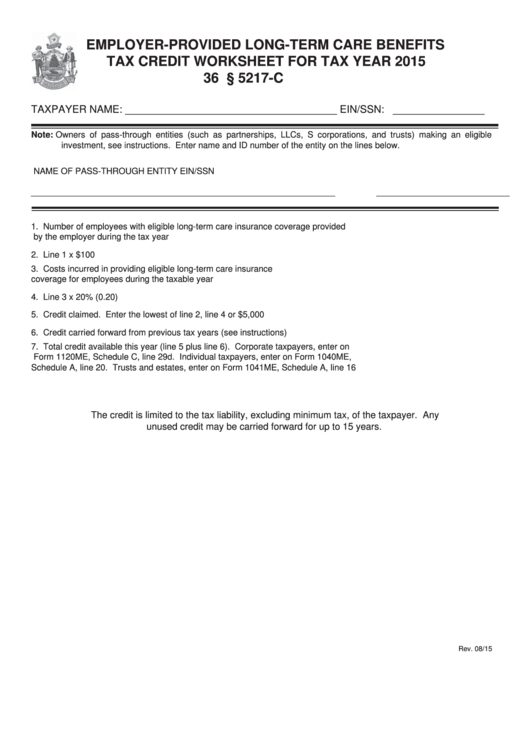

EMPLOYER-PROVIDED LONG-TERM CARE BENEFITS

TAX CREDIT WORKSHEET FOR TAX YEAR 2015

36 M.R.S. § 5217-C

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (such as partnerships, LLCs, S corporations, and trusts) making an eligible

investment, see instructions. Enter name and ID number of the entity on the lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

1.

Number of employees with eligible long-term care insurance coverage provided

by the employer during the tax year ........................................................................................1. __________________

2.

Line 1 x $100 ..........................................................................................................................2. __________________

3.

Costs incurred in providing eligible long-term care insurance

coverage for employees during the taxable year ....................................................................3. __________________

4.

Line 3 x 20% (0.20) .................................................................................................................4. __________________

5.

Credit claimed. Enter the lowest of line 2, line 4 or $5,000 ....................................................5. __________________

6.

Credit carried forward from previous tax years (see instructions) ...........................................6. __________________

7.

Total credit available this year (line 5 plus line 6). Corporate taxpayers, enter on

Form 1120ME, Schedule C, line 29d. Individual taxpayers, enter on Form 1040ME,

Schedule A, line 20. Trusts and estates, enter on Form 1041ME, Schedule A, line 16 .........7. __________________

The credit is limited to the tax liability, excluding minimum tax, of the taxpayer. Any

unused credit may be carried forward for up to 15 years.

Rev. 08/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2