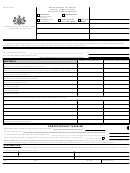

Form Rct-112 - Gross Receipts Tax Electric, Hydro-Electric And Water Power Companies - 2011 Page 2

ADVERTISEMENT

1120011201

RCT-112 (I)

Page 2

Taxpayer Name:

Corp Tax Account ID:

ELECTRIC, HYDRO-ELECTRIC AND WATER POWER

DUNS #:

GROSS RECEIPTS TAX

PA PUC - A #:

FOR TAX YEAR: 12/31/2011

Check all applicable boxes:

Identify Source(s) of Report Information:

Distributor - Complete Schedule B

®

®

®

FERC

PUC

Federal Tax

Supplier - Complete Schedule C

(B)

(C)

(D)

(E)

L

L

(A)

RECEIPTS FROM

TOTAL

NONTAXABLE PA

TOTAL TAXABLE

I

I

TOTAL

FERC

SOURCE OF GROSS RECEIPTS

BUSINESS DONE

PA RECEIPTS

RECEIPTS, PA BAD DEBTS

PA RECEIPTS

N

N

GROSS RECEIPTS

Acct #

IN OTHER STATES

(A-B)

& PA SALES FOR RESALE

(C-D)

E

E

411.6

THIS AREA

1

411.9 Utility Plant & Allowances

1

INTENTIONALLY

BLANK

2

412.0 Revenues - Electric Plant Leased to Others

2

3

414.0 Other Utility Operating Income (Attach Schedule)

3

4

415.0 Revenues - Merchandising, Jobbing & Contract Work

4

5

417.0 Revenues - Nonutility Operations

5

THIS AREA

6

418.0 Nonoperating Rental Income

6

INTENTIONALLY

BLANK

7

419.0 Interest & Dividend Income

7

8

421.0 Miscellaneous Nonoperating Income

8

421.1

9

421.2 Gain/Loss on Disposition of Property

9

10

440.0 Residential Sales

10

11

442.0 Commercial and Industrial Sales

11

THIS AREA

12

444.0 Public Street & Highway Lighting

12

INTENTIONALLY BLANK

13

445.0 Other Sales to Public Authorities

13

14

446.0 Sales to Railroads & Railways

14

15

447.0 Sales for Resale (Complete Schedule A)

15

N/A

16

448.0 Interdepartmental Sales

16

17

Other Sales, Nonmajor Only (Attach Schedule)

17

18

449.1 Provision for Rate Refunds

18

19

450.0 Forfeited Discounts

19

20

451.0 Miscellaneous Service Revenues

20

21

453.0 Sales of Water and Water Power

21

22

454.0 Rent from Electric Property

22

THIS AREA

23

455.0 Interdepartmental Rents

23

INTENTIONALLY

BLANK

24

456.0 Other Electric Revenues (Attach Schedule)

24

25

456.1 Revenues From Transmission of Electricity of Others

25

26

457.1 Regional Transmission Service Revenues

26

27

457.2 Miscellaneous Revenues (Attach Schedule)

27

28

All Other Sources (Attach Schedule)

28

29

Totals of Each Column (Lines 1 - 28)

29

30

Tax at the rate of 60.6 mills (44 mills GRT + 15 mills RNR + 1.6 mills PURTA surcharge) (Column E, Line 29 x 0.0606)

30

Carry to Page 1, Column A (whole numbers only).

All Taxpayers:

®

®

Identify method of accounting for gross receipts (see instructions):

Cash

Accrual

Other

Has method changed from prior year? (Y/N) ____

Provide a reconciliation of Column A, Total Gross Receipts, with total receipts reported on the source report(s) identified above.

Multistate taxpayers:

Provide a reconciliation of Column C, Total PA Receipts, with total receipts reported on the appropriate state income tax return.

1120011201

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5