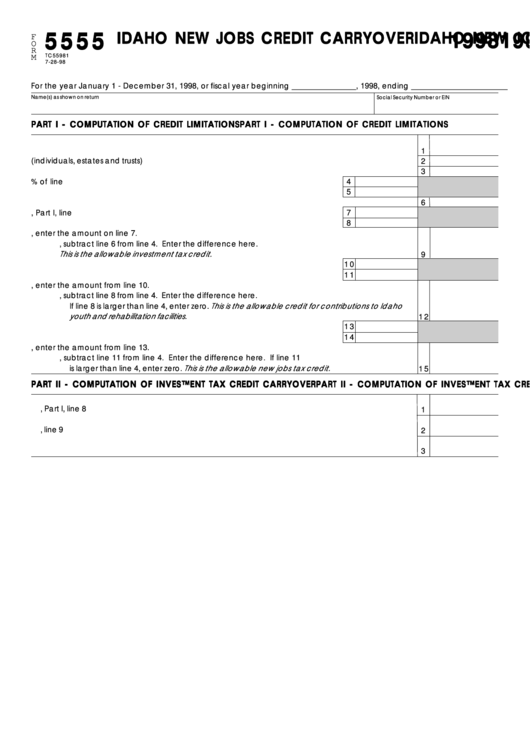

IDAHO NEW JOBS CREDIT CARRYOVER

IDAHO NEW JOBS CREDIT CARRYOVER

IDAHO NEW JOBS CREDIT CARRYOVER

1998

1998

5 5

5 5

5 5

IDAHO NEW JOBS CREDIT CARRYOVER

IDAHO NEW JOBS CREDIT CARRYOVER

1998

5 5

5 5

1998

1998

F

O

R

TC55981

M

7-28-98

For the year January 1 - December 31, 1998, or fiscal year beginning ________________, 1998, ending ________________________

Name(s) as shown on return

Social Security Number or EIN

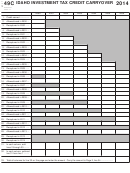

PART I - COMPUTATION OF CREDIT LIMITATIONS

PART I - COMPUTATION OF CREDIT LIMITATIONS

PART I - COMPUTATION OF CREDIT LIMITATIONS

PART I - COMPUTATION OF CREDIT LIMITATIONS

PART I - COMPUTATION OF CREDIT LIMITATIONS

1.

Idaho income tax liability. Enter amount from appropriate income tax return. ...................................

1

2.

Credit for taxes paid to other states (individuals, estates and trusts) ..................................................

2

3.

Subtract line 2 from line 1. .....................................................................................................................

3

4.

Enter 33% of line 3. .............................................................................................

4

5.

Credit for contributions to educational entities ..................................................

5

6.

Enter the smaller of line 4 or line 5. .......................................................................................................

6

7.

Investment tax credit. Form 49, Part I, line 8. ...................................................

7

8.

Total of lines 5 and 7 ............................................................................................

8

9.

a. If line 8 is smaller than line 4, enter the amount on line 7.

b. If line 8 is equal to or larger than line 4, subtract line 6 from line 4. Enter the difference here.

This is the allowable investment tax credit. ...........................................................................................

9

10.

Credit for contributions to Idaho youth and rehabilitation facilities ...................

1 0

11.

Total of lines 8 and 10. ........................................................................................

1 1

12.

a. If line 11 is smaller than line 4, enter the amount from line 10.

b. If line 11 is equal to or larger than line 4, subtract line 8 from line 4. Enter the difference here.

If line 8 is larger than line 4, enter zero. This is the allowable credit for contributions to Idaho

youth and rehabilitation facilities. ......................................................................................................

1 2

13.

New jobs tax credit carryover from your 1997 Form 55. ...................................

1 3

14.

Total of lines 11 and 13. ......................................................................................

1 4

15.

a. If line 14 is smaller than line 4, enter the amount from line 13.

b. If line 14 is larger than line 4, subtract line 11 from line 4. Enter the difference here. If line 11

is larger than line 4, enter zero. This is the allowable new jobs tax credit.

1 5

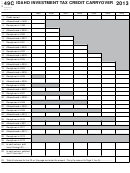

PART II - COMPUTATION OF INVESTMENT TAX CREDIT CARRYOVER

PART II - COMPUTATION OF INVESTMENT TAX CREDIT CARRYOVER

PART II - COMPUTATION OF INVESTMENT TAX CREDIT CARRYOVER

PART II - COMPUTATION OF INVESTMENT TAX CREDIT CARRYOVER

PART II - COMPUTATION OF INVESTMENT TAX CREDIT CARRYOVER

1 .

Investment tax credit available from Form 49, Part I, line 8 ................................................................

1

2 .

Investment tax credit allowable this year. Enter the amount from Part I, line 9 above. ....................

2

3 .

Subtract line 2 from line 1. This is the investment tax credit carryover to next year.

3

1

1