Property Tax Payment Agreement Request Form - New York City Department Of Finance

ADVERTISEMENT

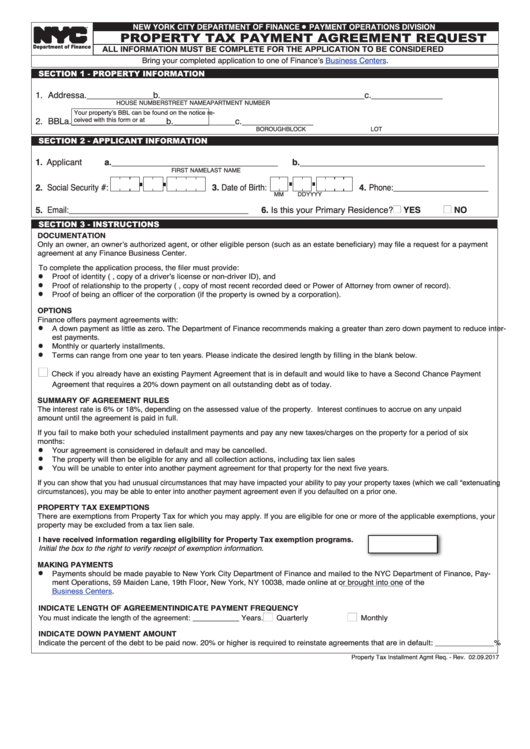

NEW YORK CITY DEPARTMENT OF FINANCE

PAYMENT OPERATIONS DIVISION

PROPERTY TAX PAYMENT AGREEMENT REQUEST

l

TM

ALL INFORMATION MUST BE COMPLETE FOR THE APPLICATION TO BE CONSIDERED

Department of Finance

Bring your completed application to one of Finance’s

Business

Centers.

SECTION 1 - PROPERTY INFORMATION

1. Address

a.______________

b.___________________________________________

c._______________

HOUSE NUMBER

STREET NAME

APARTMENT NUMBER

Your property’s BBL can be found on the notice re-

2. BBL

a.____________________ b._____________

c._______________

ceived with this form or at

BOROUGH

BLOCK

LOT

SECTION 2 - APPLICANT INFORMATION

1. Applicant

a.___________________________________

b._______________________________________

FIRST NAME

LAST NAME

2. Social Security #:

3. Date of Birth:

4. Phone:____________________

MM

DD

YYYY

5. Email:__________________________________________

6. Is this your Primary Residence?

YES

NO

n

n

SECTION 3 - INSTRUCTIONS

DOCUMENTATION

Only an owner, an owner’s authorized agent, or other eligible person (such as an estate beneficiary) may file a request for a payment

agreement at any Finance Business Center.

To complete the application process, the filer must provide:

Proof of identity (e.g., copy of a driver’s license or non-driver ID), and

l

Proof of relationship to the property (e.g., copy of most recent recorded deed or Power of Attorney from owner of record).

l

Proof of being an officer of the corporation (if the property is owned by a corporation).

l

OPTIONS

Finance offers payment agreements with:

A down payment as little as zero. The Department of Finance recommends making a greater than zero down payment to reduce inter-

l

est payments.

Monthly or quarterly installments.

l

Terms can range from one year to ten years. Please indicate the desired length by filling in the blank below.

l

n

Check if you already have an existing Payment Agreement that is in default and would like to have a Second Chance Payment

Agreement that requires a 20% down payment on all outstanding debt as of today.

SUMMARY OF AGREEMENT RULES

The interest rate is 6% or 18%, depending on the assessed value of the property. Interest continues to accrue on any unpaid

amount until the agreement is paid in full.

If you fail to make both your scheduled installment payments and pay any new taxes/charges on the property for a period of six

months:

Your agreement is considered in default and may be cancelled.

l

The property will then be eligible for any and all collection actions, including tax lien sales

l

You will be unable to enter into another payment agreement for that property for the next five years.

l

If you can show that you had unusual circumstances that may have impacted your ability to pay your property taxes (which we call “extenuating

circumstances), you may be able to enter into another payment agreement even if you defaulted on a prior one.

PROPERTY TAX EXEMPTIONS

There are exemptions from Property Tax for which you may apply. If you are eligible for one or more of the applicable exemptions, your

property may be excluded from a tax lien sale.

I have received information regarding eligibility for Property Tax exemption programs.

Initial the box to the right to verify receipt of exemption information.

MAKING PAYMENTS

Payments should be made payable to New York City Department of Finance and mailed to the NYC Department of Finance, Pay-

l

ment Operations, 59 Maiden Lane, 19th Floor, New York, NY 10038, made online at

nyc.gov/payonline

or brought into one of the

Business

Centers.

INDICATE LENGTH OF AGREEMENT

INDICATE PAYMENT FREQUENCY

n

n

You must indicate the length of the agreement: ___________ Years.

Quarterly

Monthly

INDICATE DOWN PAYMENT AMOUNT

Indicate the percent of the debt to be paid now. 20% or higher is required to reinstate agreements that are in default: ______________%

Property Tax Installment Agmt Req. - Rev. 02.09.2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2