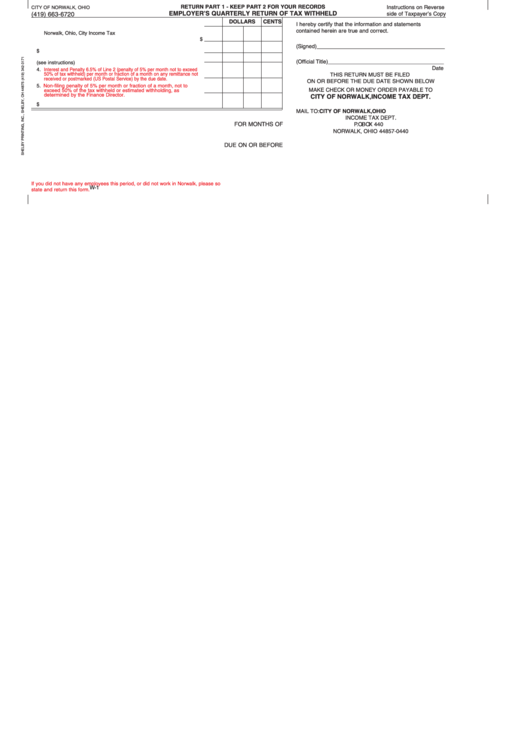

Form W-1 - Employer'S Quarterly Return Of Tax Withheld

ADVERTISEMENT

RETURN PART 1 - KEEP PART 2 FOR YOUR RECORDS

Instructions on Reverse

CITY OF NORWALK, OHIO

EMPLOYER’S QUARTERLY RETURN OF TAX WITHHELD

(419) 663-6720

side of Taxpayer’s Copy

DOLLARS

CENTS

I hereby certify that the information and statements

1. Taxable Earnings paid all Employees subject to

contained herein are true and correct.

Norwalk, Ohio, City Income Tax

$

(Signed)__________________________________________

2. Actual Tax Withheld in quarter for City Income Tax

$

(Official Title)______________________________________

3. Adjustment of Tax prior quarter (see instructions)

Date

4.

Interest and Penalty 6.5% of Line 2 (penalty of 5% per month not to exceed

50% of tax withheld) per month or fraction of a month on any remittance not

THIS RETURN MUST BE FILED

received or postmarked (US Postal Service) by the due date.

ON OR BEFORE THE DUE DATE SHOWN BELOW

5.

Non-filing penalty of 5% per month or fraction of a month, not to

exceed 50% of the tax withheld or estimated withholding, as

MAKE CHECK OR MONEY ORDER PAYABLE TO

determined by the Finance Director.

CITY OF NORWALK, INCOME TAX DEPT.

6.

Total

$

MAIL TO:

CITY OF NORWALK, OHIO

INCOME TAX DEPT.

FOR MONTHS OF

P.O. BOX 440

NORWALK, OHIO 44857-0440

DUE ON OR BEFORE

If you did not have any employees this period, or did not work in Norwalk, please so

W-1

state and return this form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1