Form 04-574.ec - Alaska Fisheries Business Tax Return - 1999

ADVERTISEMENT

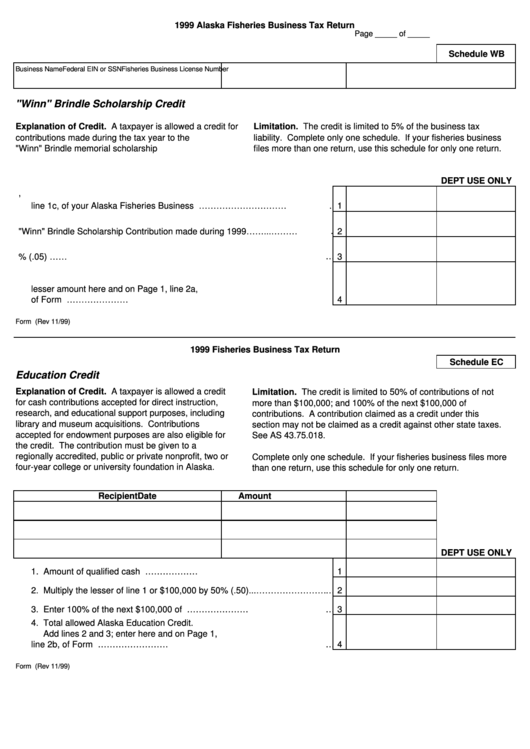

1999 Alaska Fisheries Business Tax Return

Page _____ of _____

Schedule WB

Business Name

Federal EIN or SSN

Fisheries Business License Number

A.W. "Winn" Brindle Scholarship Credit

Explanation of Credit. A taxpayer is allowed a credit for

Limitation. The credit is limited to 5% of the business tax

contributions made during the tax year to the A.W.

liability. Complete only one schedule. If your fisheries business

"Winn" Brindle memorial scholarship

files more than one return, use this schedule for only one return.

DEPT USE ONLY

1. Total Tax Before Credit. Enter the amount from Page 1,

line 1c, of your Alaska Fisheries Business Return........……………………………1

2. A.W. "Winn" Brindle Scholarship Contribution made during 1999……...…………2

3. Multiply line 1 by 5% (.05).......................................................................……… 3

4. Compare the amounts on lines 2 and 3. Enter the

lesser amount here and on Page 1, line 2a,

of Form 04-574.........................................…………………................................ 4

Form 04-574.WB (Rev 11/99)

1999 Fisheries Business Tax Return

Schedule EC

Education Credit

Explanation of Credit. A taxpayer is allowed a credit

Limitation. The credit is limited to 50% of contributions of not

for cash contributions accepted for direct instruction,

more than $100,000; and 100% of the next $100,000 of

research, and educational support purposes, including

contributions. A contribution claimed as a credit under this

library and museum acquisitions. Contributions

section may not be claimed as a credit against other state taxes.

accepted for endowment purposes are also eligible for

See AS 43.75.018.

the credit. The contribution must be given to a

regionally accredited, public or private nonprofit, two or

Complete only one schedule. If your fisheries business files more

four-year college or university foundation in Alaska.

than one return, use this schedule for only one return.

Recipient

Date

Amount

DEPT USE ONLY

1. Amount of qualified cash contributions........………………............................ 1

2. Multiply the lesser of line 1 or $100,000 by 50% (.50)...……………………… 2

3. Enter 100% of the next $100,000 of contribution..............…………………… 3

4. Total allowed Alaska Education Credit.

Add lines 2 and 3; enter here and on Page 1,

line 2b, of Form 04-574.................................................……………………… 4

Form 04-574.EC (Rev 11/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1