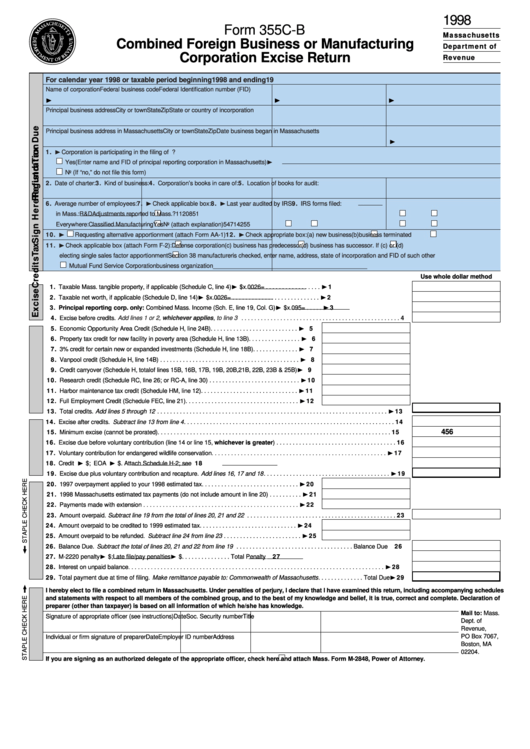

1998

Form 355C-B

Massachusetts

Combined Foreign Business or Manufacturing

Department of

Corporation Excise Return

Revenue

For calendar year 1998 or taxable period beginning

1998 and ending

19

Name of corporation

Federal business code

Federal Identification number (FID)

¨

¨

¨

¨

¨

¨

Principal business address

City or town

State

Zip

State or country of incorporation

Principal business address in Massachusetts

City or town

State

Zip

Date business began in Massachusetts

¨

1. ¨ Corporation is participating in the filing of U.S. consolidated return?

Yes (Enter name and FID of principal reporting corporation in Massachusetts) ¨

No (If “no,” do not file this form)

2. Date of charter:

3. Kind of business:

4. Corporation’s books in care of:

5. Location of books for audit:

7. ¨ Check applicable box:

8. ¨ Last year audited by IRS

6. Average number of employees:

9. IRS forms filed:

in Mass.:

R&D

Adjustments reported to Mass.?

1120

851

Everywhere:

Classified Manufacturing

Yes

No (attach explanation)

5471

4255

10. ¨

12. ¨ Check appropriate box: (a)

Requesting alternative apportionment (attach Form AA-1)

new business (b)

business terminated

11. ¨ Check applicable box (attach Form F-2):

Defense corporation

(c)

business has predecessor (d)

business has successor. If (c) or (d)

electing single sales factor apportionment

Section 38 manufacturer

is checked, enter name, address, state of incorporation and FID of such other

Mutual Fund Service Corporation

business organization ______________________________________________

Use whole dollar method

11. Taxable Mass. tangible property, if applicable (Schedule C, line 4) ¨ $

x .0026 = . . . . . . . . . . . . . . . . . ¨ 1

12. Taxable net worth, if applicable (Schedule D, line 14) ¨ $

x .0026 = . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 2

13. Principal reporting corp. only: Combined Mass. Income (Sch. E, line 19, Col. G) ¨ $

x .095 = . . . . . ¨ 3

14. Excise before credits.

Add lines 1 or 2, whichever applies, to line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

15. Economic Opportunity Area Credit (Schedule H, line 24B) . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 15

16. Property tax credit for new facility in poverty area (Schedule H, line 13B) . . . . . . . . . . . . . . . . ¨ 16

17. 3% credit for certain new or expanded investments (Schedule H, line 18B) . . . . . . . . . . . . . . ¨ 17

18. Vanpool credit (Schedule H, line 14B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 18

19. Credit carryover (Schedule H, total of lines 15B, 16B, 17B, 19B, 20B, 21B, 22B, 23B & 25B) ¨ 19

10. Research credit (Schedule RC, line 26; or RC-A, line 30) . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 10

11. Harbor maintenance tax credit (Schedule HM, line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 11

12. Full Employment Credit (Schedule FEC, line 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 12

13. Total credits. Add lines 5 through 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 13

14. Excise after credits. Subtract line 13 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

456

15. Minimum excise (cannot be prorated) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16. Excise due before voluntary contribution (line 14 or line 15, whichever is greater) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17. Voluntary contribution for endangered wildlife conservation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 17

18. Credit Recapture. ITC ¨ $

; EOA ¨ $

. Attach Schedule H-2; see instructions. Total 18

19. Excise due plus voluntary contribution and recapture. Add lines 16, 17 and 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 19

20. 1997 overpayment applied to your 1998 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 20

21. 1998 Massachusetts estimated tax payments (do not include amount in line 20) . . . . . . . . . . ¨ 21

22. Payments made with extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 22

23. Amount overpaid. Subtract line 19 from the total of lines 20, 21 and 22 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24. Amount overpaid to be credited to 1999 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 24

25. Amount overpaid to be refunded. Subtract line 24 from line 23 . . . . . . . . . . . . . . . . . . . . . . . . ¨ 25

¨

26. Balance Due. Subtract the total of lines 20, 21 and 22 from line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Balance Due

26

27. M-2220 penalty ¨ $

; Late file/pay penalties ¨ $

¨

. . . . . . . . . . . . . . . Total Penalty

27

28. Interest on unpaid balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 28

29. Total payment due at time of filing. Make remittance payable to: Commonwealth of Massachusetts . . . . . . . . . . . . . . Total Due ¨ 29

I hereby elect to file a combined return in Massachusetts. Under penalties of perjury, I declare that I have examined this return, including accompanying schedules

and statements with respect to all members of the combined group, and to the best of my knowledge and belief, it is true, correct and complete. Declaration of

preparer (other than taxpayer) is based on all information of which he/she has knowledge.

Mail to: Mass.

Signature of appropriate officer (see instructions)

Date

Soc. Security number

Title

Dept. of

Revenue,

PO Box 7067,

Individual or firm signature of preparer

Date

Employer ID number

Address

Boston, MA

02204.

If you are signing as an authorized delegate of the appropriate officer, check here

and attach Mass. Form M-2848, Power of Attorney.

1

1 2

2 3

3 4

4