page 3

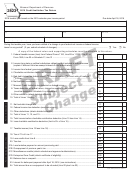

TAXABLE YEAR

NAME OF CORPORATION

ACCOUNT NO.

Schedule F - Base of Franchise Tax

PARENT CORPORATION

UNITARY GROUP MEMBER*

NAME

NAME

ACCOUNT#

ACCOUNT#

$

$

1. Total Capital Stock Outstanding less Treasury Stock (Schedule D, Line 21 less Line 24) .......................................................

____________________________________________________________

2. Capital Surplus, Earned Surplus, and Undivided Profits (Schedule D, Lines 22 and 23) .........................................................

____________________________________________________________

3. Indebtedness to or Guaranteed by Parent or Affiliated Corporation .........................................................................................

____________________________________________________________

4. All reserves which do not represent legal liabilities ................................................................................................................

____________________________________________________________

(

)

(

)

5. Deduct: Stock held in corporations doing business in Tennessee ............................................................................................

____________________________________________________________

6. Total Lines 1, 2, 3, and 4 less Line 5 ......................................................................................................................................

____________________________________________________________

%

%

7. Ratio, Schedule SF (each member must compute separate ratio) or 100% ..............................................................................

____________________________________________________________

$

$

8. Total (Line 6 multiplied by Line 7) ........................................................................................................................................

____________________________________________________________

UNITARY GROUP MEMBER* UNITARY GROUP MEMBER*

NAME

NAME

ACCOUNT#

ACCOUNT#

1. Total Capital Stock Outstanding less Treasury Stock ..............................................................................................................

____________________________________________________________

2. Capital Surplus, Earned Surplus, and Undivided Profits .........................................................................................................

____________________________________________________________

3. Indebtedness to or Guaranteed by Parent or Affiliated Corporation .........................................................................................

____________________________________________________________

4. All reserves which do not represent legal liabilities ................................................................................................................

____________________________________________________________

(

)

(

)

5. Deduct: Stock held in corporations doing business in Tennessee ............................................................................................

____________________________________________________________

6. Total Lines 1, 2, 3, and 4 less Line 5 ......................................................................................................................................

____________________________________________________________

%

%

7. Ratio, Schedule SF (each member must compute separate ratio) or 100% ..............................................................................

____________________________________________________________

8. Total (Line 6 multiplied by Line 7) ........................................................................................................................................

____________________________________________________________

UNITARY GROUP MEMBER* UNITARY GROUP MEMBER*

NAME

NAME

ACCOUNT#

ACCOUNT#

1. Total Capital Stock Outstanding less Treasury Stock ..............................................................................................................

____________________________________________________________

2. Capital Surplus, Earned Surplus, and Undivided Profits .........................................................................................................

____________________________________________________________

3. Indebtedness to or Guaranteed by Parent or Affiliated Corporation .........................................................................................

____________________________________________________________

4. All reserves which do not represent legal liabilities ................................................................................................................

____________________________________________________________

(

)

(

)

5. Deduct: Stock held in corporations doing business in Tennessee ............................................................................................

____________________________________________________________

6. Total Lines 1, 2, 3, and 4 less Line 5 ......................................................................................................................................

____________________________________________________________

%

%

7. Ratio, Schedule SF (each member must compute separate ratio) or 100% ..............................................................................

____________________________________________________________

8. Total (Line 6 multiplied by Line 7) ........................................................................................................................................

____________________________________________________________

UNITARY GROUP MEMBER* UNITARY GROUP MEMBER*

NAME

NAME

ACCOUNT#

ACCOUNT#

1. Total Capital Stock Outstanding less Treasury Stock ..............................................................................................................

____________________________________________________________

2. Capital Surplus, Earned Surplus, and Undivided Profits .........................................................................................................

____________________________________________________________

3. Indebtedness to or Guaranteed by Parent or Affiliated Corporation .........................................................................................

____________________________________________________________

4. All reserves which do not represent legal liabilities ................................................................................................................

____________________________________________________________

(

)

(

)

5. Deduct: Stock held in corporations doing business in Tennessee ............................................................................................

____________________________________________________________

6. Total Lines 1, 2, 3, and 4 less Line 5 ......................................................................................................................................

____________________________________________________________

%

%

7. Ratio, Schedule SF (each member must compute separate ratio) or 100% ..............................................................................

____________________________________________________________

8. Total (Line 6 multiplied by Line 7) ........................................................................................................................................

____________________________________________________________

9. Total all Line 8s, enter here and on Schedule A, Line 1 ..........................................................................................................................................................................

*Applies only to members of a unitary group of financial institutions required to file a combined return.

NOTE: Schedule F, Base of Franchise tax and the franchise tax apportionment ratio (Schedule SF) of each member of the unitary filing group must be computed as though each

member were filing a separate return. Copies of this form should be made if necessary in order to compute the net worth of each member of the unitary filing group. The total of

all the bases is entered on Schedule A, Line 1.

INTERNET (02-98)

1

1 2

2 3

3 4

4 5

5